Since posting a high trade of .7740 on February 23rd, the AUD/USD has dropped over 250 points , or 3.2%.

A corrective bounce into the weekend sees the Aussie currently trading back near .7540, but the technical chart structure looks weak and momentum indicators are point lower.

In addition, The US Federal Reserve is a near certainty to raise the Fed Funds target this Wednesday.

This policy move will lift the Fed Funds target to 1%, and, (with Aussie overnight rates at 1.5%) will further narrow the overnight lending rate spread to just 50 basis points.

This fundamental shift will likely accelerate the repricing of the AUD/USD back into the .7300 handle.

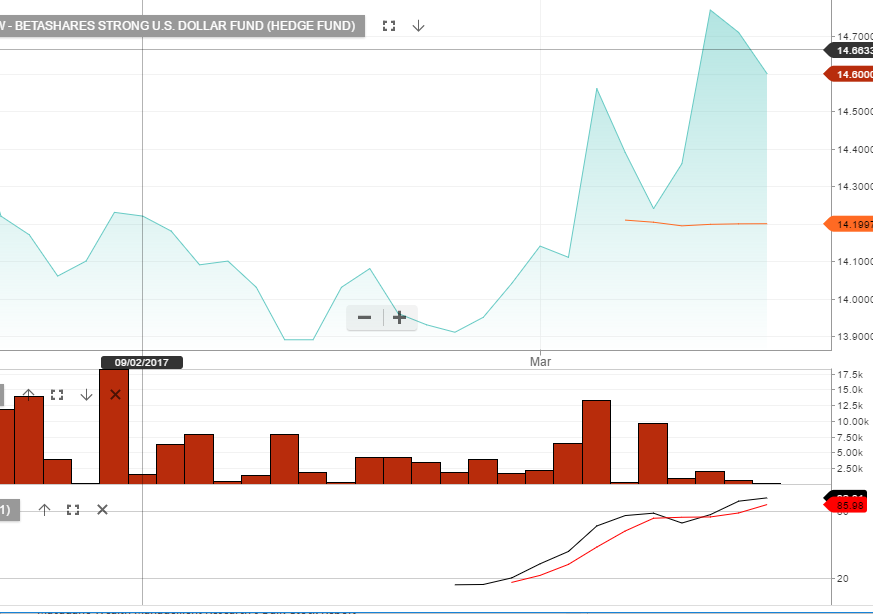

Investors can profit from the AUD/USD moving lower with the BetaShare YANK Exchange Traded Fund (ETF).

YANK is an inverse, unit trust EFT with a weighing of approximately 2.5 to 1. This means that a 1% drop in the AUD/USD price will increase the value of the ETF units by approximately 2.5%.