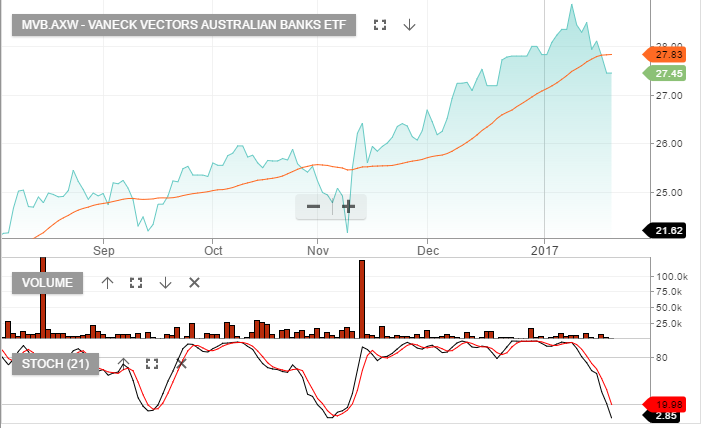

The market has priced in a better and brighter outlook for the Australian banks during the past 6 months.

During the middle of last year, we had off-shore hedge funds shorting our banks. Concerns about capital requirements, bad debts ticking up from one-off corporate failures and concerns about the Australian property market nearing peak prices.

Six months later and the market is thinking about better underlying conditions, reduced risk of capital raising, improving credit quality from the recovery in commodity prices and better operating margins. As a result, the valuation discount has now diminished following the 20% rally in bank names.

Our base case is that the environment has not actually changed materially from where we were 6 months ago. The news flow has turned more positive but that’s about it. The underlying issues remain the same or are intensifying, in our view.

We watch with interest the Chinese markets and in particular the risk of weaker property prices in China and the sentiment impact it will have on Australia. This is one of our key risks to Australian bank prices in 2017.

We expect low levels of credit growth due to over-leveraged household balance sheets and pressure from regulators to improve the quality of housing lending.

At best we see the banks at full value; and our most likely investment case is for further weakness driven by a pickup in global macro risk-off sentiment.

Our bank hedge into February/March remains in place and we’re expecting share prices to remain at or slightly below current prices over the coming months. The risk for further share price weakness will likely pickup towards the middle of the year.

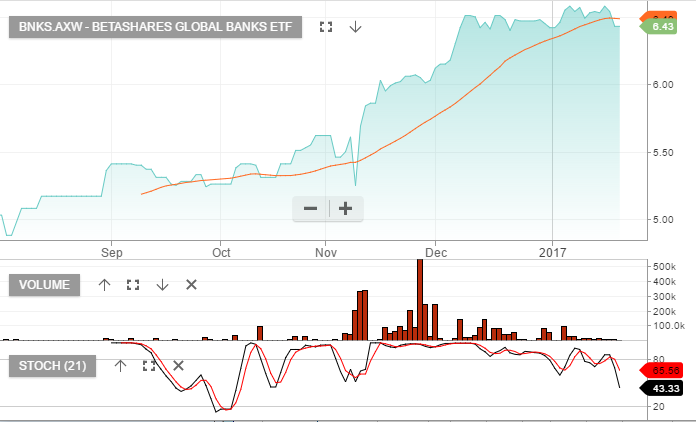

Chart – Global Bank ETF