Algo Update – Sonic Healthcare

Following the recent Algo Engine buy signal, Sonic Healthcare looks like it is finding support at or near $22.50.

We continue to like RMD, SHL, CSL, MPL & RHC in the healthcare sector.

Following the recent Algo Engine buy signal, Sonic Healthcare looks like it is finding support at or near $22.50.

We continue to like RMD, SHL, CSL, MPL & RHC in the healthcare sector.

Both SYD and TCL are core investor holdings where we’ve applied “buy-write” strategies to enhance the cash flow. A combination of the December dividend and the call option income is generating 10 – 12% annualised cash flow.

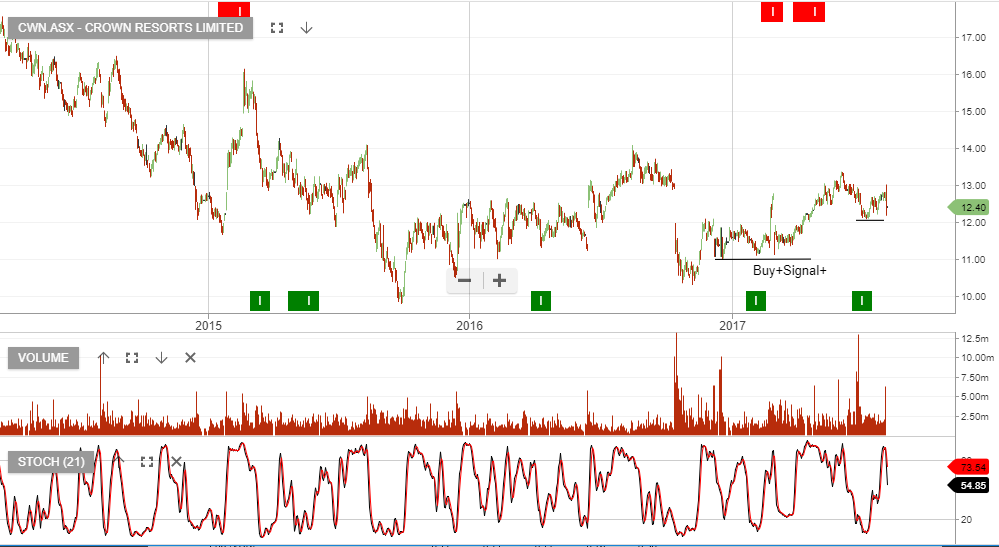

Crown Resorts reported their FY17 earnings on Friday, and the result showed a 13% decline in revenue and 11% fall in EBITDA. Helping to offset this was a further $375m share buyback.

Based on $0.60 of DPS in FY18, Crown trades on a forward yield of 4.8%.

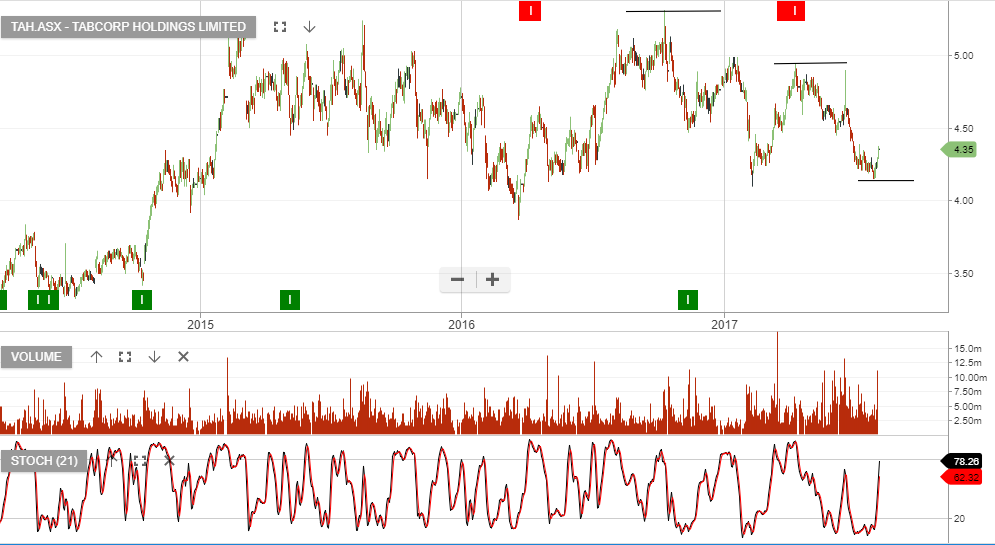

TabCorp Holdings reported FY17 earnings on Friday with underlying net profit of $179m, down 4% on the same time last year. We see encouraging trends within the core wagering business with digital turnover up 14% and fixed odds revenue growth of 15%.

