Algo Short Signals – CBA, SUN & QBE

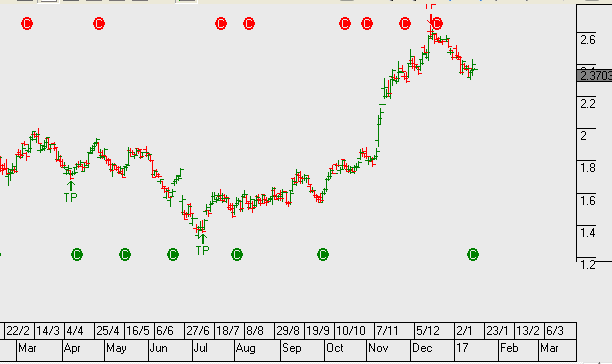

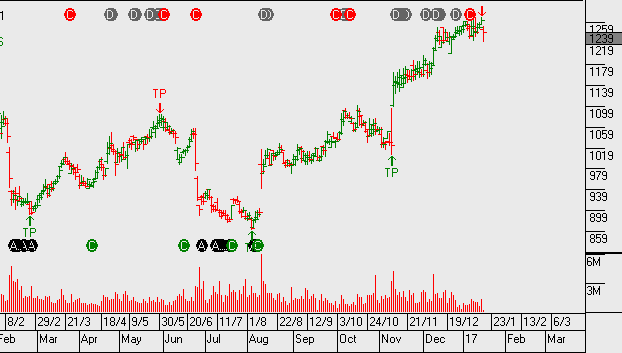

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

With 30% of QBE’s insurance business in North America, the 20% drop in the share price after Hurricanes Harvey and Irma now looks excessive.

It’s estimated that the net impact of these events for QBE was $600 million, comfortably short of the $1.1 billion gross costs implied as the storms made landfall.

However, based on after-tax earnings of the Australia and New Zealand operations only, we estimate that QBE’s 2H17 dividend will fall from 33 cents per share down to 10 cents.

After posting an intra-day low of $9.65 on October 3rd, the share price has recovered back over $10.80 in early trade.

In our view this bounce back is approaching technical resistance and internal momentum indicators are suggesting a move lower in the near-term.

Investors should exit long QBE positions and look to reenter in the lower $10.00 handle.

QBE

QBE

On account of heightened claims activity in QBE’s Emerging Markets (EM) division, QBE has downgraded its FY17 guidance.

However, we remain optimistic regarding the QBE turn-around and feel the cycle is bottoming for QBE and the outlook is encouraging.

With the stock trading 10x forward earnings and 6% yield, along with a 3-year A$1bn buy back, which was announced in February, QBE is worth adding to your watchlist.

QBE is likely to commence their share buy-back program by late August 2017 and buying ahead of this time should be rewarded with higher prices into 2018.

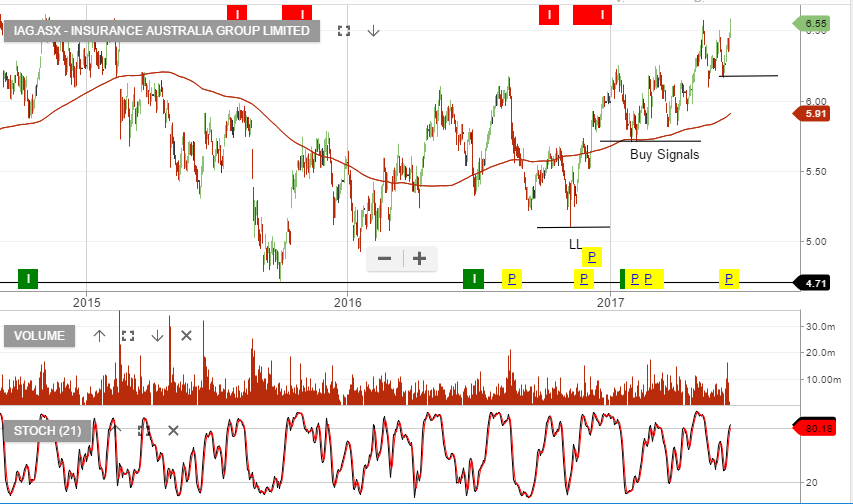

We’ve been buying QBE and IAG over the past few weeks. further upside is likely to be limited from the current level and therefore, taking profit or selling covered call options is advised.

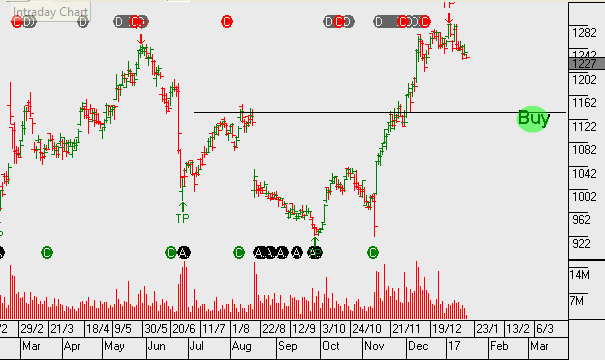

Recent price action in the local ASX market suggests we’ve entered a period of heightened volatility and potential for downside risk. Since posting the high for-the-year at 5945.00, the index for Australian shares has dropped almost 4%.

Looking across the spectrum of ASX top 100 stocks, we have found several names which can offer defensive value in a broadly sideways to lower share market.

These include: IPL, MPL, WOW, CTX, QBE, SHL, SYD, TCL, AMC, and IAG.

