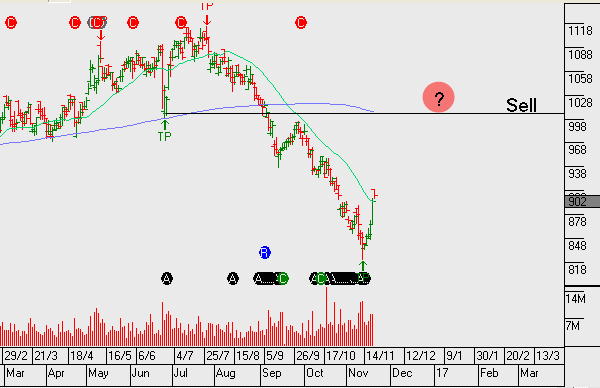

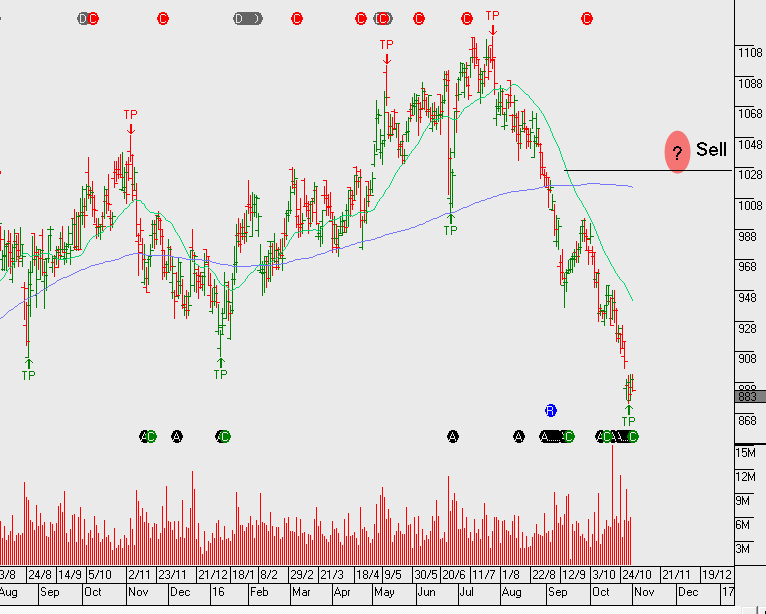

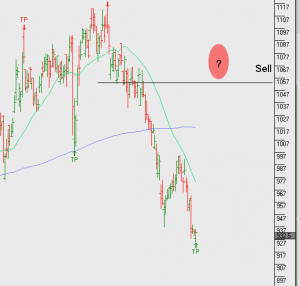

US 10-year Yields

The Dow Jones 30 posted it’s 7th straight lower close for the first time since 1978.

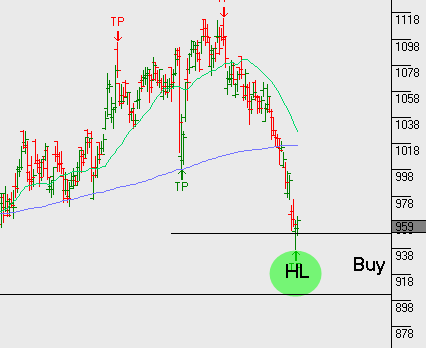

As a result, the US 10-year bond yields fell to a 1-month low of 2.38%. An increase in equity market volatility could could lead to another 10 to 15 basis points of downside on the yield.

