Crown Resorts has announced several changes to their strategic business plan to simplify the business and enhance their balance sheet.

The firm has decided to cancel its Alon project in Las Vegas, sell off a major stake in its Macau casino business and cancel plans to spin off its international business.

The company will sell off almost half of its holdings in Melco Crown Entertainment for $1.6 billion, using the proceeds to cut debt, pay a special dividend of $500 million and enable a share buyback of around $300 million. Crown’s share of Melco’s annual net profit dropped by 60% in 2016 to $43 million following a corruption crackdown by Chinese authorities.

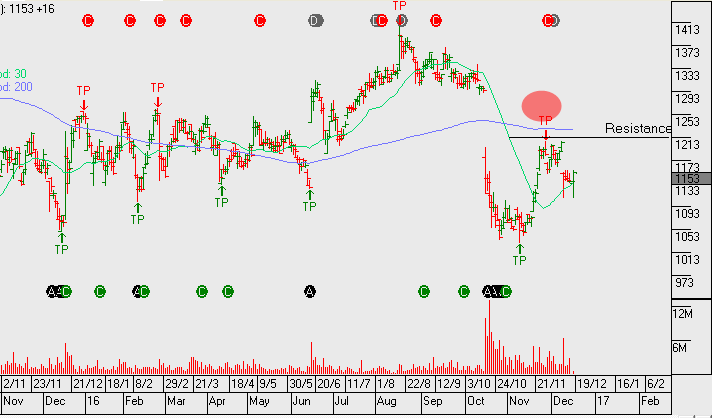

We still like the long side of CWN, although our upside target has been lowered from $14.00 to $12.50 following earnings revisions due to CWN’s reduced stake in Melco. CWN currently trades on 10x FY 17 estimated EBITDA and is on pace for a 5% yield for FY 2017.