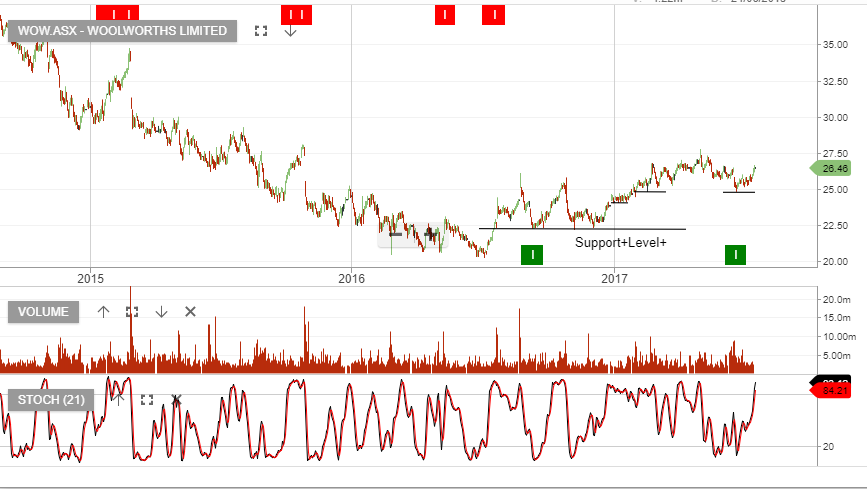

Woolworths – BUY

Short-term traders may consider buying WOW with a stop loss below yesterday’s $25.41 low.

WOW – Ex-Div on 7/9/2017 (Div 50c, Franking 100%).

Short-term traders may consider buying WOW with a stop loss below yesterday’s $25.41 low.

WOW – Ex-Div on 7/9/2017 (Div 50c, Franking 100%).

As the Algo Engine identified the “higher low” price pattern in both Woolworths and Origin Energy, we’ve regularly highlighted these as preferred buying opportunities.

We’ve remained buyers of ORG and WOW throughout the past 12 months but now feel that we’re approaching a level where we see full value.

Resistance in ORG will likely be found at or near $8.00 and WOW is likely to experience selling based on valuation grounds at or near $27.50.

Following recent Algo Engine buy signals, we continue to hold WOW, BHP and ORG as preferred holdings.

We’ve been long Woolworths following the recent Algo Engine buy signal.

Through adding a $28 December covered call option we’ve boosted the annualized cashflow to 10 – 12%, which includes capturing the $0.58 September dividend.

WOW reports on the 23rd August. The stock is trading on 20x FY18 earnings and 3.3% forward yield.

FY17 EPS is likely to around $1.50 per share and the market is forecasting underlying EPS growth into FY18 of 8 %, to $1.65 per share.

Recent Algo Engine buy signals in BHP and WOW continue to perform strongly.

An overnight rally in metal and oil prices will support BHP in today’s trading and investors may wish to consider selling covered calls into November, at or near the $26 strike price.

Woolworths reports earnings on the 23rd August and the market will be looking for underlying EPS growth of 8% to support the 22x earnings multiple.

With WOW now trading on forward yield of 3% and a relatively high multiple, we encourage investors to sell $28 Dec call options to boost the annual cash flow return.