We expect the Tatts merger to be completed by the end of the year and with the FY18 dividend yield at 6%, we see upside potential to $4.50 – $5.00.

The Aussie Dollar posted a high on July 27th against the US Dollar at .8065.

It tested that level again just before the RBA announcement last Tuesday but failed to advance and slipped briefly below .7900 going into the weekend.

Comments in the RBA statement about the strength of the AUD/USD combined with a weaker Trade Balance report on Thursday pressured the pair lower.

A break of the .7875 level will confirm that a formidable top is in place, and will likely spur another cent correction lower to the next support price of .7780.

Investors looking to profit from the AUD/USD trading lower can look to buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the unit price increases as the price of the AUD/USD decreases. YANK also has a 2.5% weighting, which means a 1% change in the AUD/USD will correspond to a 2.5% move in the unit price.

The current price of YANK is $12.60. We calculate that when the AUD/USD trades back to the January low near .7300, the unit price will trade at $16.75.

BetaShare ETF: YANK

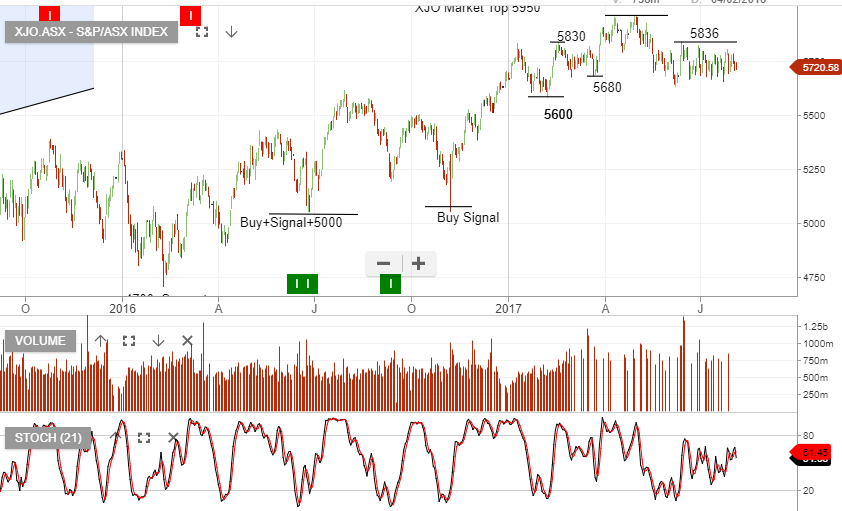

The S&P/ASX 200 Index finished the week up 0.31%

The best performer was the Utilities sector, up 3.6% and the worst performer was the Financials ex-Property sector, down 1.1%.

The XJO remains in a “lower high” pattern, as illustrated on the chart below.

On June 29th, when CBA was trading at $84, our Algo Engine generated a sell signal, as CBA formed a “lower high” structure.

Since then, selling pressure has gradually increased with the $84 to $85 range forming the resistance of the bearish pattern.

Our Algo Engine has been alerting us to the retracement and “higher low” pattern developing in GrainCorp.

The stock price bounced from oversold conditions in Thursday’s trading, after touching $8.51. Friday displayed strong follow through buying with the price action closing near session highs.

We’ve been looking for a move higher in GNC, it looks like it could be underway, and a rally back to $9.25 – $9.50 is our target.

Apply a stop loss below $8.51.

Invocare is another name we’re watching for confirmation on a developing “higher low” pattern. Friday’s closing price was a little weak. We’ll watch this name into next week and keep you updated on our analysis.

Our Algo Engine recently triggered a buy signal in IPL. With the stock price now beginning to see buying interest at or near $3.20, (as the “higher low” formation develops), we recommend investors continue to hold the long exposure.

Consider stop losses below the $3.20 level.

Chart – IPL

Following recent Algo Engine buy signals, we continue to hold WOW, BHP and ORG as preferred holdings.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.