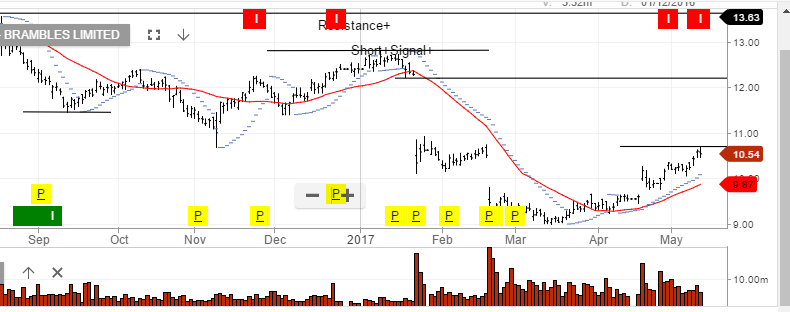

BXB – Trading Update

Brambles reported 1Q FY19, which guided towards flat 1H EBIT growth.

With the stock trading 16 x earnings and 3% yield, we believe there is only limited upside to the share price in the short-term.

The attractive story here is the upcoming spin-off of the plastic pallet pooling business. We expect this to go to a shareholder vote and be finalized early next year.

Buy BXB and sell covered call options to enhance the yield.

Brambles