US Stock Market Outlook

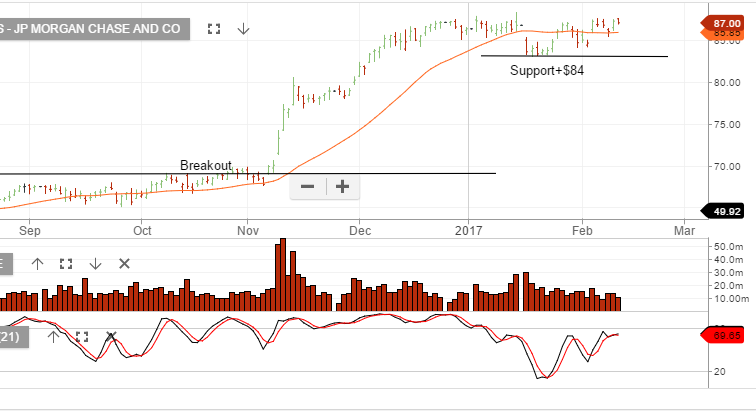

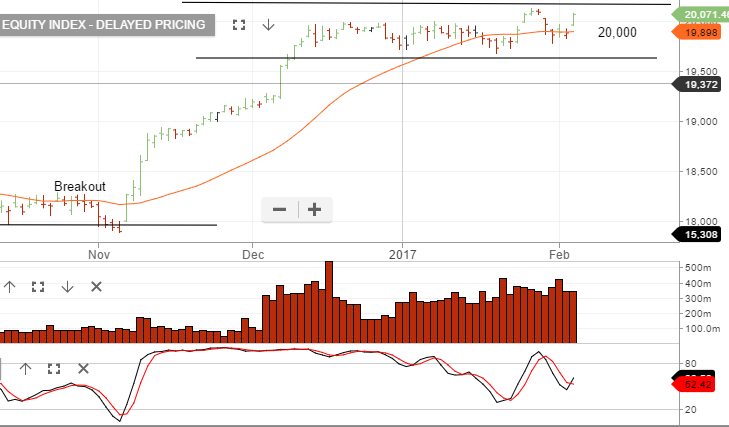

A late push on Wall Street helped US Stocks recover and allow the DOW JONES 30 Index to extend its winning streak to an 11th day.

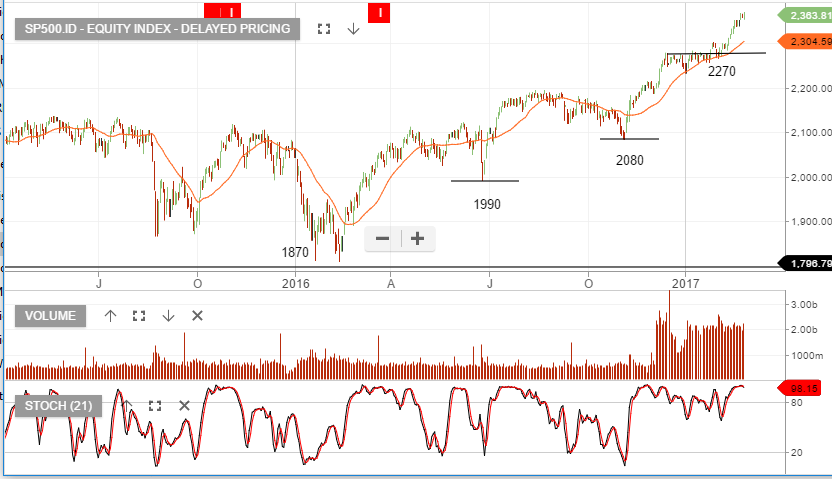

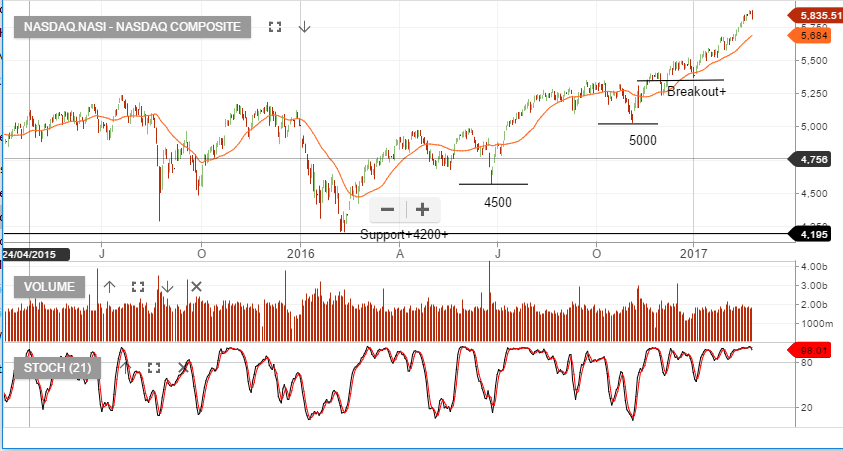

For the week, the DOW rose 1%, the SP 500 picked up 0.7% and the NASDAQ closed out the week pretty much unchanged.

Looking ahead to next week, President Trump will deliver a speech before a joint session of Congress, when he is expected to give more details about his tax plan, trade policies and the direction of health care in the USA.

It’s interesting to see that the Investor Signals ALGO engine gave a sell signal for 2 pharmaceutical companies today: Eli Lilly (LLY) and Pfizer (PFE). Those sell signals were posted at $82.85 and $34.25, respectfully.

US Drug companies have shown weakness on Mr Trump’s comments about health care reform in the past and investors will be listening closely to his speech on Tuesday.