ASX Signals for December 19, 2017

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Inghams Group

Inghams Group

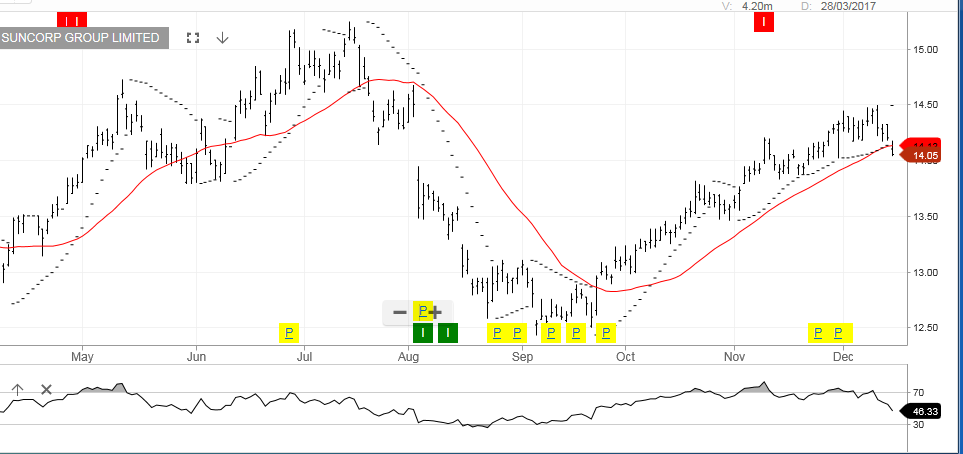

Suncorp

Suncorp