Recent Buy Ideas Revisited

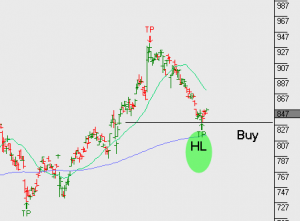

Sonic Healthcare (SHL.ASX)

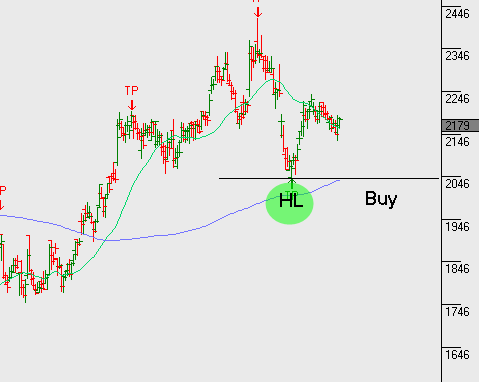

Amcor (AMC.ASX)

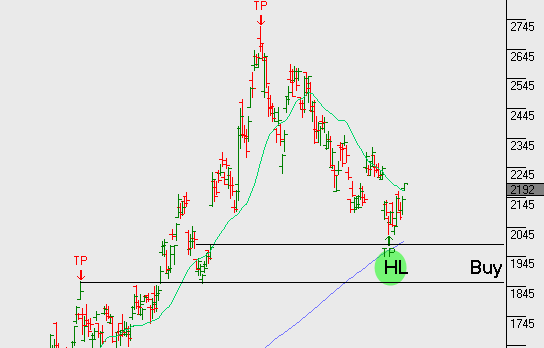

James Hardie (JHX.ASX)

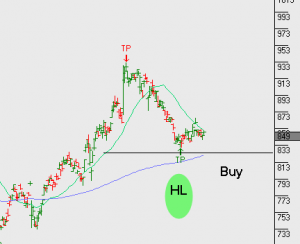

Lend Lease (LLC.ASX)

Newcrest (NCM.ASX)

Resmed (RMD.ASX)

For more analysis on our recent buy recommendations and market stratagey, please keep an eye out for tomorrow’s mid-week market update video report. It will be sent out tomorrow morning as a blog post.