We consider these stocks to have the potential for moderate capital growth and, combined with a buy/write strategy, will offer 10 to 12% cash flow on an annualized basis.

ASX: XJO Index

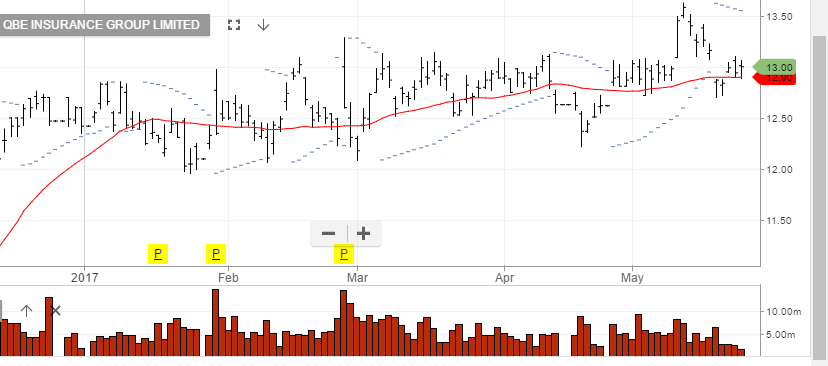

QBE Insurance posted an $844 million net profit on May 3rd, which was their best result since 2010.

By May 11th, the share price had raced to a new high for the year at $13.60.

With internal momentum indicators beginning to turn lower, we are suggesting to exit long positions or sell the $13.50 covered calls into September.

We expect to see good support in the $12.00 area as a medium term target.

QBE

Shares of QBE are up over 5.5% in early trade as the insurance giant reported a 5% jump in net profit, as well as, a $1 billion share buyback scheme.

In the year up to December 31st, the company announced net profit after tax of $844 million, which is up from $807 million over the previous year. Return on equity also improved from 7.5% to 8.1%.

QBE declared it will pay a 33 cent dividend, compared to 30 cents last year.

QBE is fully valued and we recommend selling covered call options to enhance the investment return.

Shares of QBE have jumped over 5% in early trade, posting a new 15-month high of 12.97, on rumors that the firm was in formal merger talks with insurance giant Allianz.

According to an article in a German newspaper, the CEO’s of the two companies met before Christmas and Allianz made an informal offer of $15.00 per share for QBE.

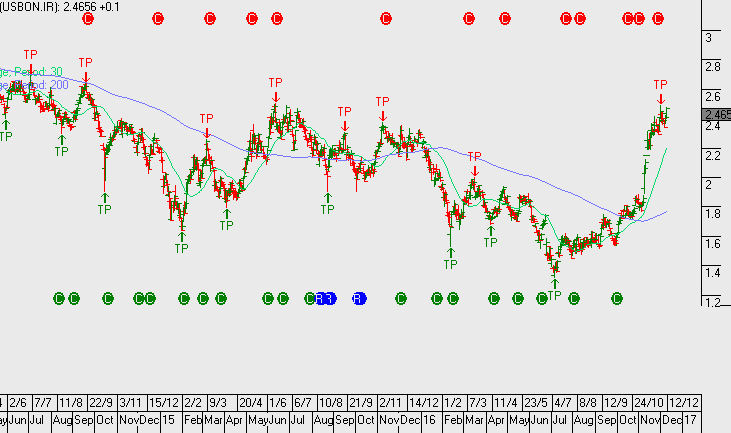

This offer price represents a 20% premium to QBE’s closing price on Friday. Aside from this merger rumor, the stock has had a steady increase since early November as US bond yields have move higher.

Without any further clarification about the merger talks, we would expect technical resistance to be seen in the $13.25 area.

Over recent weeks, we’ve highlighted a number of stocks that are overvalued and susceptible to any increase in market volatility or risk-off period.

Stocks that have rallied due to higher US interest rates are starting to retreat as the yield on the US10-YR starts to slip lower from the recent 2.64% high. Companies affected in this group include Computershare and QBE.

Australian Banks are beginning their sell-off and our bank hedge is starting to pay-off.

Exiting property plays, especially where there’s development risk will likely prove worthwhile in the coming months. We’re happy to stay exposed to the best-of-the-best only in this space and sell tight covered calls.

The issue we see is that the US bank results out so far, is probably as good as it gets for US 4Q earnings. Over the next two weeks, multinationals, industrial names and then big technology will announcement their results.

If we see an average EPS run rate for the S&P500 that fails to meet the $132 per share expectations, and in fact averages somewhere in the range of $120 – $125, then the Dow Jones will struggle to move higher.

With the above in mind, we’ve been making adjustments to portfolios to hedge an uptick in volatility and deliver returns through an aggressive derivative overlay.

Since posting a low of $9.40 on November 9th, shares of QBE have rallied over 30% to close at $12.58 on Friday.

As a result of a major restructuring and consolidation undertaken in 2013-15, the group is better positioned to benefit from higher earnings on their USD 25.7 billion high-quality investment portfolio. QBE’s stock price is highly correlated to the yield on US 10-year Treasuries, which have jumped by 60 basis points since early November.

In addition to boosting returns on security holdings, higher interest rates help QBE by lifting the discount rate used to value future claim liabilities, thereby reducing the value of these liabilities. It’s estimated that a 50 basis rate rise could add an extra USD 70 million to QBE’s net profit.

2016 earnings forecast $760 million, 2017 jumps over 20% to $920m, this places QBE on a 5.8% forward yield. Total dividends for 2017 are likely to be around $0.60 per share (50% franked).

Chart – QBE

Or start a free thirty day trial for our full service, which includes our ASX Research.