Algo Short Signals – CBA, SUN & QBE

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

QBE, SUN and CBA are recent examples of the “lower high” formation being identified by the Algo Engine.

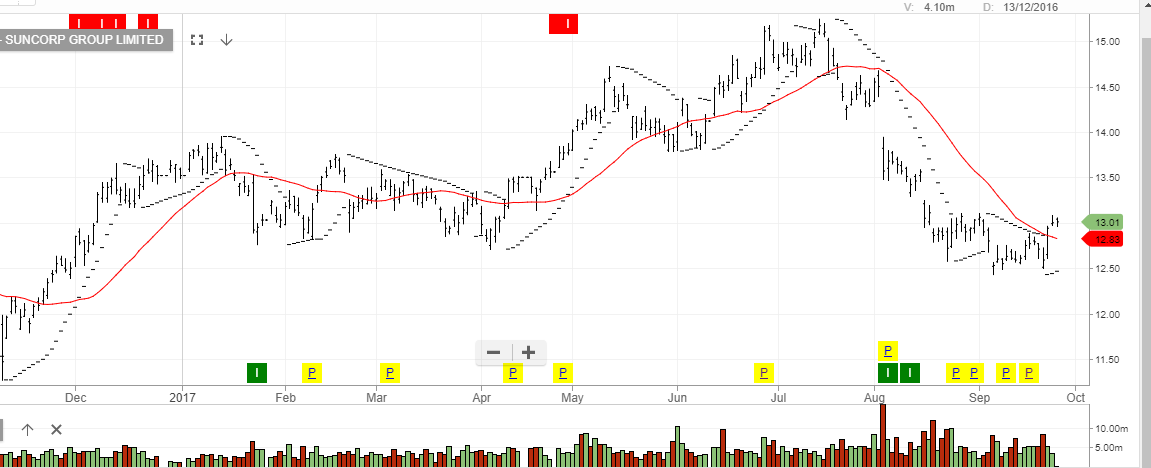

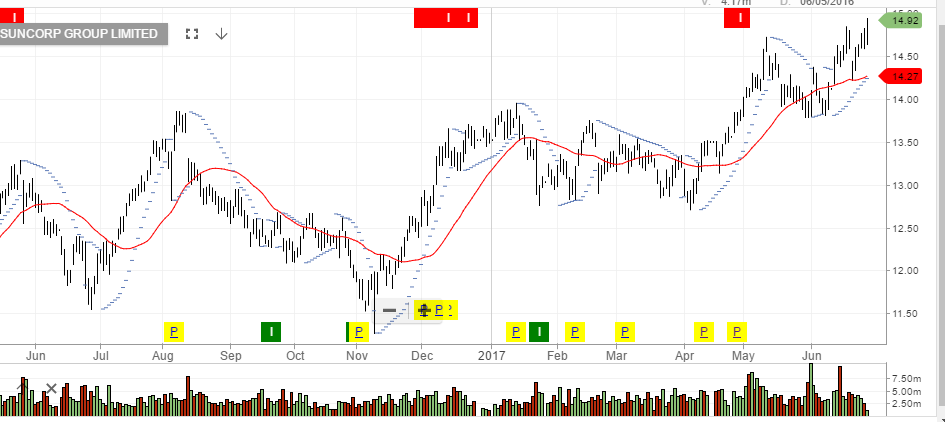

We see price resistance at $14 – $14.30 for Suncorp and we’re watching for the momentum indicators to turn negative.

The trade set-up should provide a short-term “short” trade for ASX50 CFD traders on our Saxo Go platform.

Suncorp

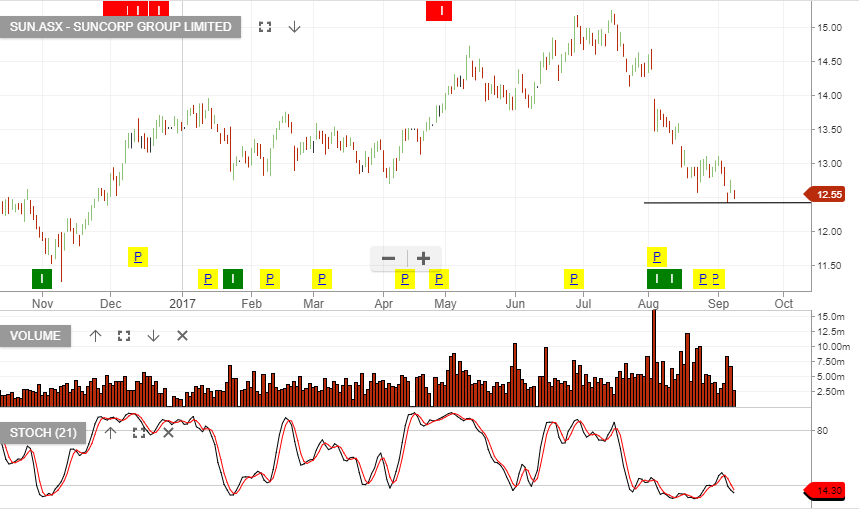

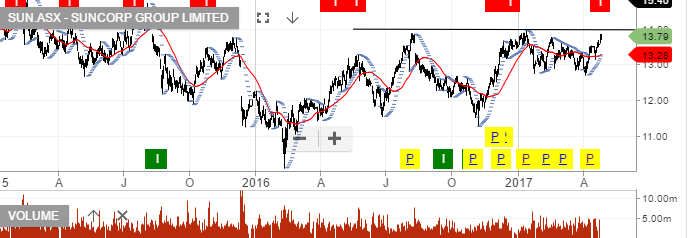

On September 18th, The ALGO engine signalled a “higher low” structure in shares of Suncorp at $12.60.

