Since posting a low of $9.40 on November 9th, shares of QBE have rallied over 30% to close at $12.58 on Friday.

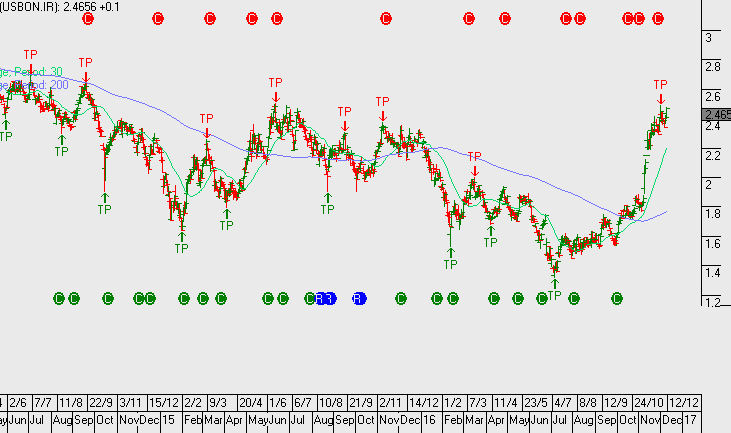

As a result of a major restructuring and consolidation undertaken in 2013-15, the group is better positioned to benefit from higher earnings on their USD 25.7 billion high-quality investment portfolio. QBE’s stock price is highly correlated to the yield on US 10-year Treasuries, which have jumped by 60 basis points since early November.

In addition to boosting returns on security holdings, higher interest rates help QBE by lifting the discount rate used to value future claim liabilities, thereby reducing the value of these liabilities. It’s estimated that a 50 basis rate rise could add an extra USD 70 million to QBE’s net profit.

2016 earnings forecast $760 million, 2017 jumps over 20% to $920m, this places QBE on a 5.8% forward yield. Total dividends for 2017 are likely to be around $0.60 per share (50% franked).

Chart – QBE