ETF Update: BetaShares BBOZ

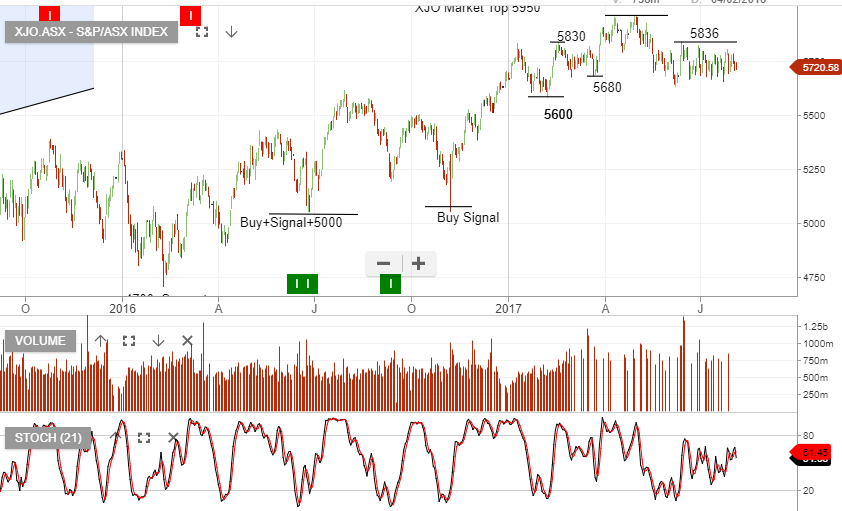

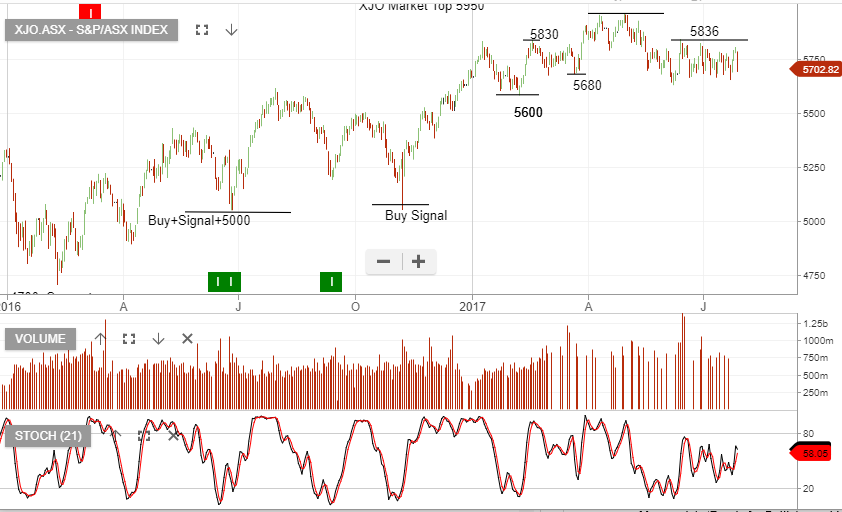

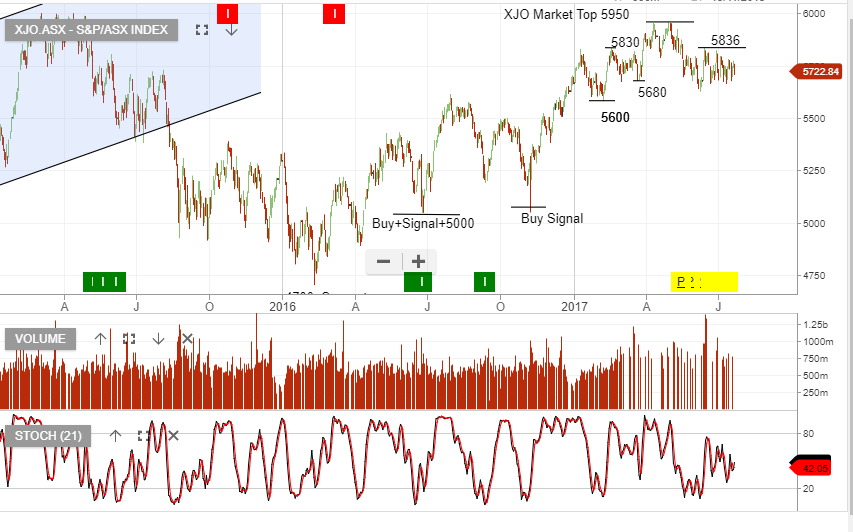

The XJO 200 Index continues to trade within a broad, sideways “Flag” pattern bound by the June 8th low of 5624 and the June 15th high of 5834.

The index is currently trading at 5666, which puts the key support level of 5624 within reach. A break of this level would open up range extension to the downside and find the next key target at 5578.

