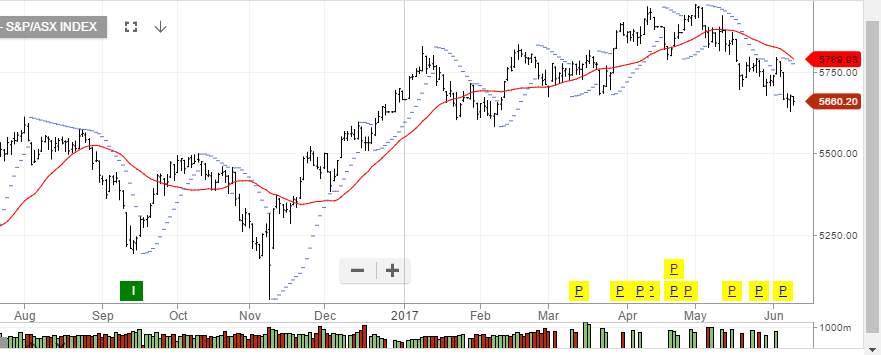

As ASX market participants prepare for the Queens Birthday weekend, we would like to update some of the recent market themes suggested to investors and subscribers.

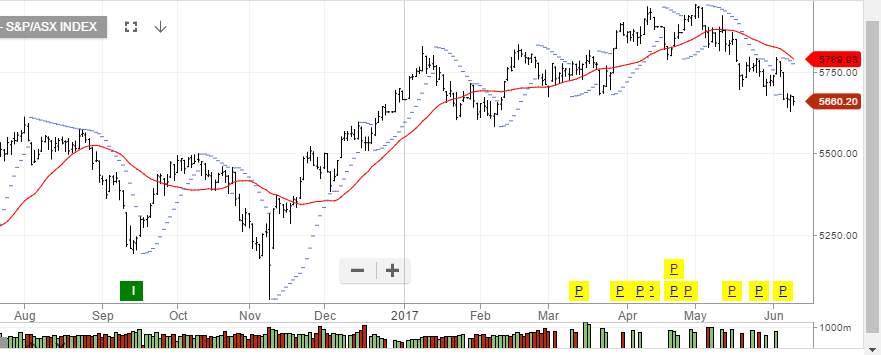

Our short bias on the XJO took a little longer to develop than had hoped but now looks to be on track to hit our 5500 target by mid-July. An integral part of the technical price breakdown in the XJO has been the sell off in the major banking names.

