November – ASX Top 50 Video Market Update

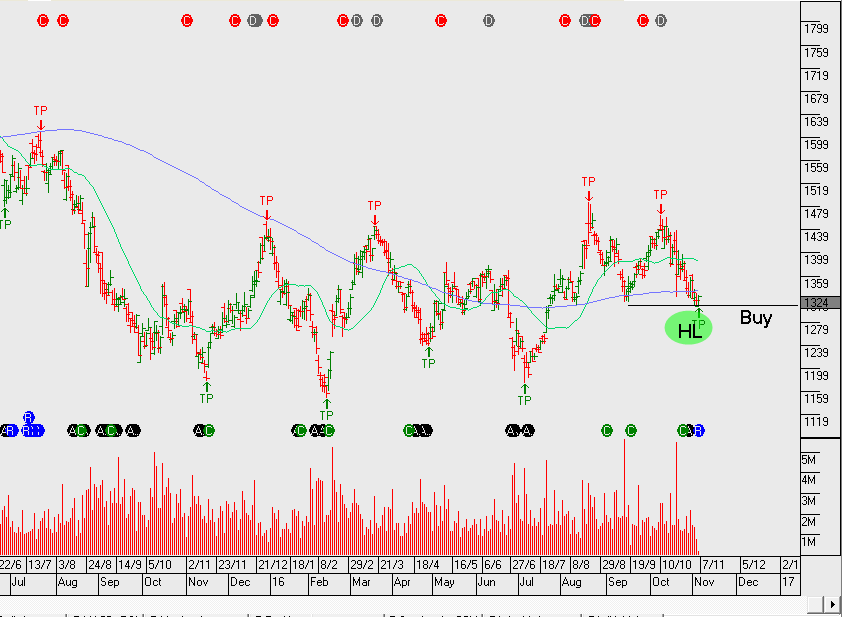

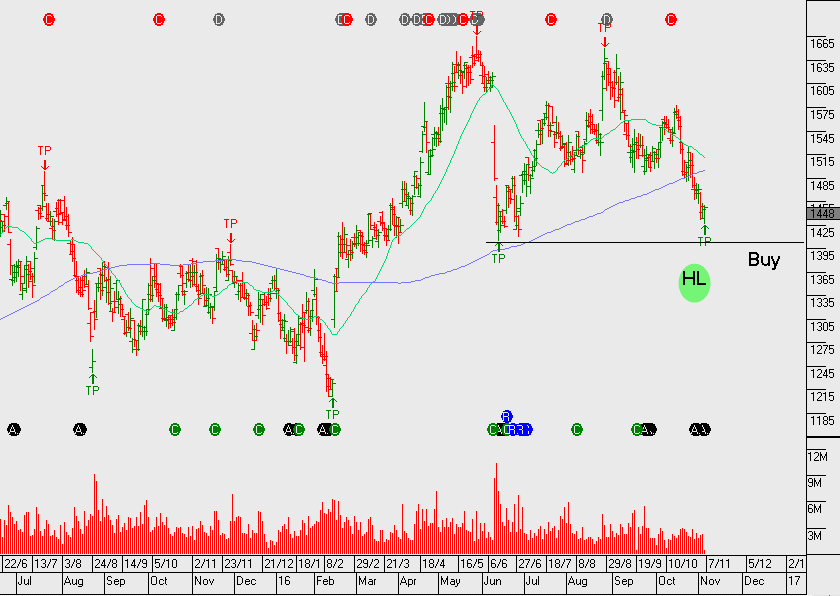

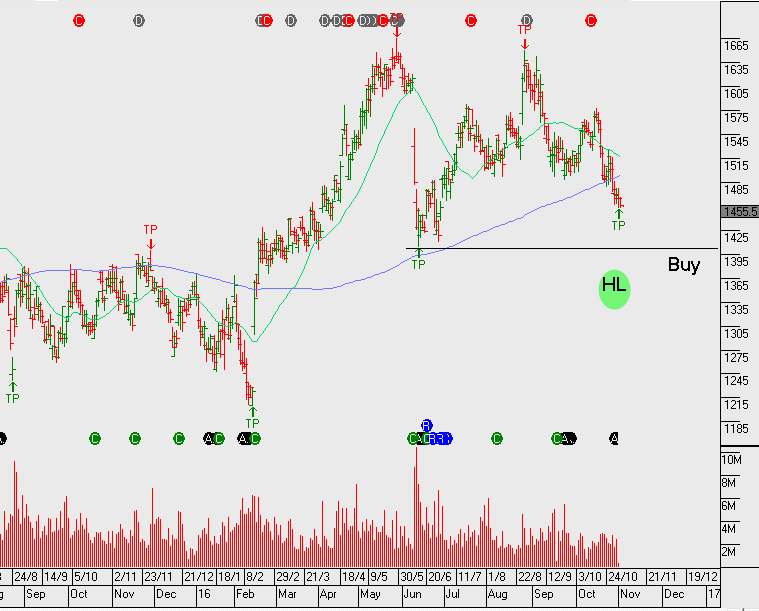

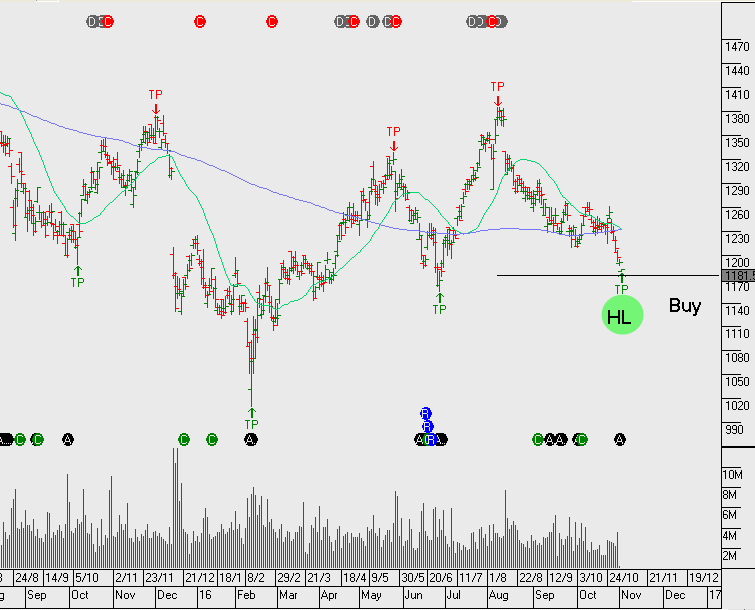

The great consolidation – we had a 50% drop in Australian equity prices from Jan 2008 to March 2009.Over the last 7 years, the bulk of the bull market recovery in Australian equities occurred during 2010 to 2014. Since that time, the ASX 200 has mainly traded sideways. Within this sideways price action, we’ve experienced the banks and resources under-perform from May 2015, (although