The US Dollar Index reached a seven month high of 98.10 on Friday as both US Inflation data and the Retail Sales report beat expectations. The Greenback gained ground against the GBP, JPY and the CHF, but it was the move against the Euro which held the most technical significance going into the weekend.

The EUR/USD posted a NY close below 1.1000 for the first time since mid-June and looks likely to challenge key support at the 1.0950 level.

Thursday’s ECB meeting could possibly be an important pivot point in both the single currency and global equity markets. The idea that recent stock market valuations are heavily reliant on central bank stimulus could be tested if ECB chief Mario Draghi isn’t clear about the direction and composition of future EU monetary policy.

During the last four ECB meetings, there has been extreme volatility in both the currency and equity markets. The March 10th meeting saw the EUR/USD trade in a 400 point range while during the June 2nd meeting the single currency moved over 200 points higher on the day.

From an equity perspective, the German Dax dropped close to 600 points during the March 10th meeting and close to 250 points after the meeting in June.

Granted, the expectations for expansion on the QE purchase pool and extension of the duration of stimulus were much higher than forecasted for this week’s meeting.

However, we’ve seen a lot of conflicting headlines about the central bank’s thinking since the last meeting. Two weeks ago there was high level talk about tapering asset purchases and last week that was reversed with comments about extending and expanding the current level of stimulus.

During the last meeting, Mr Draghi expressed confidence about the resilience and positive outlook for the Eurozone economy but also lowered the staff growth forecasts and announced EU committees to evaluate additional stimulus options. With recent EU growth aggregates showing stabilization across the region, Mr Draghi has cause to express an optimistic tone.

The AUD/USD managed to recover into the weekend and retake the .7600 handle. The RBA minutes and the domestic employment report are the key data points for the Aussie this week. The early forecasts are for a bounce back in manufacturing and construction jobs to lift employment growth.

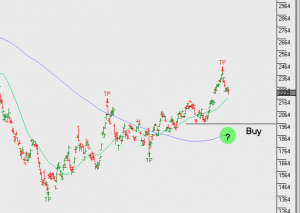

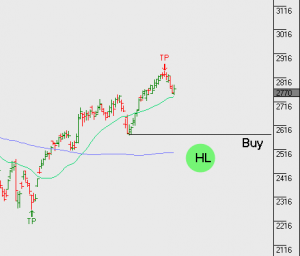

USD Index