Take Profits In Newcrest Mining

On August 8th, Spot Gold posted a low during the New York session of $1254.00.

Overnight, the yellow metal posted a 10-month high of $1341.00, a 7% gain in less than a month.

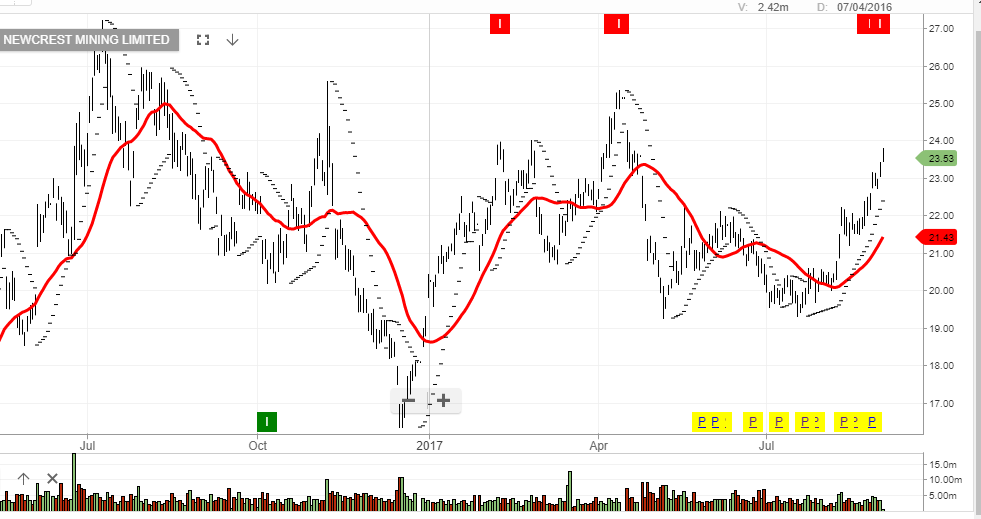

Over the same period of time, Newcrest mining has rallied from $20.25 to post a high of $23.70 early in yesterday’s session. This move represents a bit less than a 17% gain.

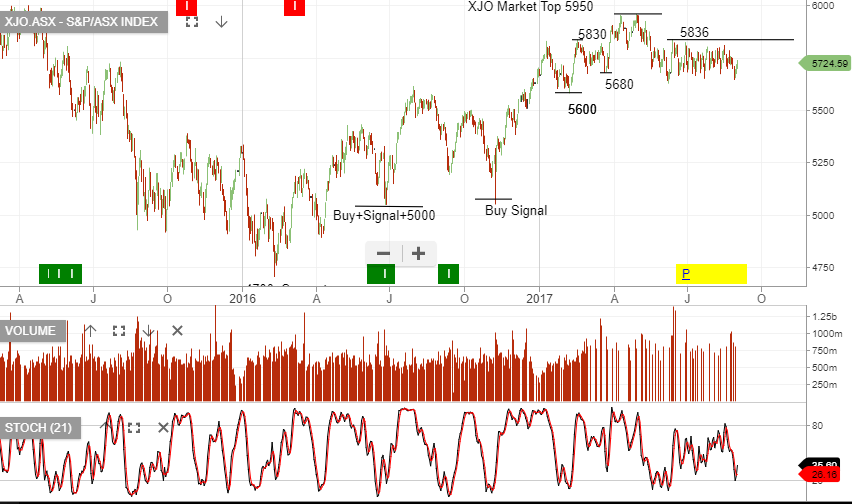

Even though the heighten geopolitical tensions which have supported the Gold price are still very much a part of the market, technical momentum indicators are signalling that investors can expect a short-term correction lower.

We believe the medium-term price trajectory in Gold will remain intact after the overbought conditions are alleviated.

As such, we suggest taking profits today in NCM, along with the smaller Gold miners: EVN, SAR, NST and OGC.

Newcrest

Newcrest

Newcrest Evolution Mining

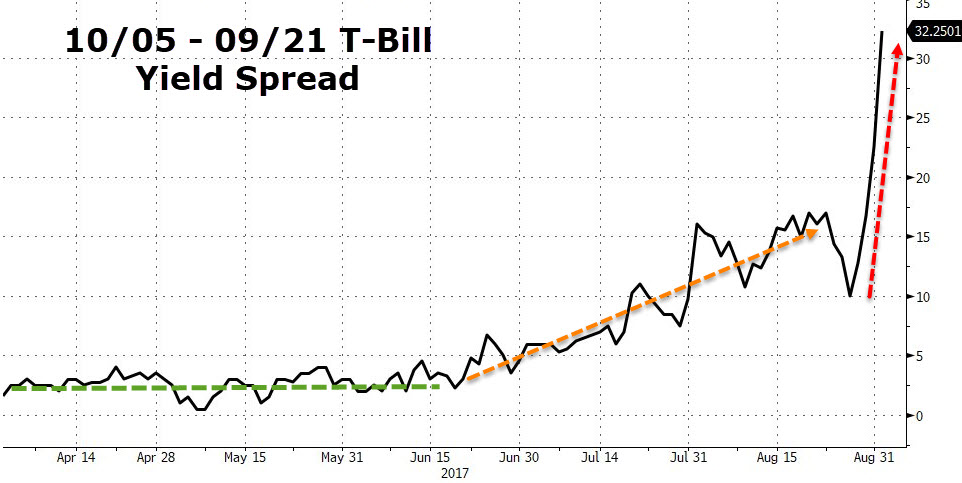

Evolution Mining September 21st versus October 5th T-Bill yield spread

September 21st versus October 5th T-Bill yield spread