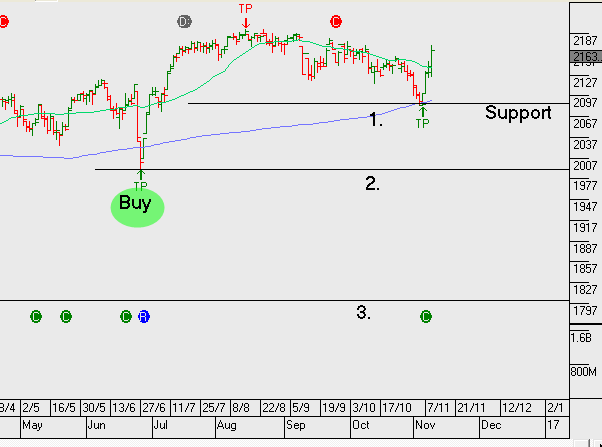

S&P500 Bounces & Holds Higher Low Support

We’ve remained bullish equities and our base case has been that US stocks would hold support following a satisfactory 3Q earnings result. Our resolve was tested in the last 24 hours with US markets down sharply as the election result and Trump Presidency looked possible. However, by the time the Presidential acceptance speech began, the market losses on US indices were cut in half and by the close of US trading markets were up on average by 2%.

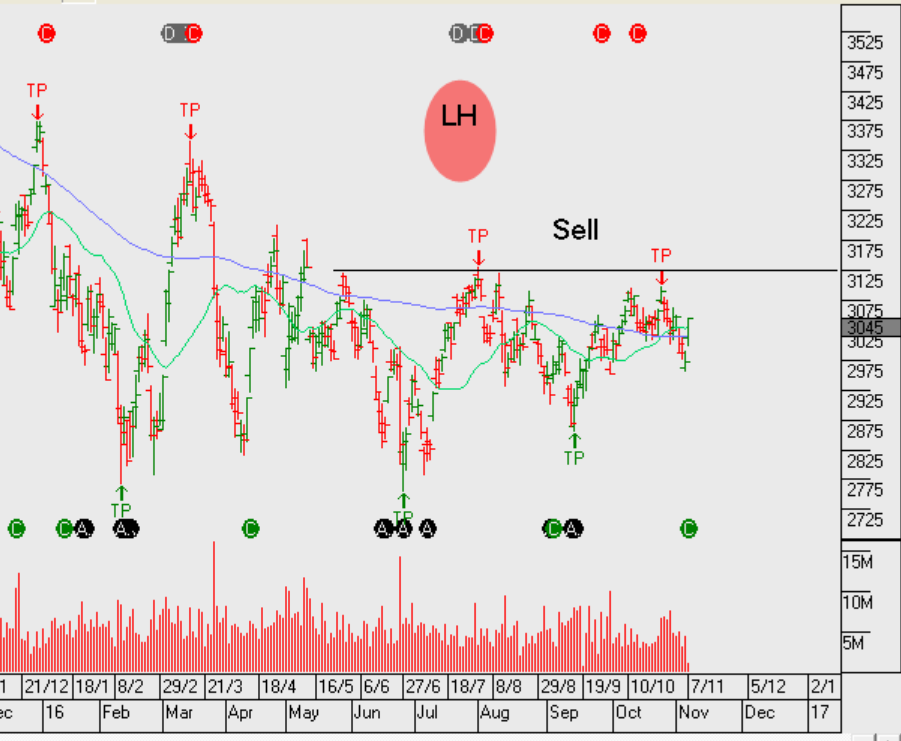

We keep our long bias towards equities and turn our focus back to the reality that 3Q S&P500 average earnings per shares growth is tracking at only 3.5% up on the same time last year. Considering the magnitude of share buybacks, we don’t consider the underlying earnings growth to be that encouraging. Chinese export data remains weak, reflecting the slow growth in the global economy and bond yields continue to push higher in the US with the 10year bonds now trading up from 1.3 to 2.05% over the last 3 months.

As stated in the monthly strategy review video, we caution portfolio investors on a blanket buy and hold strategy. We encourage you to establish contact with us, so we can discuss the advantage of adding a call option strategy to your holdings, as well implementing well timed trading ideas around the fringe of your portfolio to help deliver better outright returns.