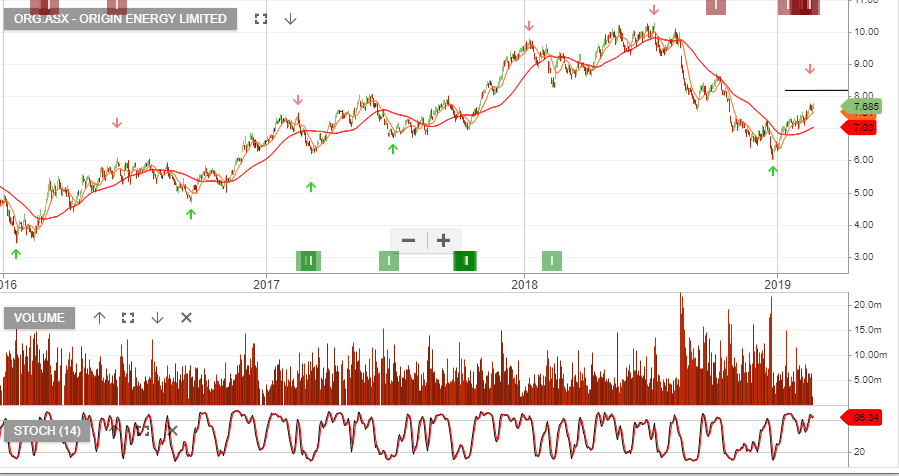

Origin Energy – Get Ready to Take Profit

Origin Energy is under Algo Engine sell conditions, however, we’ve been expecting stronger earnings to support another leg in the share price rally.

ORG reported its 1H19 with EBITDA of $1.73bn, which is ahead of market consensus. The dividend was reinstated at $0.10 per share.

We see the balance sheet improving which will lead to ongoing increases in the dividend. Based on FY20 earnings we have ORG now trading on a 5.5% yield.

We’re sellers “short term” on a push above $8.00 in ORG.