Buy Tabcorp – Price Reversal Approaching

We recommend buying Tabcorp as the price action retests the recent support level at $4.37.

Institutional money re-positioning ahead of the August earnings result will be the likely catalyst, which sees the share price trade back to the $5.25 level.

TAH goes ex-div $0.125 on the 11th of August.

TabCorp

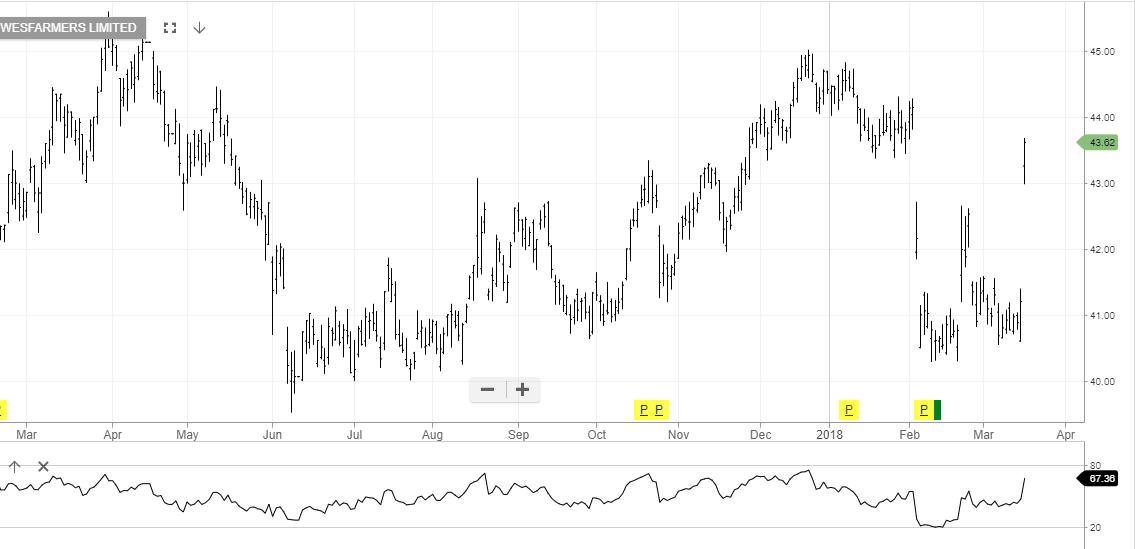

Wesfarmers

Wesfarmers

Oil Search

Oil Search