West Texas Intermediate (WTI) Crude Oil rose over 3% in NY trade to reach a 7-week high of $65.70.

The boost was a result of EIA data showing US crude stocks unexpectedly fell by 2.6 million barrels, or 0.6%.

For the week, WTI has risen over 5%.

In Monday’s blog, we mentioned our preference to buy local names STO, WPL and OSH.

These three stocks are up over 2% for the week and we still see scope for further upside range extension. Also, all three of these stocks are in our ASX Top 50 Model portfolio.

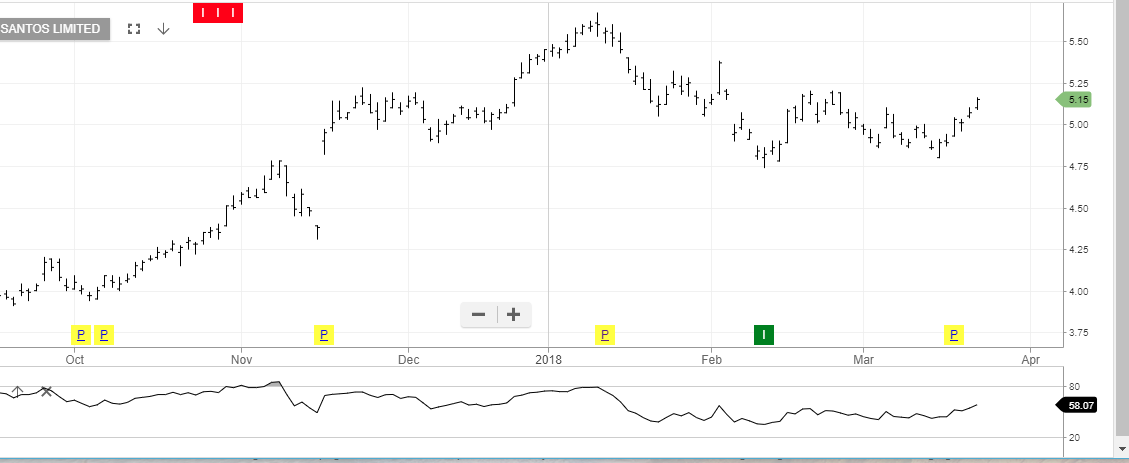

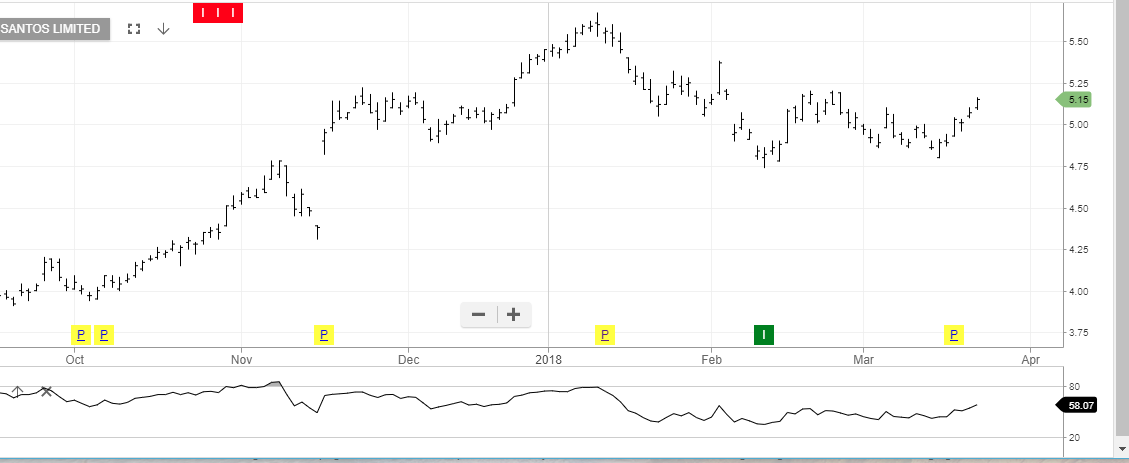

On the daily charts, the next area of resistance for STO is near the $5.65 level, with support at $4.90.

