Ansell & Tabcorp

We’ve been recent buyers of TAH and ANN and now look to sell covered call options.

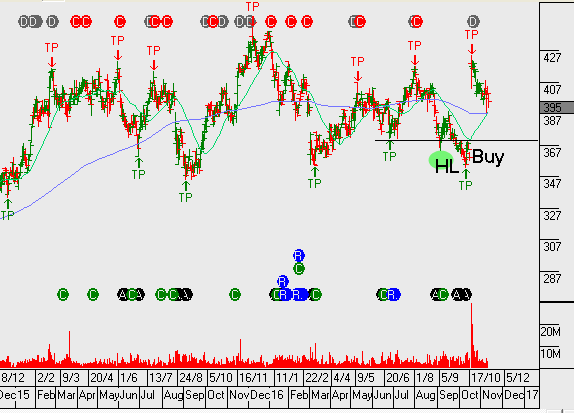

Chart – ANN

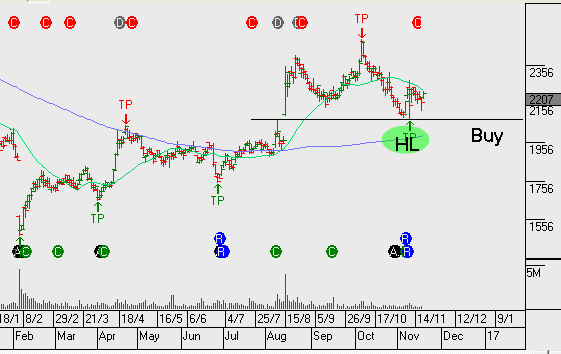

Chart – ANN

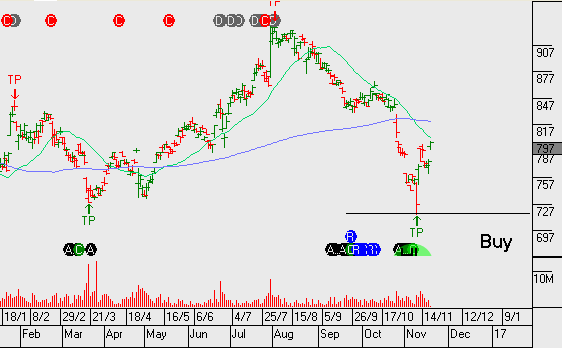

Chart – TAH

We’ve been recent buyers of TAH and ANN and now look to sell covered call options.

Chart – ANN

Chart – ANN

Chart – TAH

Tabcorp has agreed to pay the largest civil penalty in Australian corporate history yesterday, as company officials admitted that they had failed in it’s obligation to strictly follow domestic Anti-money laundering laws.

The gaming company agreed to pay $45 million to the Federal Government and pledged to modify its protocol for management oversight and operational execution of their money laundering program.

We feel the “silver lining” to this story is that the ACCC will take a favorable view of Tabcorp’s admission of oversight and commitment to increasing internal surveillance when ruling on the pending merger with Tatts group.

Shares of the company have traded back to support at $4.50 in early trade. We view Tabcorp as a $5.00 stock in the medium-term and suggest adding to long positions at these levels.

We’ve been buyers of Tabcorp and continue to see upside potential to $5.00.

Tabcorp is a relatively defensive income opportunity for portfolios, with earnings supported by potential synergy savings after the Tatts integration.

The company continues to progress the merger proposal with Tatts and the ACCC is scheduled to release its statement of issues on the 23rd of February.

By applying a covered call option, we’re able to allow 5 – 10% capital growth from the current price, whilst still generating 10%+ in annualised cash flow from the dividend and call option income.

We expect modest earnings growth into FY18, which will place the stock on a forward yield of 5%. TAH goes ex-div on the 7th of Feb paying out $0.125

Our buy range for Tabcorp is between $4.20 & $4.50.

Shares of Tabcorp have opened 3.5% lower as the betting company posted a 5% rise in half-yearly profits.

The firm reported an interim dividend of 12.5 cents fully franked, which was 4% higher than this time last year.

The underlying net profit of $102.7 million for the half year ended December 31st was up from $97.5 million a year ago.

Tabcorp reports earnings on the 2nd of February.

We assume Tatts merger is completed by middle of this year and generates cost savings post integration of $100m plus.

FY18 revenue $5.2b, EBIT $800m, DPS $0.25 places the stock on a forward yield of 5%.

We’re buyers of TAH at $4.70 and selling call options post the earnings result.

We continue to track the following names as preferred recent buy signals from our algorithm engine.

Strong competition is likely to subdue 1H17 earrings growth for TABCORP.

The 5% sell-off the stock has had over the last two weeks sees TAH trading back into our value range and the stock is now producing a buy signal from our algorithm engine.

The announced merger on the 19th of October between TABCORP and Tatts Group along with the $500m share buyback, should help to underpin the share price.

FY17 revenue $2.2b, EBITDA of $550m, EPS of $0.24 places the stock on a forward yield of 5.5.

The following group of stocks are in either established uptrends or, in recent months they’ve broken downtrends to begin building the early stages of a bullish “higher low” formation.

Many of these names have been mentioned previously in the blog and/or the monthly strategy video report. It’s worth loading these codes into your watch list and considering rebalancing your portfolio to include allocations towards some, or all of these names:

JHX, LLC, MQG, SHL, TWE, ANN, ANZ, ASX, CCL, CIM, COH, QUB, TAH, WOW & WPL.

With the lower growth names within the above basket, such as WOW & CCL, we compliment the position now with tight covered calls to enhance the yield to 10%+ per annum. With some of the other names, we give a little more breathing space as we expect 5 to 10% price appreciation before selling the call option overlay.

Tabcorp (TAH.ASX) will likely see $20m+ in earnings upgrade from the NSW Government’s decision to reverse its ban on greyhound racing from FY18.

FY17 revenue of $2.3b looks flat on the same time last year, with EBIT of $350m and EPS $0.23. Out into FY18 the investment case picks up. FY18 revenue $2.35b, EBIT jumps to $370m on $0.25 of EPS and a forward yield of 5%+. With a relatively high payout ratio and 20x PE, the stock looks slightly expensive and we prefer to be a buyer on a dip back below $5.00

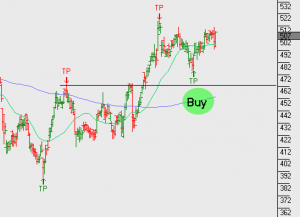

TAH.ASX

CWN.ASX

Crown looks attractive at or near $13.00 with gaming revenue picking up in Macau and the pending breakup of the ASX listed Crown business splitting into 3 separate entities, unlocking value for shareholders.

Or start a free thirty day trial for our full service, which includes our ASX Research.