resources have rebounded in the past few months), whilst infrastructure, property trusts and industrials outperformed.

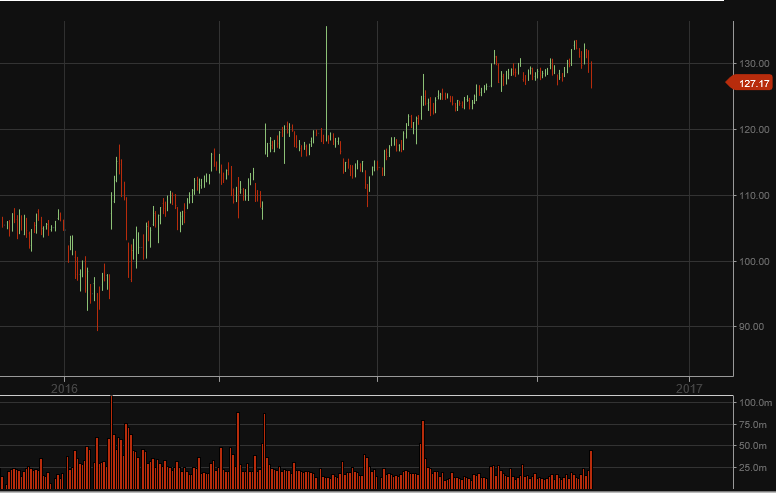

During the past few months, the driver of equity prices has been the fear of rising US bond yields and, as a consequence, it’s driven a rotation out of defensive assets and into growth names. Albeit, domestically we think it’s been a net selling position by off shore money managers, rather than a rotation into domestic growth names, large US listed companies are where global money managers are allocating towards growth.