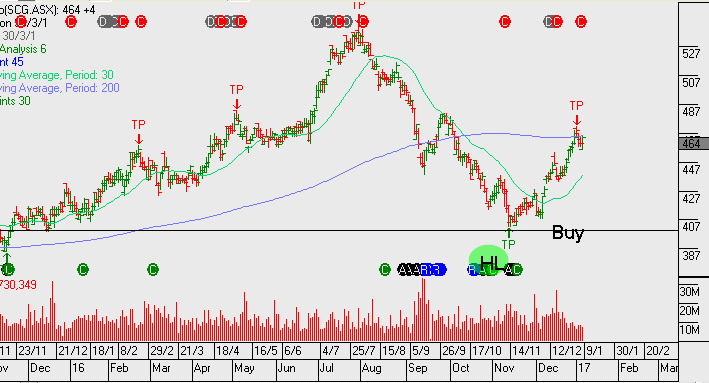

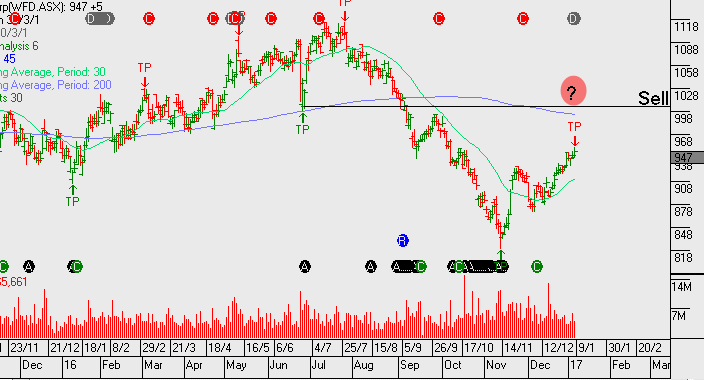

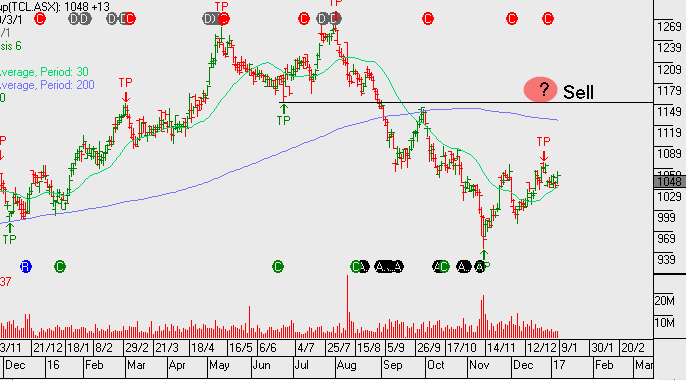

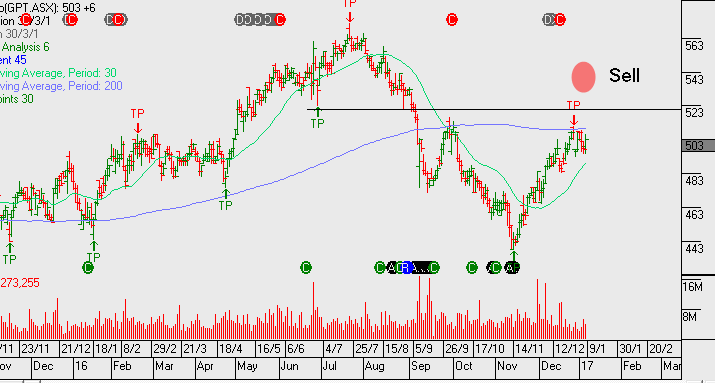

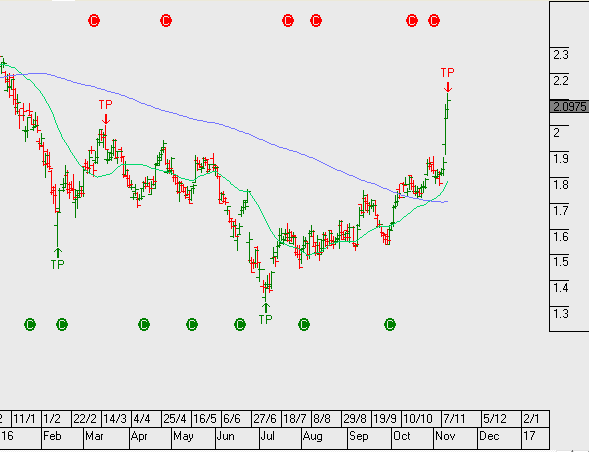

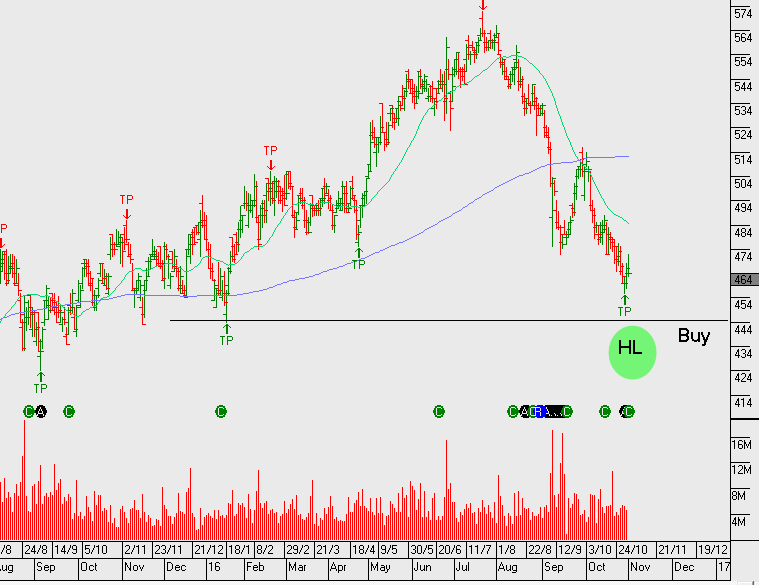

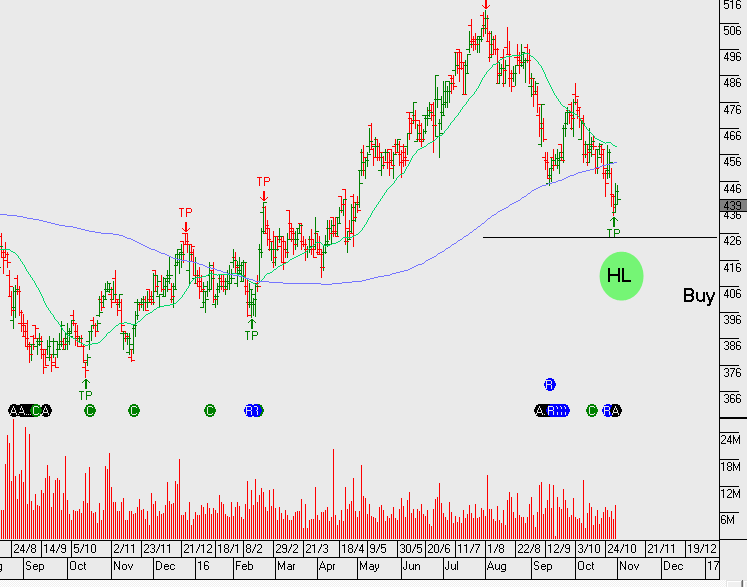

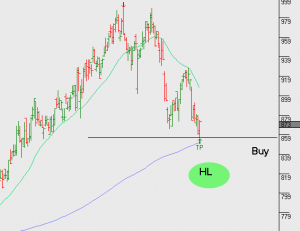

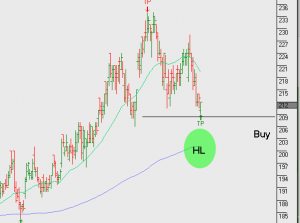

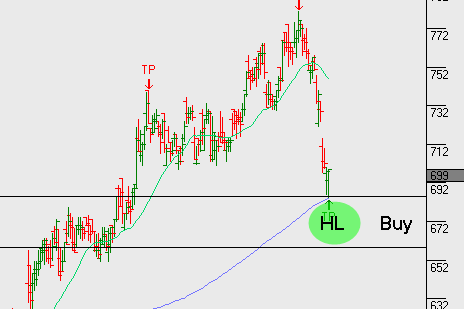

Some of the local names that have moved higher on the lower yields have been SYD, TCL, WFD and, to a lesser degree, TLS.

It’s likely interest rate stabilization will work as a near-term cap on these companies and allow for a covered call strategy to enhance the portfolio returns