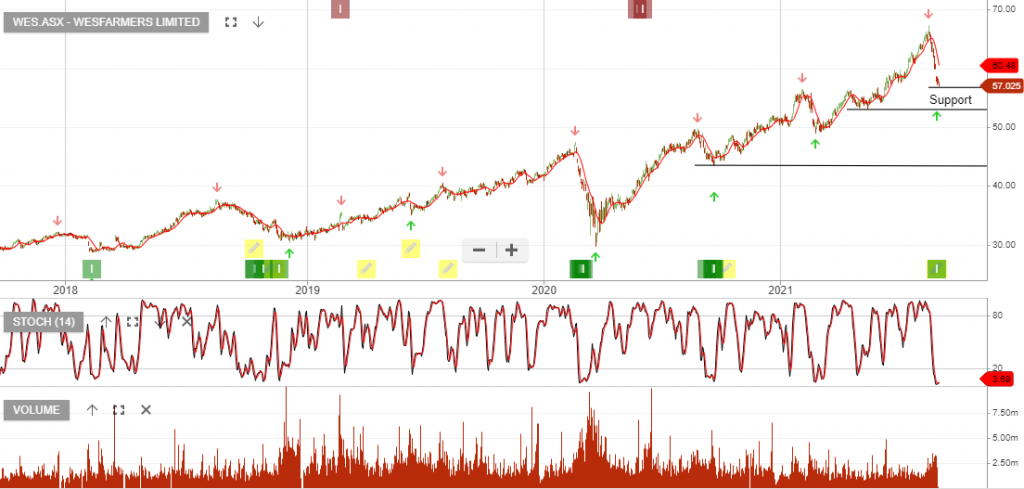

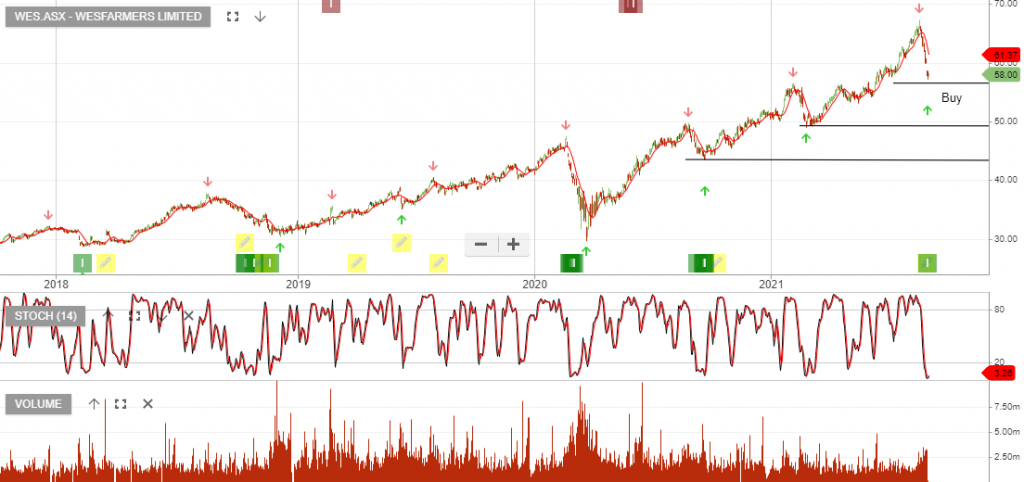

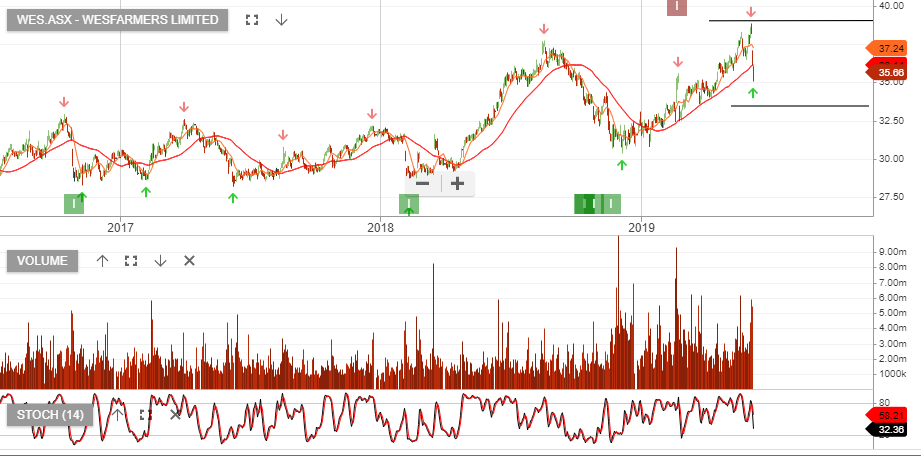

Wesfarmers – Buy

Wesfarmers is under Algo Engine buy conditions.

FY21 result was slightly above expectations with underlying EBIT up 21% to $3.55bn.

WES has proposed a A$2.3bn (A$2.00 per share) capital return that is expected to be paid in December (subject to shareholder approval).

WES advised that its retail divisions have been affected by recent lockdowns with trading restrictions and several store closures.

WES trades on a forward yield of 2.5%.

Accumulate WES within the $50 – $57 range.