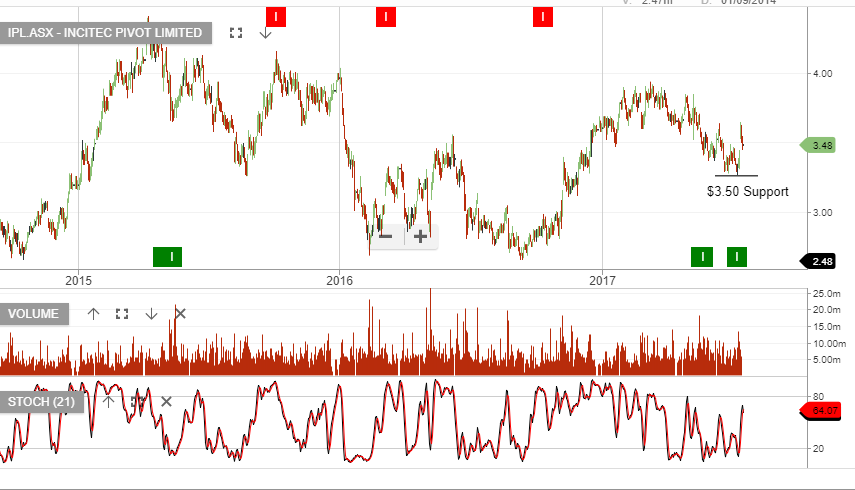

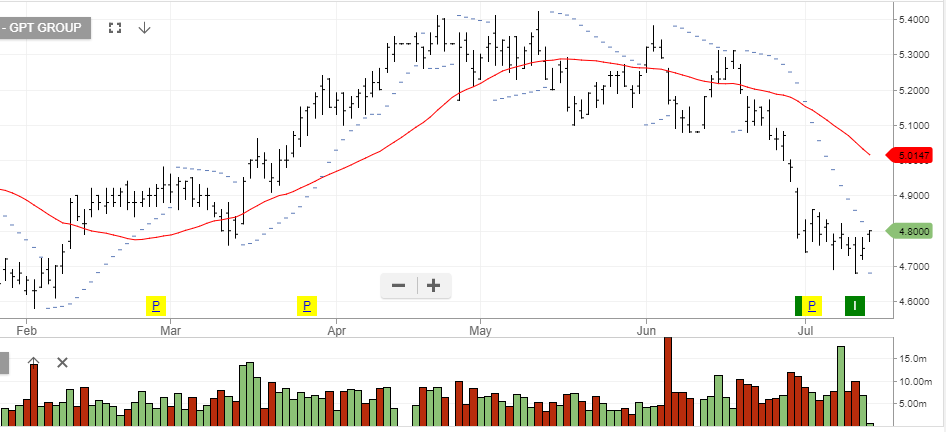

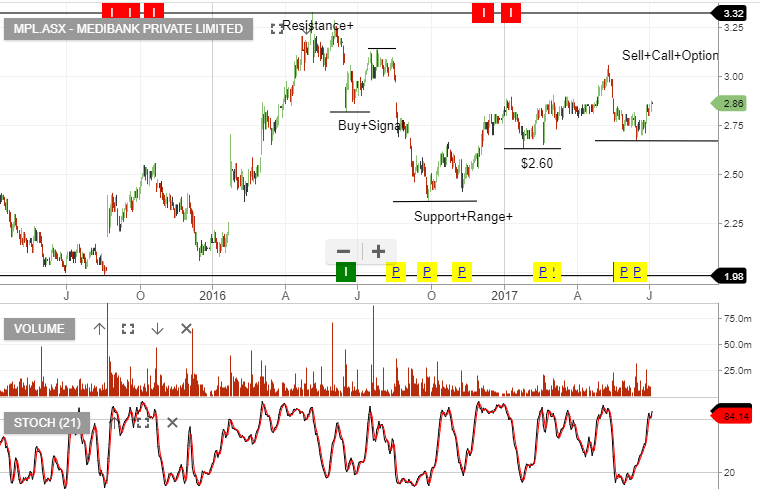

We’ve been highlighting the buying opportunities in WOW, ORG, IPL, GPT, TCL & SYD over the last few weeks.

We continue to like these names and see supportive technical and fundamental factors, which we believe will create investor value.

Over the last two weeks, yield sensitive names like SYD, TCL and GPT have all dropped over 10% from recent highs.

One of the main drivers has been the change in interest rate expectations from G-7 central bankers and the subsequent rise in short-term paper.

Moving forward, we see more likelihood of G-7 rates reverting lower within the year’s range and providing upside potential in the stocks above.

Other stocks we like on the basis of lower local rates are: AMC, WOW and MPL.

We see reasonable upside potential in the names and will employ the derivative overlay strategy (selling covered calls) to enhance the portfolios returns.

Transurban

Sydney Airport

General Property Trust

We continue to like the setup in CTX, WOW and IPL. We also feel that TCL and SYD are now approaching oversold levels.

Woolworths, Woodside, Medibank & Origin look like they’re setting-up as strong buy signals.

Other names which we view favourably from recent ALGO alerts include, SYD, TCL & GPT.

Our Algo Engine triggered buy signals in both WOW and SOL; both opportunities are worth further consideration. Buying support is likely to increase at or near the current entry levels.

Reminder: We now have a new tutorial video in the help menu which explains the navigation of the watch-list feature, this includes reviewing the recent algo signals and customising your own watch-list.

If you need more help, please call our dealing/help desk on 1300 614 002

Or start a free thirty day trial for our full service, which includes our ASX Research.