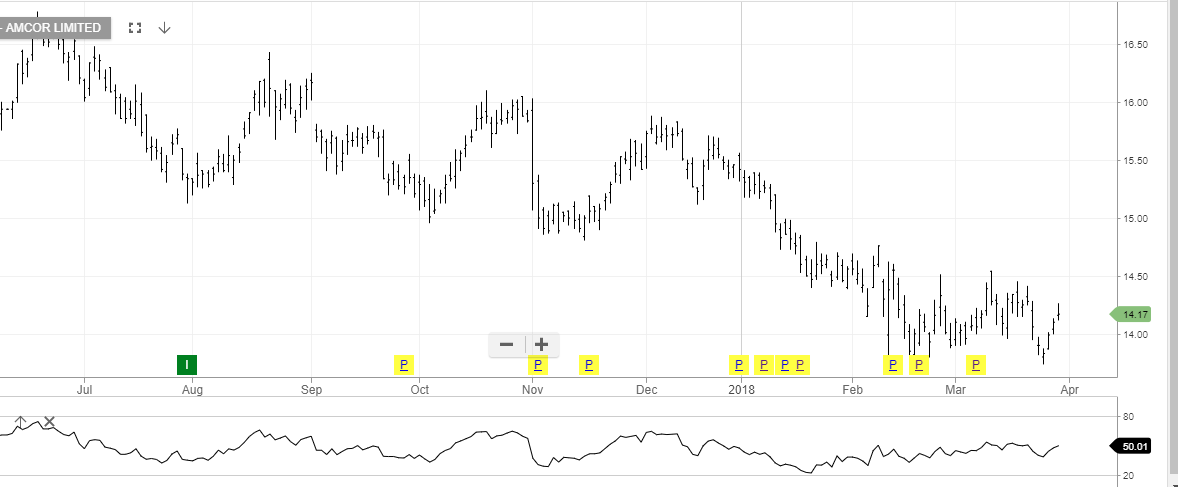

ALGO Sell Signal For Amcor

Our ALGO engine triggered a sell signal for AMC into the ASX close at $14.60.

The “lower high”pattern is referenced to the $14.76 high posted on February 8th.

Since trading as low as $13.10 on May 4th, the share price has risen close to 12%. At this point, we suggest clients either take profits on open positions or use a covered call strategy.

For those interested in the covered calls, we suggest selling the $14.75 calls into October for 35 cents.

This will allow investors to receive the 30 cent dividend on September 4th while increasing cash flow into the portfolio.

Amcor