US Payroll Preview

The US Non-Farm Payroll data will be released at the start of today’s NY session. With US Stocks reacting negatively to the news of the FED’s plan to begin reducing their balance sheet, attention will be focused on the interest rate aspect of the report.

The consensus headline number is expected at 174,000 new jobs with Hourly Earnings expected to climb by .2%.

The cause and effect logic to the data will be that a stronger report would be negative for stocks, since it would support the odds of another rate hike in June.

Both the DOW 30 and SP 500 indexes are trading below their 30-day moving averages and could extend lower on stronger data. We see downside support at 20,300 and 2315, respectfully.

A large miss in the data would likely lift US stocks on the notion that the FED will remain on hold until August.

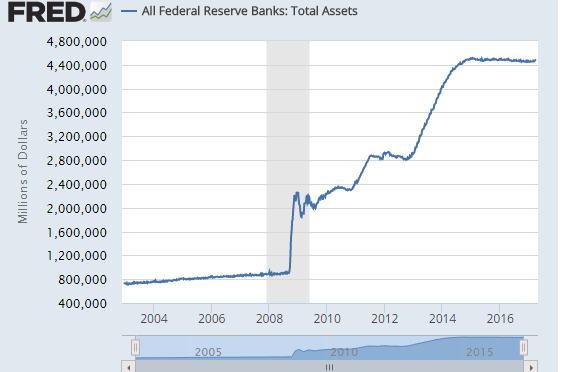

FED Balance Sheet

FED Balance Sheet Chart – ANN

Chart – ANN

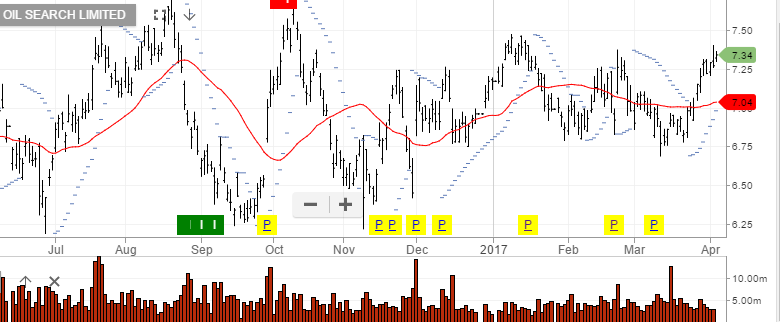

Chart Oil Search

Chart Oil Search