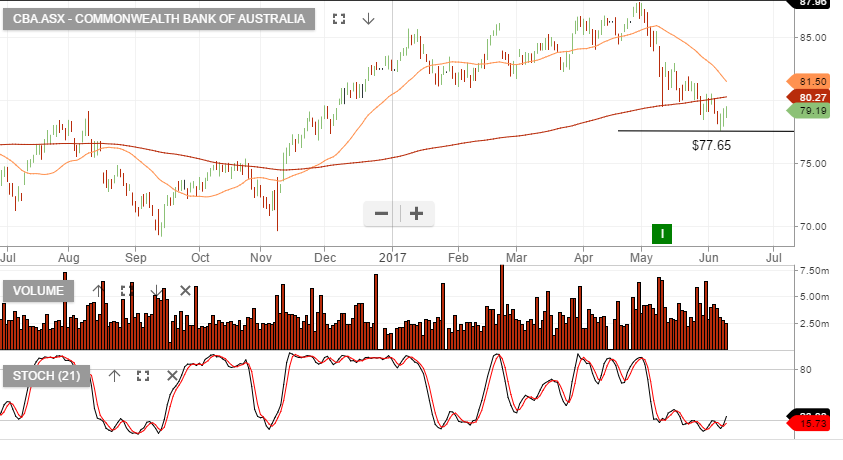

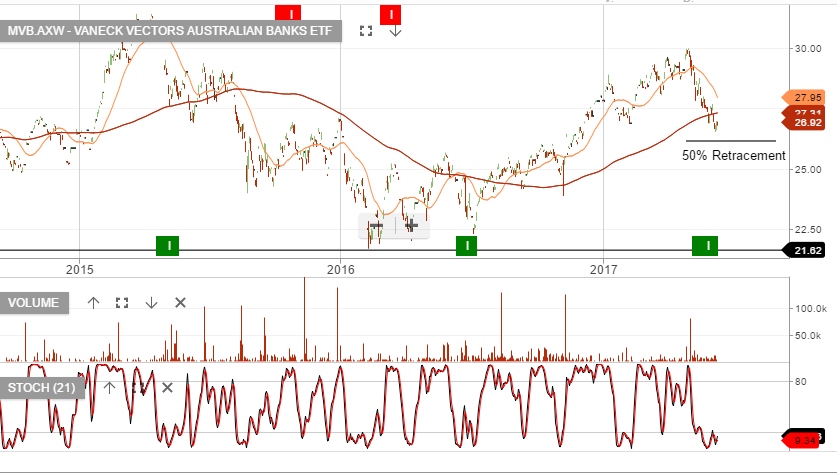

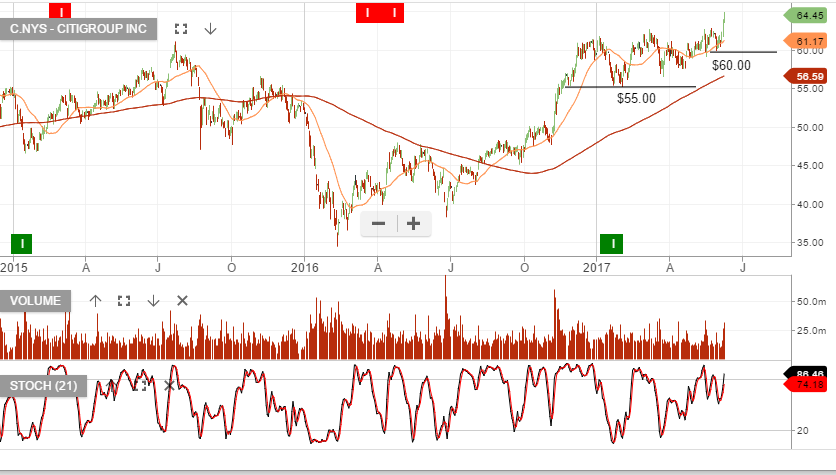

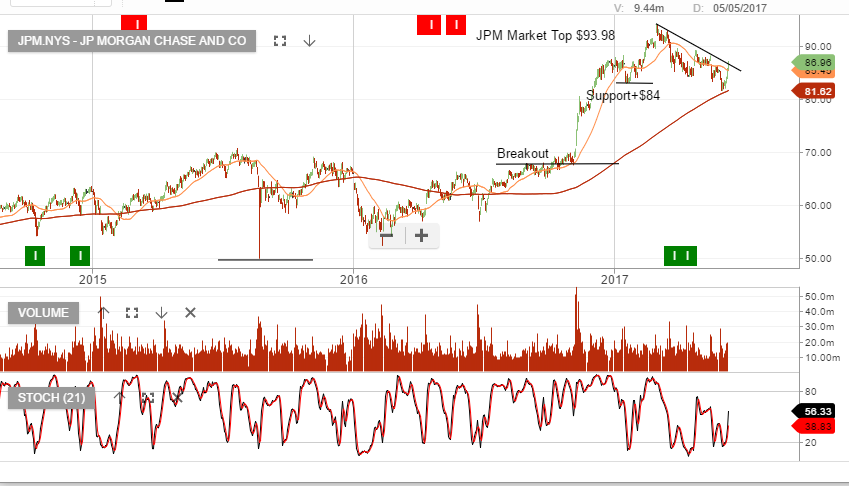

The major banking names are all 8 to 10% off their April highs. The Government’s Levy legislation, combined with slower loan growth and loss provision numbers, has the potential to see the banks trade back to the November 2016 lows.

Many clients who were reluctant to sell their bank shares are now calmed in the knowledge that they will be able to re-establish those positions at lower levels.

In addition, investors with a slightly higher risk profile were able to profit handsomely on the bought put options as the banks traded lower.

Like the XJO trade, the long put positions in JHX and AMP are now gaining momentum to the downside. Since both of these strategies were structured as “Put Spreads”, we are looking to scale out of these positions and replace them with outright downside directional strategies over the next few weeks.