CCL has it challenges as consumer trends continue to move away from large volume consumption of carbonated sugar drinks. CCL is responding through new product ranges and reducing the size of both cans and bottles.

$100m in cost savings along with automation and efficiency gains in the production facilities will help to offset any revenue weakness. Our base case for CCL on a 12 to 24 month outlook is for relatively flat revenue and EPS growth.

FY17 revenue $5.2b, EBIT $680m, EPS $0.55, DPS $0.45 places the stock on a forward yield of 4.8% and a PE ratio of 17x.

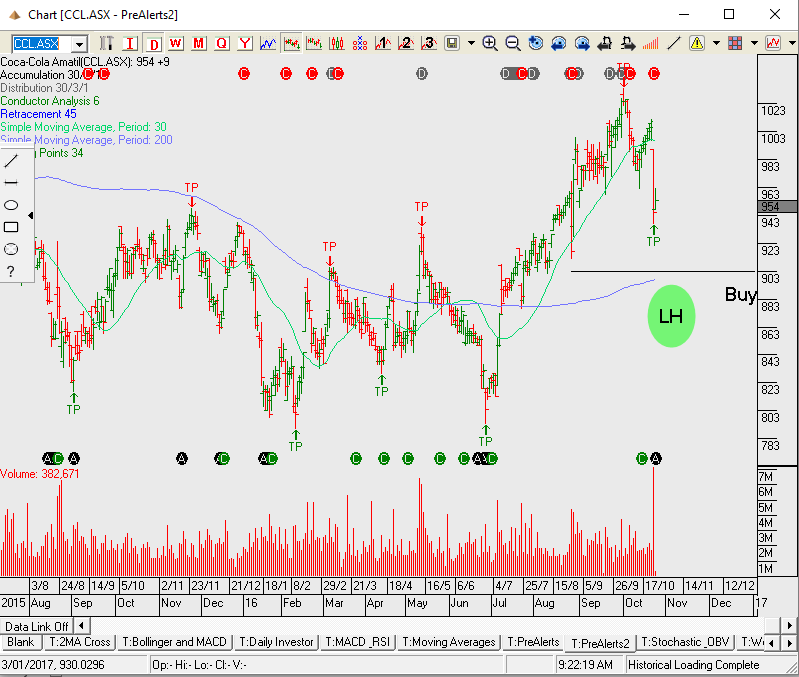

We’ve been active in selling covered calls over CCL as we’ve maintained full value is around $9.50. Keep CCL on your radar as a pull back to $9.00 is worth considering as an entry point to buy the stock. We think CCL trades in a consolidation channel over the next 12 months. A combination of the dividend and option premium produces 10% annualised cash flow.