Federal Reserve Chief Janet Yellen was on Capitol Hill today addressing Congress for the first time since the US Presidential election. With the USD Index pushing against a 13-year high over 101.00, it was reasonable to expect some of her testimony to address the stronger USD and the sharp increase in Treasury yields. However, these specific developments weren’t addressed and, instead, Ms Yellen expressed confidence in the progress the economy is making towards their inflation and employment goals.

She indicated that waiting too long would force the FED to tighten faster in 2017 and could spur excess volatility in financial markets, but gave no indication about the pace of interest rate normalisation going forward. On balance, her comments were hawkish enough to keep the G-7 basket of currencies under pressure against the USD, but tempered enough to lift the DOW Jones 30 and SP 500 back up into historic high closing territory.

The economic data released supported this view with housing starts and building approvals rising sharply and weekly jobless claims falling to a 40-year low at 235,000. With three other FED Governors scheduled to speak today, we could see further confirmation that US rate policy is ready to adjust higher.

With all of the bullish USD data stacking up, it’s no surprise that the EUR/USD made a new low for the year, fell for the 9th consecutive day and posted a NY close below 1.0650. It’s worth noting that only once in its 17-year lifetime has the EUR/USD gone down 9 days days in a row. That was from August 28th to September 11th, 2008 when the pair dropped for 11 days in a row and lost close to 10 big figures from 1.4810 to 1.3880. The Euro also lost more ground against the Sterling, reaching a 7-week low of .8540, which is more than 11.5 big figures below the spike high of .9695 on October 6th.

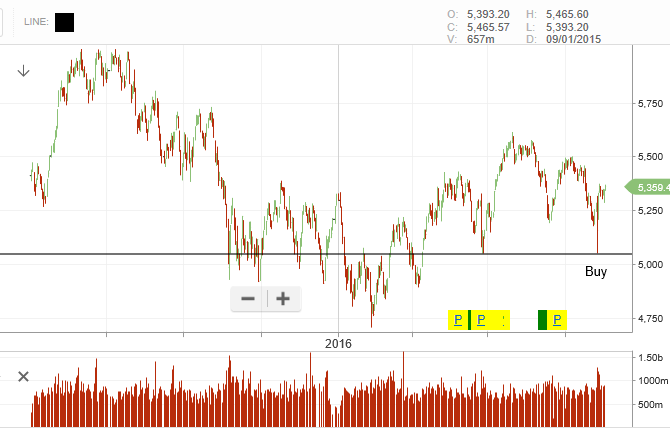

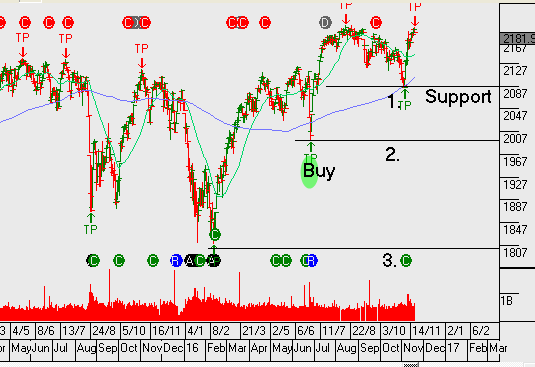

With the Fed Funds futures now showing a 98% chance of a rate hike in December, we expect the chatter from the FED Governors to remain hawkish about the December hike but somewhat blithe about the dot plots and interest rate trajectory going into 2017. It was the markets’s expectation of 4 rate hikes in 2016 which roiled global equity markets earlier this year, and it’s unlikely that the voting FOMC members will want to repeat that level of market dysfunction.

With this in mind, we expect the USD to maintain an upward bias, but with a slower pace, and for US Stock indexes to probe higher and beyond recent resistance levels.