Two days later the company paid a 40 cent special dividend and pledged to boost dividends throughout 2018, which lifted the share price.

Despite posting a high of $13.10 on Monday, the upside technical momentum looks to be running out of steam.

As such, we would suggest taking profits at current levels or raising stops to break-even. The chart below illustrates that the next key support level is near the $12.40 area.

Suncorp

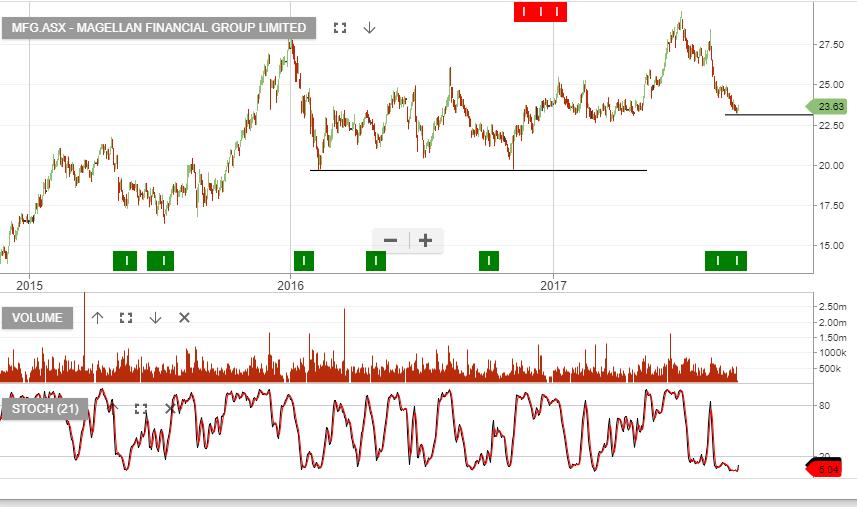

Our Algo Engine has flagged the higher low structure in MFG, BTT, SUN and MQG.

Traders may want to take a closer look at these names and place sell stops below the low formed in the past few trading sessions.

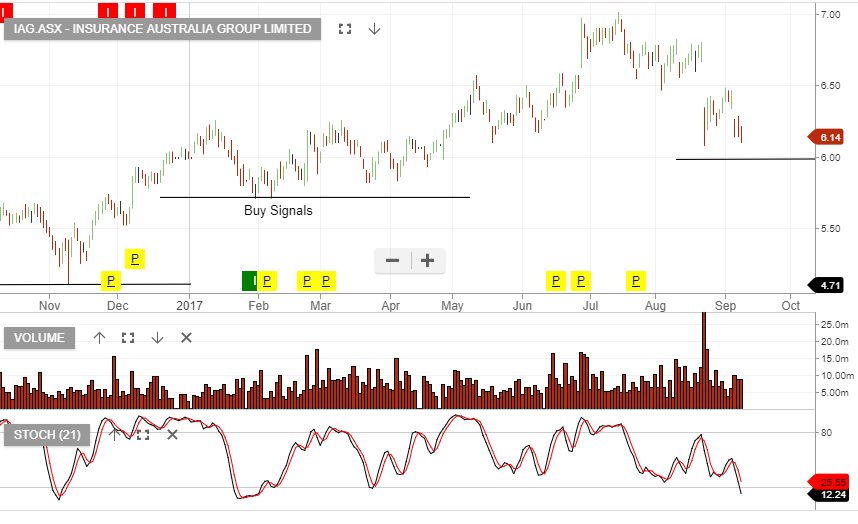

The Insurance sector in the US rebounded in Friday’s session, following oversold levels which were caused by concerns about weather related claims.

We’re expecting the local insurance companies to find buying support near the current price levels. This will likely be a short-term trade higher, as we anticipate the sector will then make a “lower high” formation.

Our two preferred names are IAG and SUN.

We continue to take a very cautious approach to the market, especially when we look at potential negative events over the next 8 weeks. Also, realizing that we approach this juncture at peak valuations for many global equity markets.

With the above in mind, Investors could be forgiven for wanting to sit on the sideline or only hold the highest of quality names. Traders on the other hand, will continue to remain active and apply stop-losses as a way of mitigating risk.

The Algo Engine has recently flagged buy signals in AMP and SUN. Both of these are reasonable prospects for a bounce from the oversold conditions, although stop losses should be established below the recent pivot point.

