Chart Watch – Telstra

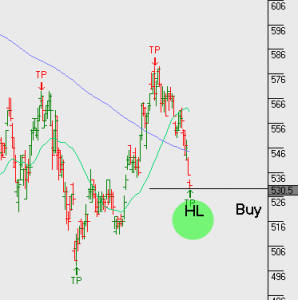

Telstra should push higher into the top end of the trading band, as shown on the chart below.

Yield hungry investors buying TLS for the compelling 7% fully franked dividend, will likely push the share price higher, before running into resistance at $4.80.

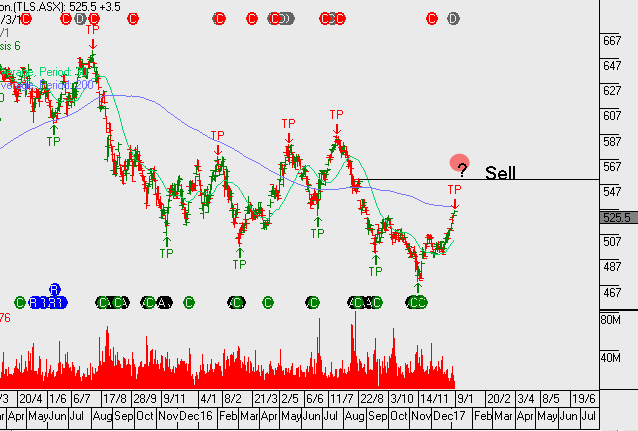

The last Algo Engine signal on TLS was a sell signal back in January at $5.25

Telstra

Telstra