Fortescue Shares Higher On Positive Earnings

Shares of Fortescue Metals Group opened firmer as the Iron Ore miner more than doubled its net profit to AUD 2.7 billion and pledged to pay shareholders a bigger dividend going forward.

FMG will pay a final, fully franked dividend of 25 cents per share, which pencils out to 52% of the company’s net profit after tax. The full year dividend was announced at 45 cents per share.

Looking into next year, FMG announced it would increase its dividend guidance to a range of 50 to 80% of net profit after tax.

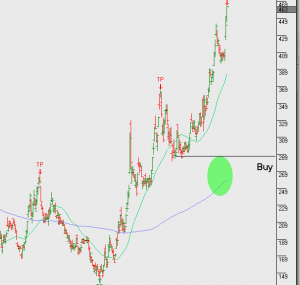

We feel that the share price will run into resistance around the $6.10 level and aren’t buyers at these levels.

While Iron Ore has had a respectable price rebound off the $54.00 low posted in June, we don’t expect a protracted move higher back into the $80/82.00 range, which will temper the profit outlook for FMG.

Fortescue Metals Group

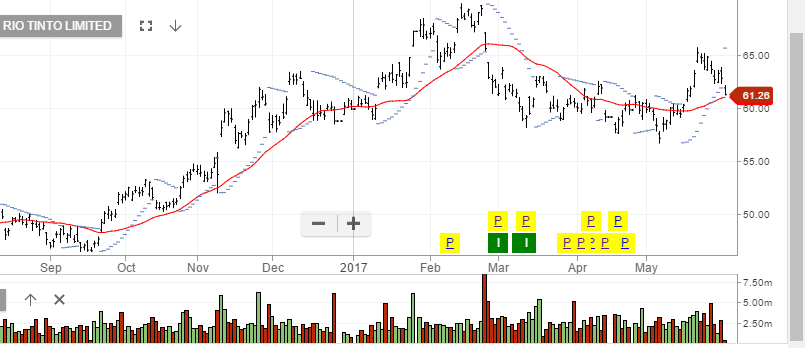

Rio Tinto

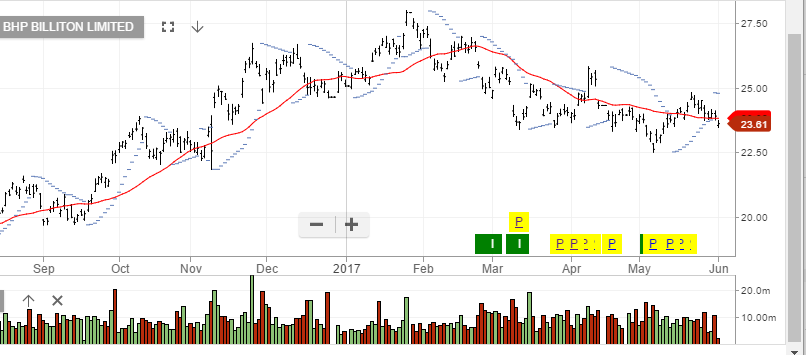

Rio Tinto BHP

BHP