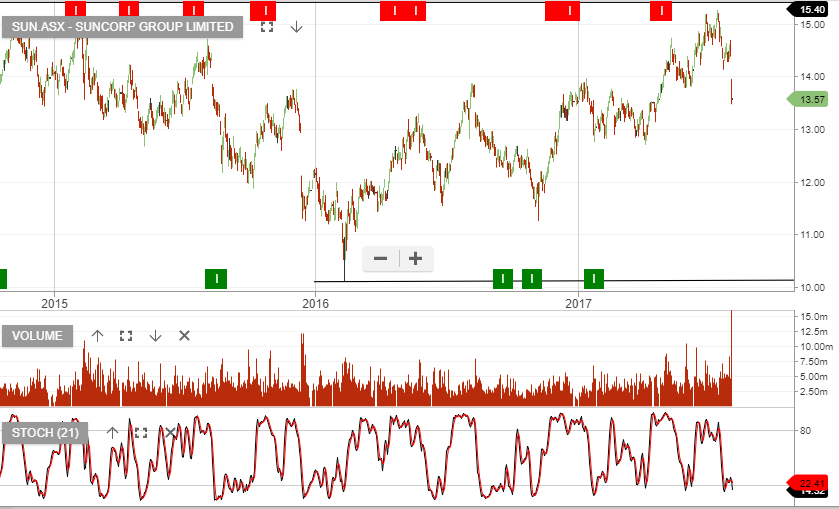

Our Algo Engine flagged a buy signal in Suncorp following the recent sell-off, which has resulted in a 15% price correction.

At $13.00, Suncorp is now forming a “higher low” formation and a technical bounce is likely to occur.

We recommend a stop loss below the $12.58 low.

SUN

SUN

Suncorp announced earnings for FY17 which resulted in a sharp drop in the share price during yesterday’s session.

The group delivered NPAT of $1,075m up 3.6% on the same time last year. Suncorp also announced a final dividend of $0.40 taking the full year dividend to $0.73.

We’ve been warning about Suncorp in the monthly ASX 50 video reports and exited all Suncorp holdings 8 weeks back at $14.50 per share. We remain cautious, as downside risks are increasing from higher costs and increased risk of higher BDD charges in the bank.

The previous point is not a unique issue to Suncorp, the pattern of higher expenses and under preforming loans will soon become more evident for all the banking names.

Since Treasurer Scott Morrison announced a banking levy in the May 9th budget, banking stocks have been sold off across the board.

It’s become clear that a fair percentage of this investment flow has rotated into the local Insurance names with IAG and Suncorp both posting material gains since early May.

We hold both of these stocks in client portfolios and they are now up 12% and 8% since mid-May, respectfully.

With respect to the re-valuation in the banking shares, NAB has posted a fresh low at 29.00 in early trade today.

Both WBC and ANZ are approaching the lows posted in early June, while MQG and CBA have held up better but are still pointing lower.

On balance, we continue to expect to see rotation out of the banking names to the benefit of the insurance stocks.

IAG

Suncorp

NAB

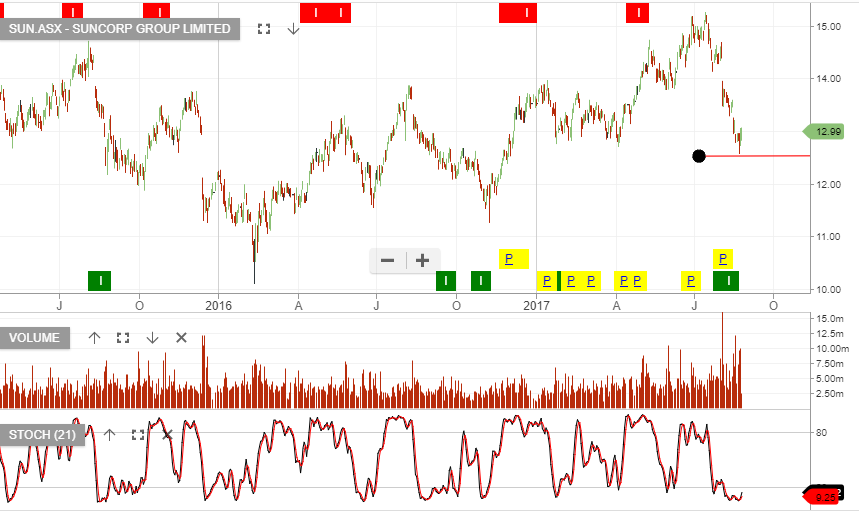

The ALGO engine gave us a buy signal on Suncorp on January 23rd at $12.92. Yesterday, the ALGO engine generated a sell signal at $13.77.

We suggest that investors who took advantage of the buy signal use this recent price increase to take profits or write covered calls above $14.00.

Technically, the $14.00 level has proved stiff resistance dating back to January of 2015.

Furthermore, the ALGO engine has generated exceptional signals for capturing the medium-term trading ranges for Suncorp.

Suncorp

Or start a free thirty day trial for our full service, which includes our ASX Research.