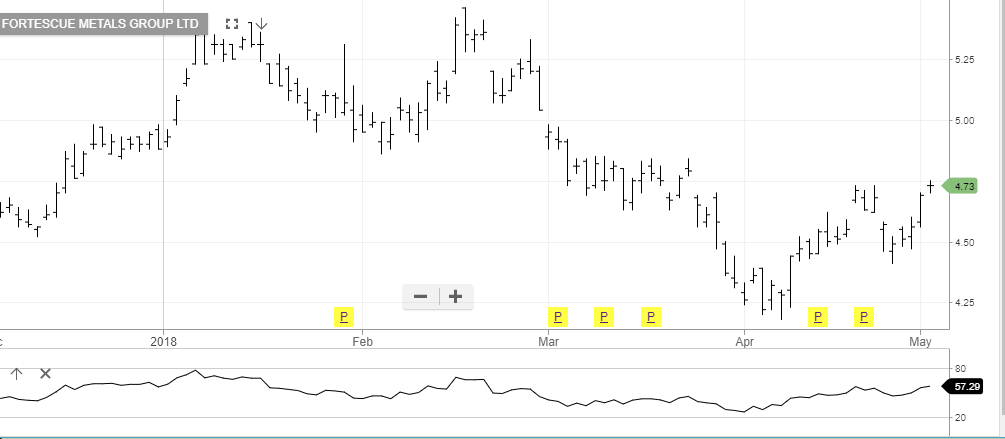

Foretescue Is Nearing The Buy Zone

Since posting a high of $5.03 on May 15th, shares of FMG have dropped almost 10%, reaching a low of $4.53 in early trade today.

Much of the weakness has been focused on the tepid demand for Iron Ore from China, as well as, the widening spread between the higher grade ore and the lower grades of ore.

However, as profit margins contract for Chinese steel mills, we will likely see this spread contract to the benefit of low grade producers like FMG.

FMG is the 3rd largest Iron Ore producer in the world and, as a low cost producer, is still profitable even in the lower grade market.

The company is scheduled to pay a 25 cent dividend on September 1st, which is 5.5% of the current share price on a stand alone basis.

Fortescue

Fortescue Metals Group

Fortescue Metals Group

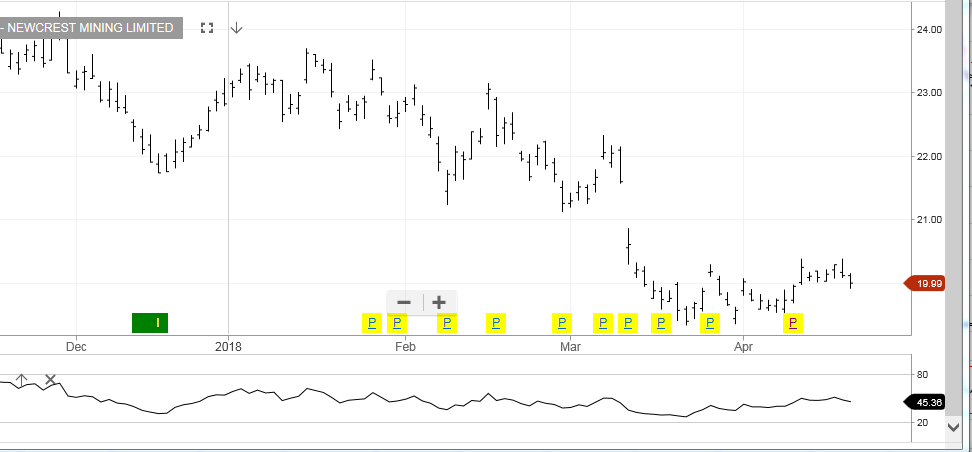

Newcrest Mining

Newcrest Mining Fortescue Metals Group

Fortescue Metals Group Oz Minerals

Oz Minerals

Fortescue Metals Group

Fortescue Metals Group

Fortesque Metals Group

Fortesque Metals Group