The video runs for 6 minutes and if you’d like to discuss the ideas presented, please call our office on 1300 614 002.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Welcome to our Morning Review video report.

We look at the reversal in Dow Jones overnight and the BBUS, BBOZ & Yank ETF’s which benefit from further US equity market weakness.

WFD was added to the ASX 20 & 50 model portfolio yesterday.

The video runs for 10 minutes and if you’d like to discuss the ideas presented, please call our office on 1300 614 002.

The price of Spot Gold has dropped over $40.00 since last Friday.

As a result, shares of Newcrest mining have fallen close to $2.00 and posted a 4-month low of $21.20 earlier today.

We expect good support in the spot Gold market near the $1300.00 area.

This roughly pencils out to the $20.80 level for NCM shares.

We suggest keeping NCM, as well as the smaller Gold producers, on the radar for a buying opportunity if spot Gold holds the $1300.00 level over the next few trading sessions.

Newcrest Mining

Shares of Tabcorp have dropped over 5% in early trade as H1 results were dampened by Tatts acquisition costs and weaker earnings from their UK start-up, Sun Bets.

The wagering giant posted a statutory net profit of $102 million, which was down 16% from a year ago. This included a $25.5 million charge in significant items related to the Tatts merger costs.

All together, the Tatts acquisition costs represented a one-off $59.3 million drag to the bottom line.

The company announced a fully franked interim dividend of 11¢ cents per share, payable on March 13.

We expected a much better H1 result for TAH and still believe the merger will prove profitable this year.

As such, we see value in the stock in the $4.80 area and expect the previous high price of $5.70 to be challenged over the medium-term.

Tabcorp

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Welcome to our Morning Review video report.

We look at the impact the recent market volatility has had on our ASX 20 and 50 model portfolio.

Buy ideas include ASX, AGL, AMC, SGP, TAH, TCL and GPT

Sell ideas include CPU & BEN

The video runs for 6 minutes and if you’d like to discuss the ideas presented, please call our office on 1300 614 002.

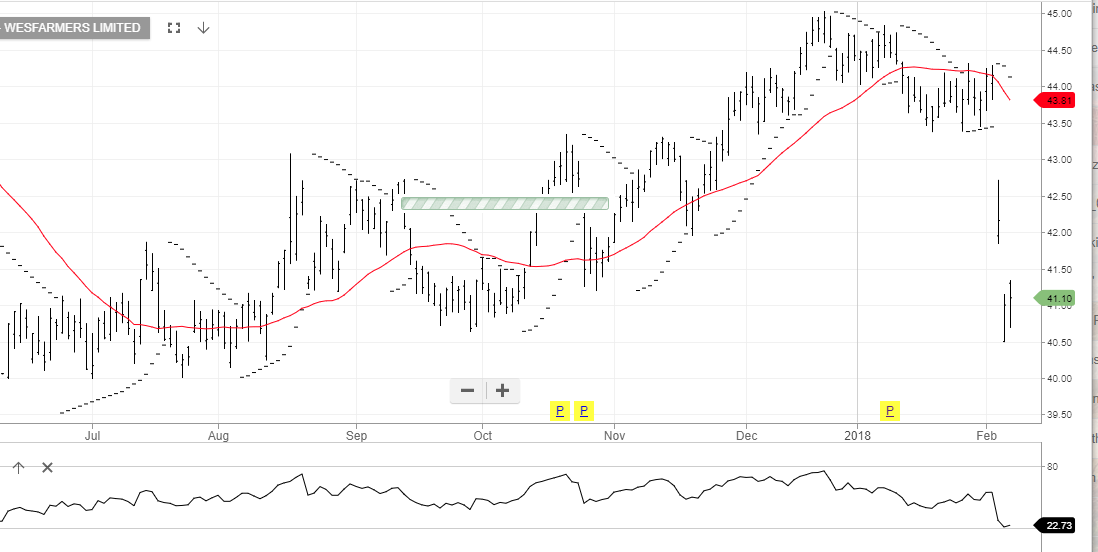

Shares of Wesfarmers have lost over 7% this month and posted a six-month low of $40.50 yesterday.

The main drag to the share price has been the growing losses and poor outlook for their UK-based Bunnings hardware stores.

After writing off close to $1 billion on Monday, analysts have estimated that WES may have to invest another $540 million into the venture for a chance to break-even by 2022.

Over the last three years, the share price has traded in a broad range with resistance near $45.00 and investor support coming in near $39.00.

In the January 9th daily blog, we suggested selling a $45.00 June call for $1.02 to increase cash flow and keep exposure to the $1.03 dividend on February 20th.

WES has been in our ASX Top 50 model portfolio since January 2016 from $39.05. We continue to view WES as a range-bound stock and will use the derivative overlay strategy to enhance returns.

Wesfarmers

Shares of CBA have traded in a wide range today as the bank’s cash profit, including provisions, was posted at $4.87 billion on expectations of $5.2 billion.

The bank announced that it would set aside $575 million to address the AUSTRAC AML accusations and costs related to the Banking Royal commission.

Our ALGO engine triggered a sell signal on CBA at $80.90 on November 13th.

Considering the headwinds facing the domestic banking industry in general, we see the next key support level for CBA at $75.80.

Commonwealth Bank

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.