Housing Construction – Sell Signal

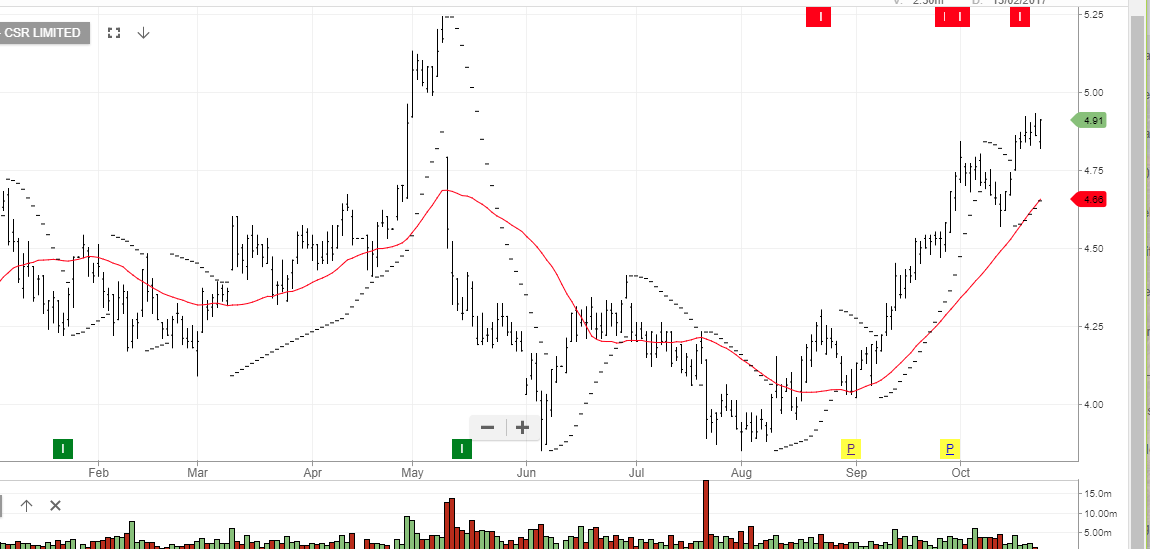

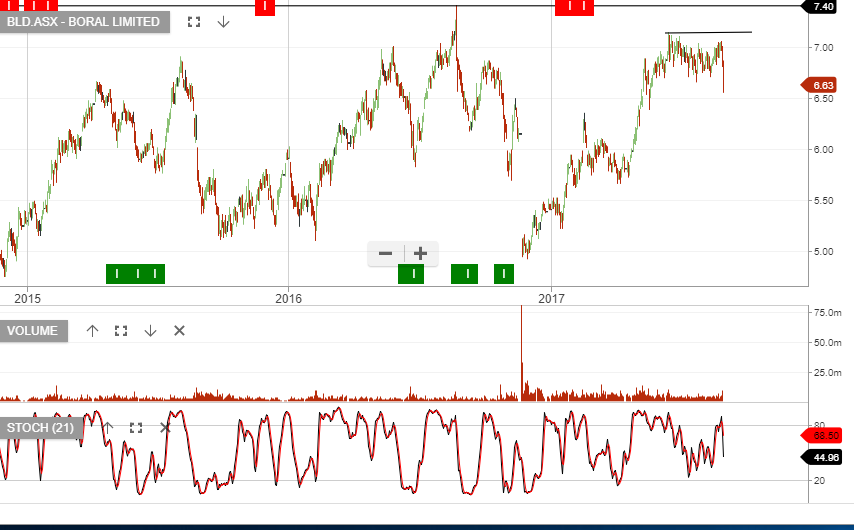

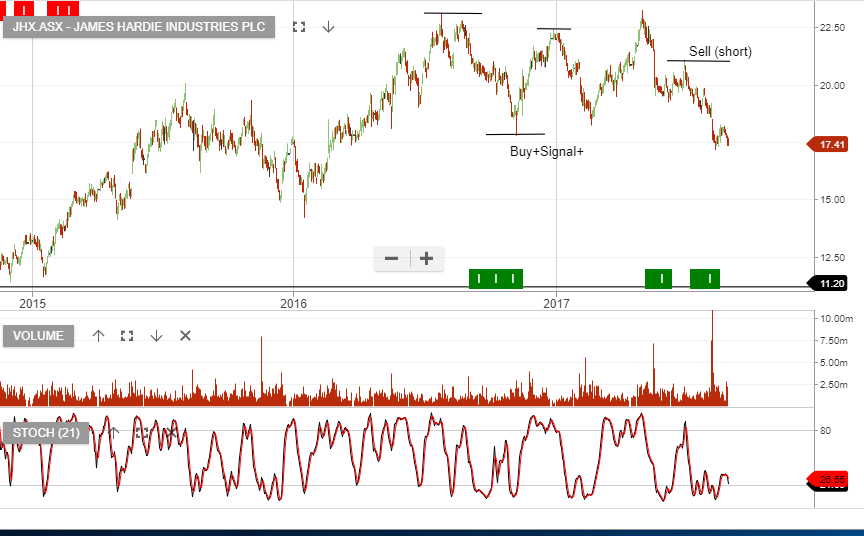

Boral, James Hardie Industries and CSR have rallied from oversold levels, as buyers have been attracted to the reduced PE multiples. The question is whether non-residential and engineering construction will offset the fall in residential construction volumes.

