In the lead up to last Friday’s US Payroll (NFP) report, there were several Federal Reserve officials, as well as many market commentators, who believed that a better-than-expected jobs report would increase the likelihood of a November rate hike. Even FED “dove “Charles Evans seemed to warm to the idea that above trend growth in employment would justify a near-term move in the Fed Funds target.

However, the less than spectacular Non-Farm Payroll report saw the odds of a November move scaled back materially, the USD lose some of its gains for the week.

We have never really supported the speculation about further rate normalization at the November FOMC meeting. There is no historic precedent for any FED policy change so close to a Federal election and the current FED will likely want to show a political and independent posture.

In addition, the November FOMC doesn’t have a scheduled press conference nor are any updated economic forecasts scheduled for release. These scheduling issues wouldn’t completely preclude a rate hike if the recent data was extremely strong; which is not the case. On balance, the NFP report was solid even though the headline new jobs component was weaker-than-expected. Private sector jobs gained 167,000, while the participation rate rose to 63% which is the best rate since February of 2014.

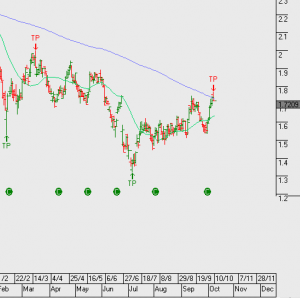

Chart – US 10yr

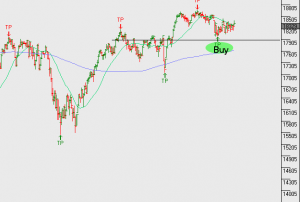

Dow Jones