Our ALGO engine triggered a buy signal in the BBOZ ETF into yesterday’s ASX close at $14.80.

BBOZ is an inverse equity ETF based on the shares which trade in the ASX 200 index.

Since BBOZ is an inverse ETF, the price will rise as the ASX 200 index trades lower.

The “higher low” buy signal is referenced to the January 14th low of $14.40.

With the ASX 200 index trading near the highs of the year, investors can look to buy BBOZ to hedge their exposure to a wide basket of shares in just one ASX regulated transaction.

As the local share index has rallied sharply over the last 4-weeks, the price of BBOZ has dropped over 14% from $16.85 to $14.50.

For more information about how to profit with trading strategies in the BBOZ ETF, call our office at 1-300-614-002.

BetaShare BBOZ ETF

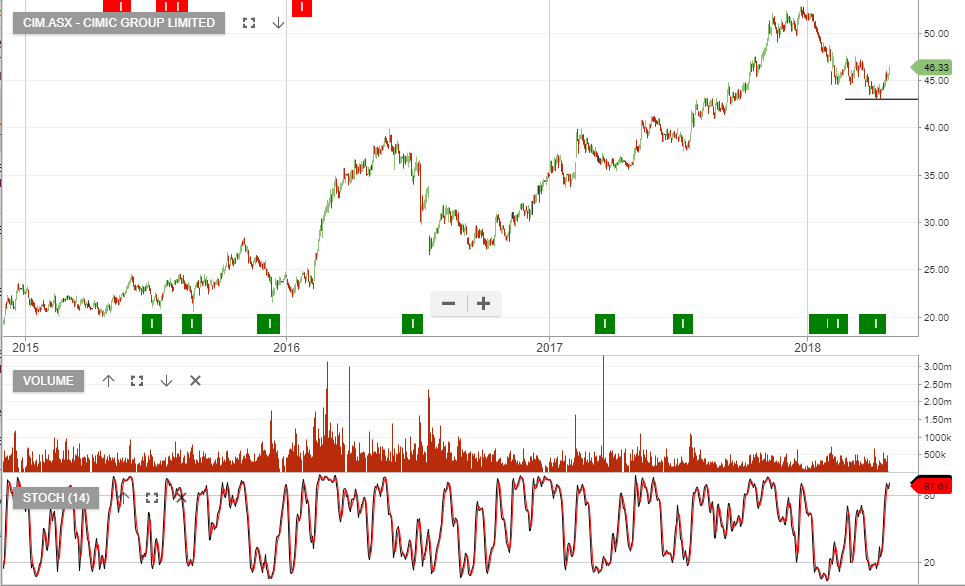

CIM

CIM