The US Dollar ended last week mixed as Friday’s Retails Sales and Inflation data disappointed to the downside. This saw the Greenback offered across the G-7 pairs at the NY open. However, the unexpected drop of .1% in consumer spending along with the -.4% reading in the Producer Price Index were shaken off by the NY close setting up some interesting chart patterns as we start the new week.

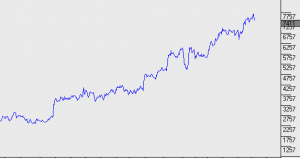

The AUD/USD, in particular, looks vulnerable to further downside range extension. After posting a .7755 high on Thursday, the AUD/USD finished the week with two consecutive losses for the fist time in almost two months and the first close below the five-day moving average since July 25th. Technically, the pair has been in a strong uptrend over the last three weeks but the RSI, along with the MACDs, are looking stretched.

With Tuesday’s RBA minutes likely to include a warning about the risks of currency appreciation derailing the sluggish post-mining economic recovery, a break of the key support level at .7630 is a reasonable bet. Further, the preliminary forecasts for Thursday’s Australian Employment report are looking for a softer reading in the key metrics in what has become a volatile data series.