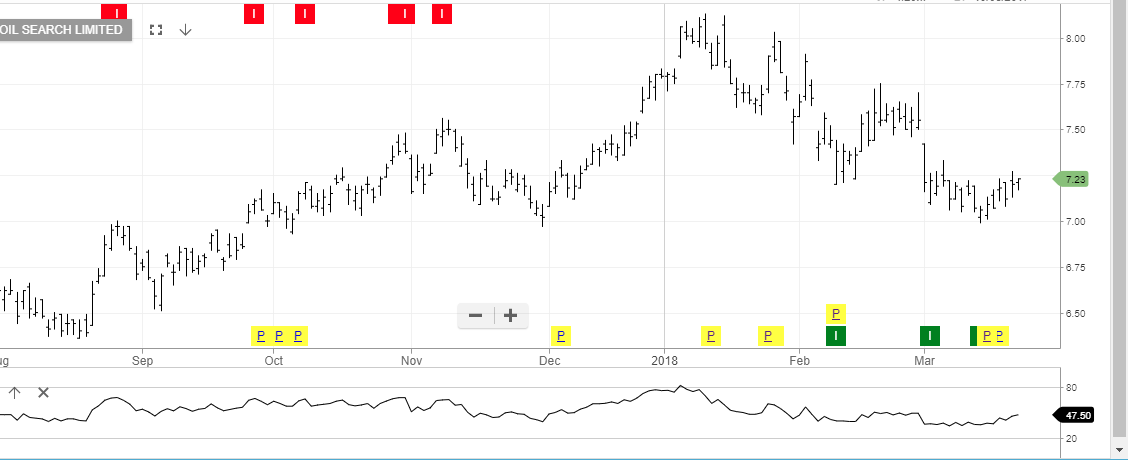

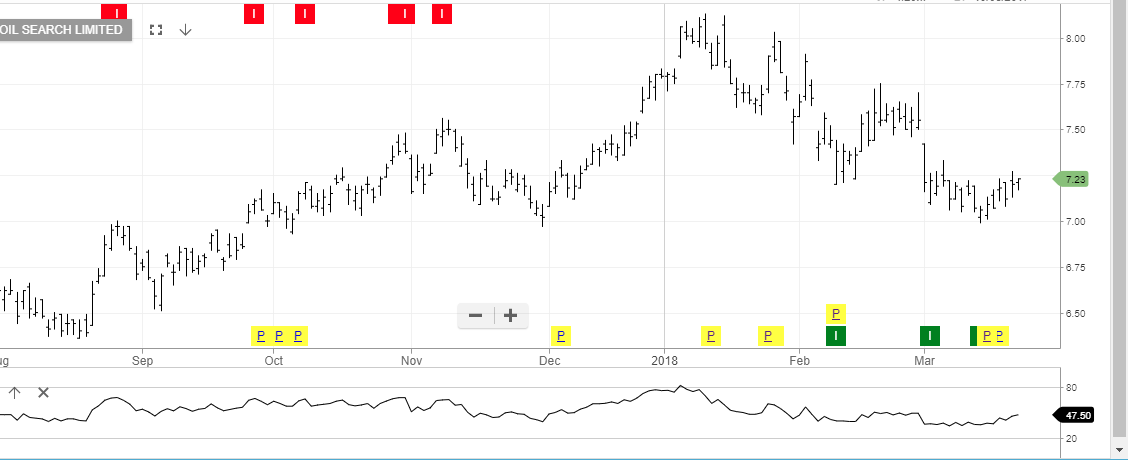

The chart of OSH shows resistance at $7.70 and support at $7.05

The valuation metrics for WPL are more complex. The share price has under performed the Spot WTI price by 24% since September and is 21% below it’s EPS momentum trend.

At 6.50 X EBITDA, WPL may be the best pick for a move back into the price gap above $29.65.

Santos

Oil Search

Woodside