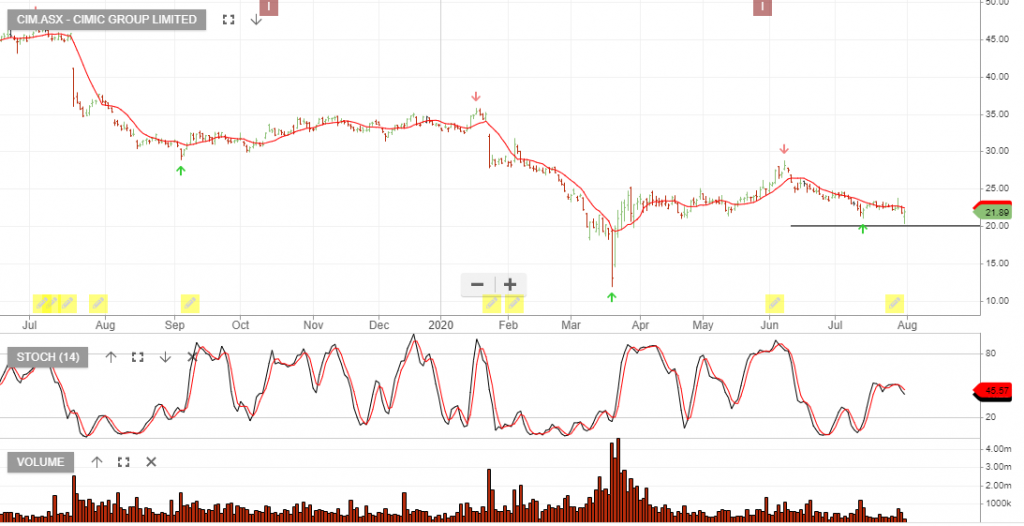

CIMIC – Buy Opportunity

Cimic Group is currently trading under Algo Engine sell conditions and therefore, any buy is based on a “counter-trend move”.

The fundamentals support improving earnings growth for CIMIC and we see the dip below $25, as an area where buying interest is likely to rebuild.

Continue monitoring the short-term momentum indicators.