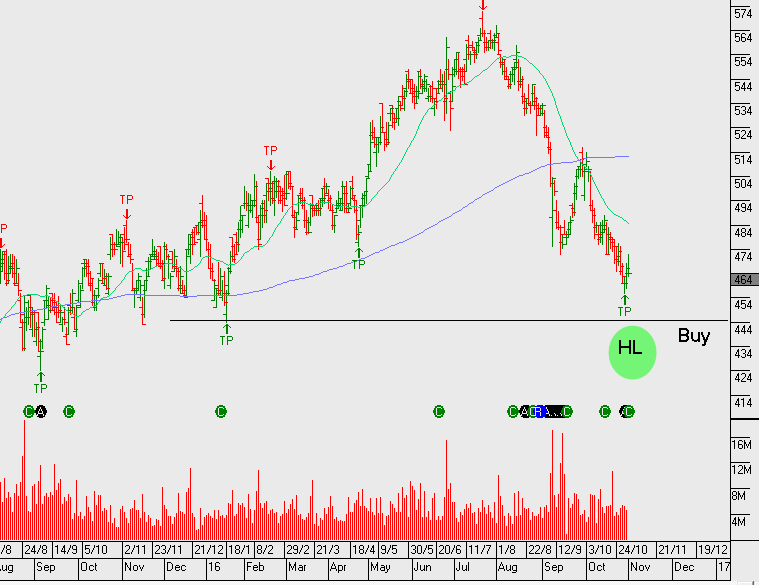

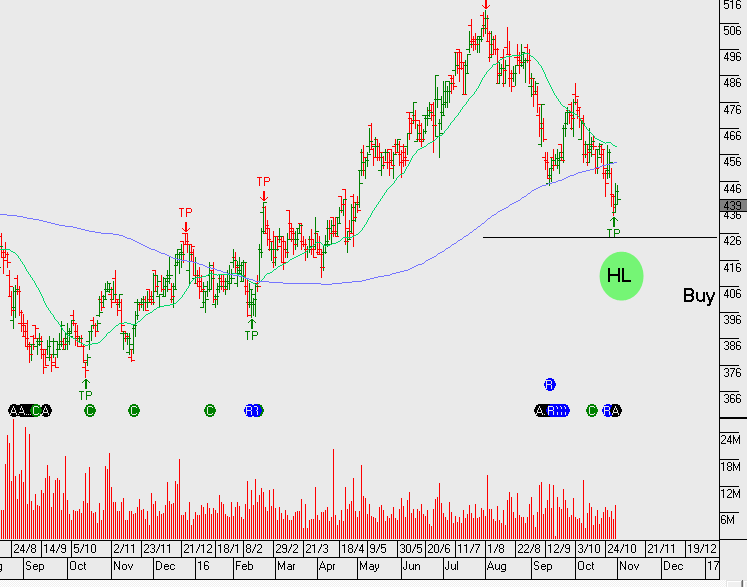

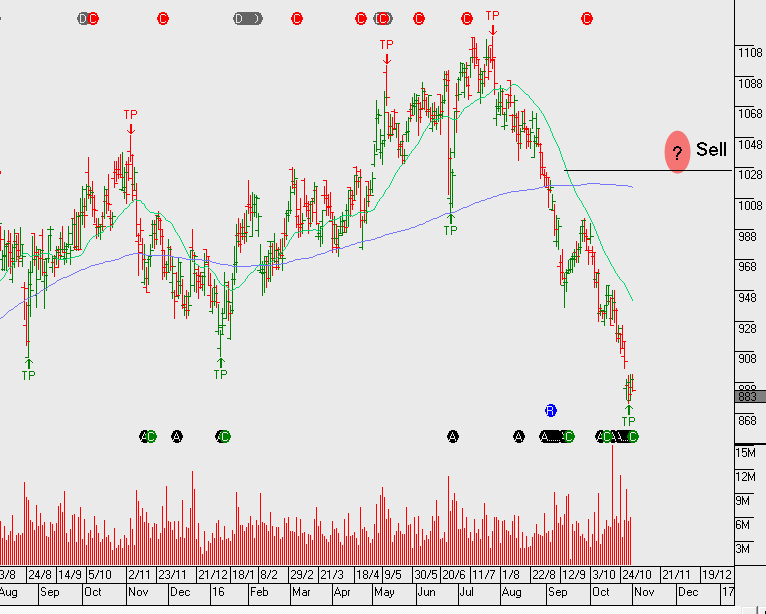

As a result of this dynamic, yield names will bounce from here but not make new highs, resources will move a little higher but run out of steam by the first quarter of the new year, industrials are trading on relatively high PE and Australian banking shares offer little or no growth at a revenue or underlying profit level.

So, what does this mean for your average Australian share portfolio? I believe the message is: get ready for the great consolidation. Equities will mostly move sideways and selective asset allocation based on technical and fundamental support levels, combined with a derivative overlay, is the most compelling risk reward way to beat the market. Dividends, franking credits and call option income should lead to a much better bottom line in FY17 than the 4% average return of industry super funds in FY16.

Most portfolios that carried overweight positions in banks and Telstra delivered negative returns in FY16. A passive buy and hold strategy is not enough. Unless an investor is taking advantage of covered call options and trading opportunities around the fringe of their portfolio, I fear that FY17 could be another year of under-performance for the retail investor.

Please take the time to watch the latest video market update report to understand more about the strategies Investor Signals is implementing in the current market.