Australian housing approvals have been trending down for the past 6 months with Jan approvals of 172k, down 30% on the same time last year.

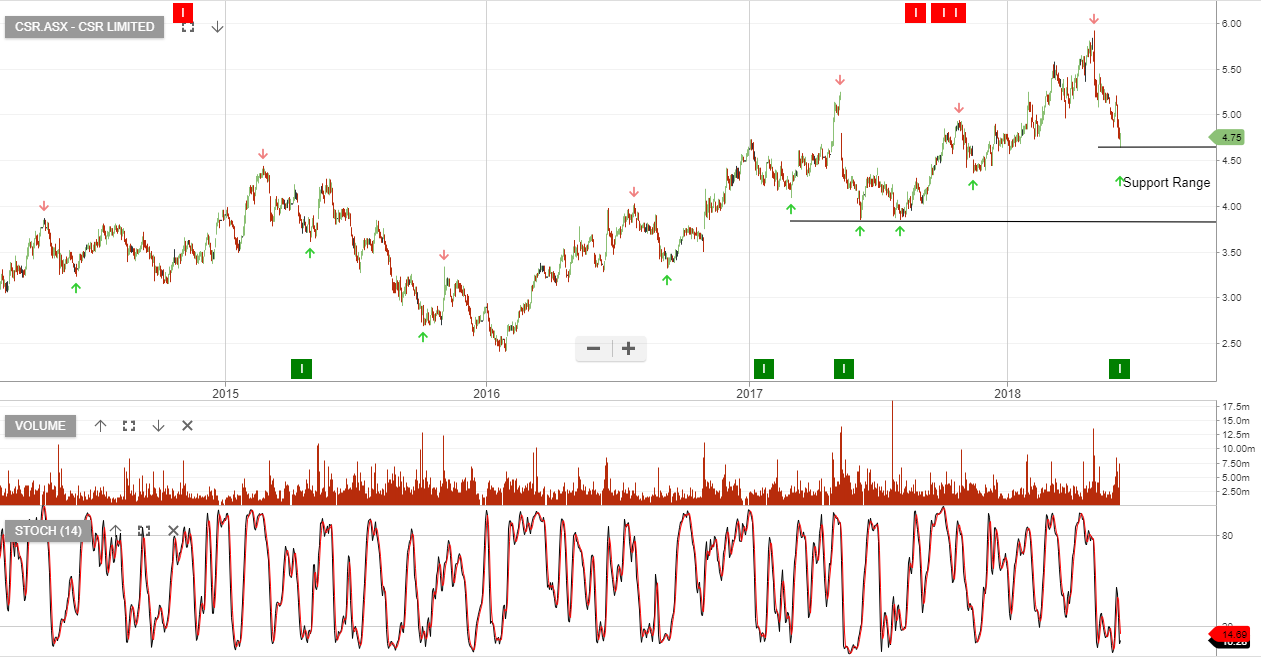

BLD, JHX and CSR are now under Algo Engine sell conditions and we remain cautious given the broader market index back drop.

We consider Boral as the best recovery opportunity, but expect short-term sell pressure to persist.