Investors looking to profit from a move lower in the XJO can buy the BetaShare ETF with the symbol: BBOZ.

BBOZ is an inverse ETF which means the unit price increases as the XJO Index trades lower.

BBOZ also has a 2.5% weighting, which means a 1% move in the XJO will have a 2.5% impact on the unit price of BBOZ.

The current price of BBOZ is $17.80.

We estimate that unit price of BBOZ will be $19.50 when the XJO trades down to 5578.

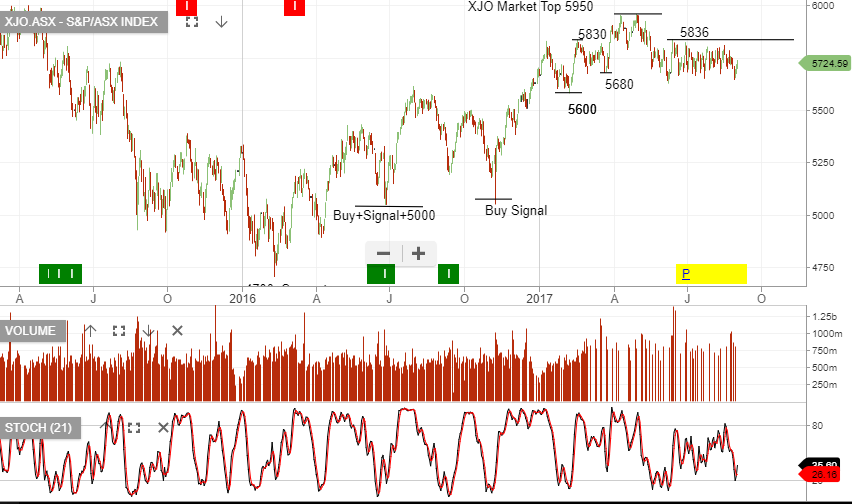

ASX XJO Index

BetaShare Inverse ETF: BBOZ

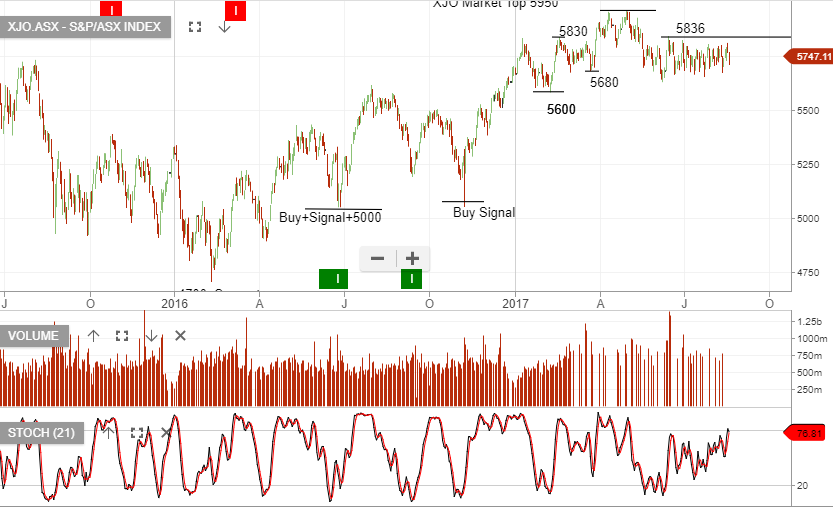

ASX XJO Index

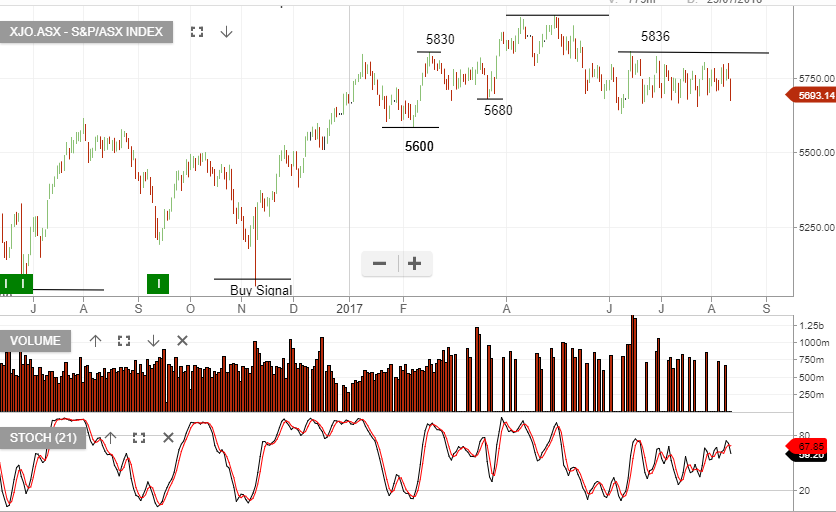

ASX XJO Index