Stay Long Treasury Wine Estates

It was just over a month ago that TWE shares were hammered from $20.00 down to $15.60 in just a matter of days.

The catalyst for the 20% drop was a report that TWE’s business model had caused a glut of lower grade wines in China and the local franchisees were not happy.

However, CEO Mike Clarke was quick to step in and stridently defend the company’s distribution structure and future earnings trajectory.

So far this year, earnings in Asia are up 48% to $117 million, 8% in North America to $100.4 million, 17% in Europe to $24 million, and 28% in Australia and New Zealand to $68.2 million.

Technically, the internal momentum indicators are pointing higher and we see the next key resistance point near the $17.50 level, before returning to the $20.00 handle over the medium-term.

Treasury Wine Estates

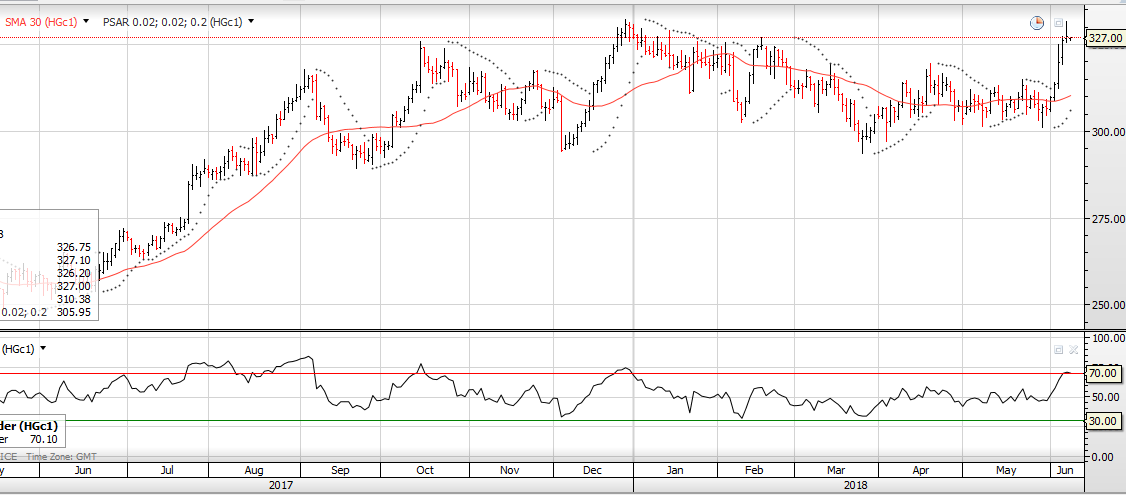

ZGOL Gold ETF

ZGOL Gold ETF Super Retail Group

Super Retail Group