Alphabet

Honeywell

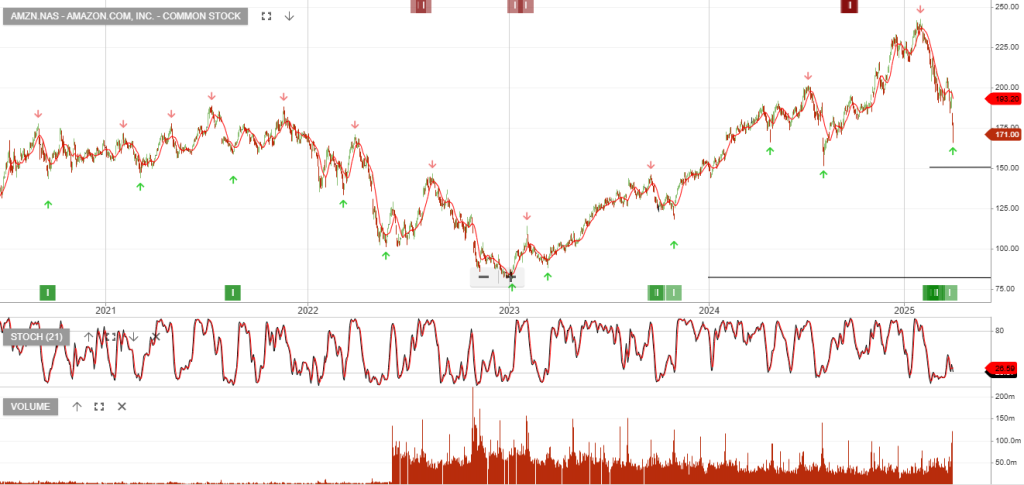

Amazon

GE Healthcare

Micorsoft

Trade Table S&P 100 Model Opens New Position in Accenture (ACN.NYS)

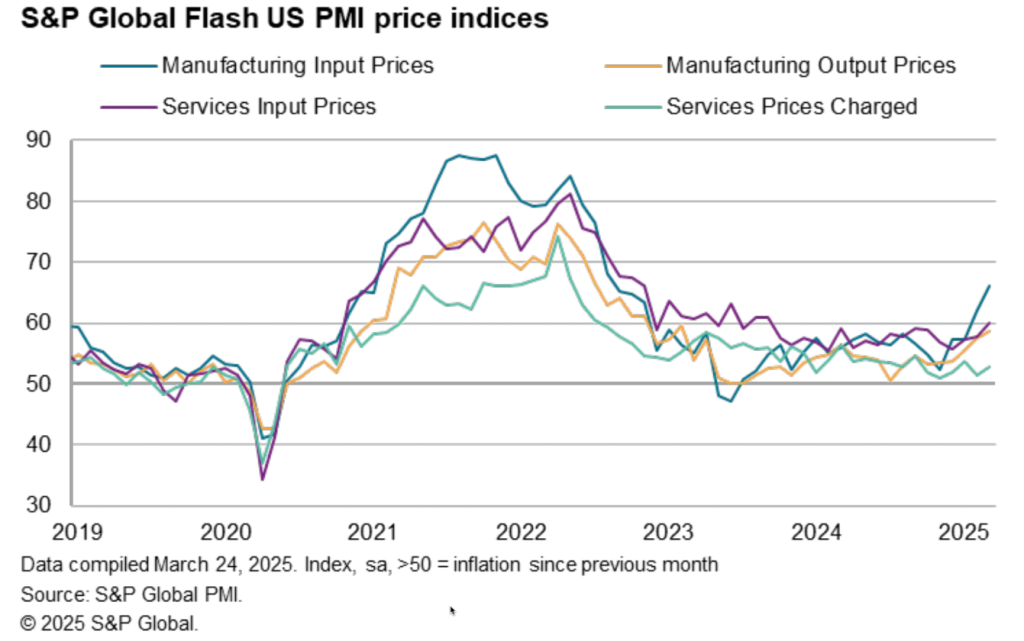

US Data

Key data will be released this week, starying on Tuesday, April 1, with the ISM Manufacturing report, Wednesday the ADP private payroll reports, ISM services report on Thursday and of course, Friday morning will bring us the BLS job report.