In the lead up to the UK Referendum on June 23rd, many market commentators warned that a “Brexit” vote would have an acute and immediate impact on domestic UK assets in general, and on the price of the GBP/USD , specifically.

After posting an intraday low of 1.2800 on July 6th, the Sterling recovered over 5% to reach an intraday high of 1.3481 on July 15th, but only managed to hold on to the 1.3340 level on a closing basis; over 120 points below the high and the highest NY close since.

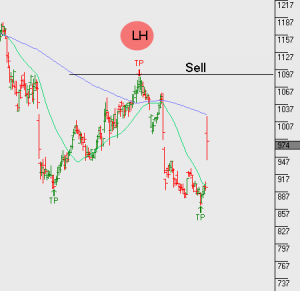

From a technical perspective, this week’s price action suggests the GBP/USD has completed a bearish pennant formation based on the break of the 1.3220 trend line last week and the failure of the pair to post a NY close above last week’s low close of 1.3020 on August 5th. Following this pattern, the next key support is found at 1.2820 followed by the 1985 low at 1.2750.

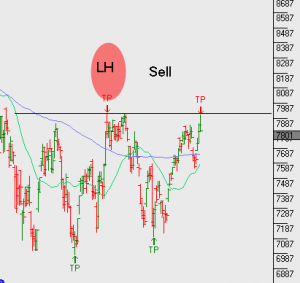

An interesting aspect of this this technical pattern is the correlation break and divergence between the Sterling and the FTSE 100 Index. The UK Equities markets rallied alongside the GBP from early July on a combination of “time-lagged” UK economic data and expectations of further stimulus from the Bank of England (BoE).

However, since mid-July, several key UK growth aggregates have softened or offered little in terms of positive forward guidance. As a result, the GBP/USD and the FTSE 100 have diverged with the index posting its highest close of 2016 at 6902.00 today, and the GBP/USD picking up momentum to the downside. It’s reasonable to expect that if this recent trend continues, investors hedging out currency exposure on rising UK equity prices could add to the downside pressure on the Sterling.

Yesterday’s UK Housing Survey illustrates how the Brexit impact may be finally working its way into the overall UK economy. The GBP/USD was triggered lower as the RICS house pricing index slumped to 5% from 15% in June. This was the lowest reading in three years and underscores concerns about how heavily leveraged UK consumers are to housing, and the potential impact on retail spending if the property market continues to adjust lower.