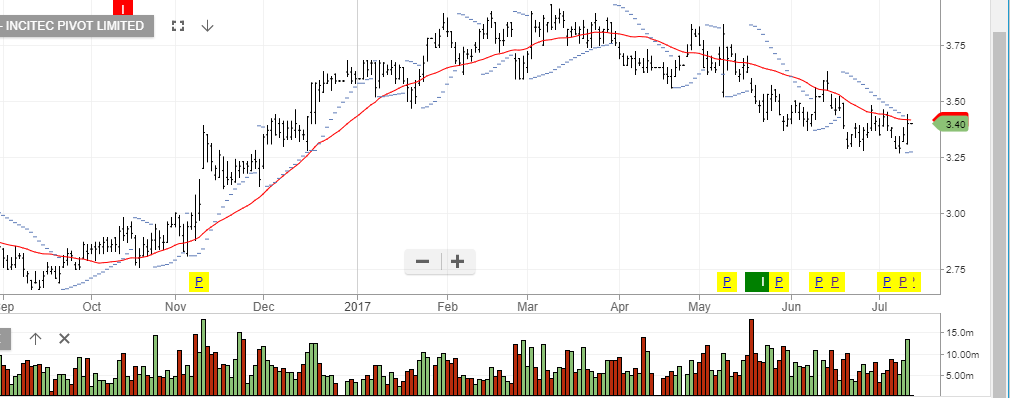

Incitec Pivot: Look To Take Profits

On 11th of July we reminded readers of the blog that we viewed the recent Algo Engine signal on IPL, as one our preferred buy-side signals.

IPL today has opened up 6.5% higher and is now up over 10% from the recent low.

Considering the recent volatility in fertiliser prices, we suggest taking profits in the current $3.55/60 price range.

Incitec Pivot