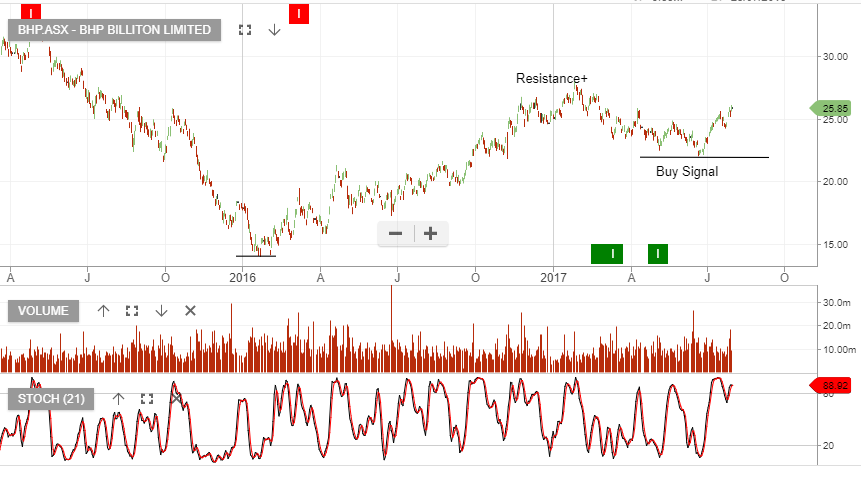

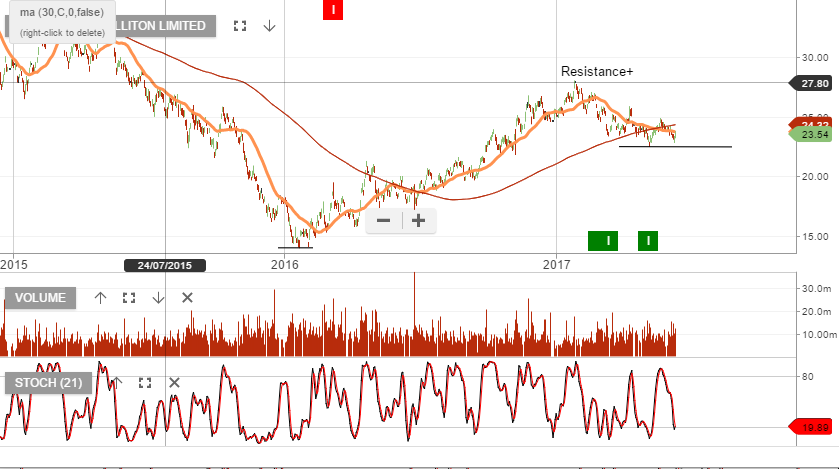

BHP Rebounds From Last Year’s Losses

Shares of BHP are up over 1% in early trade as the mining giant announced a USD 6.73 billion full year profit and declared a final dividend of 43 cents per share, which lifts the full-year dividend to 83 cents per share.

Higher prices for both Iron ore and Coking Coal helped contribute to the improved performance over the course of the year.

The company also announced that it wants to sell off its US Shale oil assets, as they have not performed to plan.

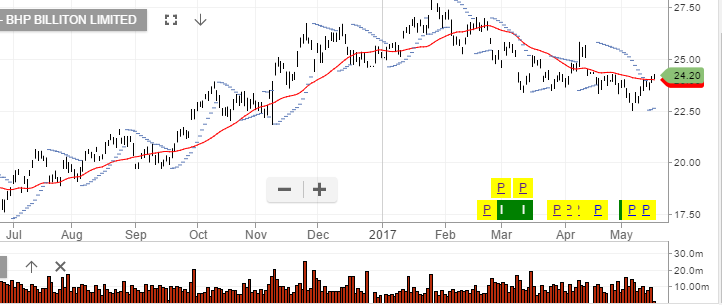

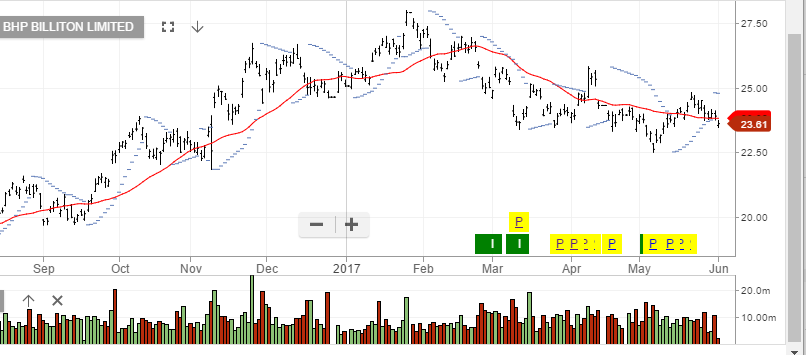

In our blog update from July 26th, we suggested that investors could sell European-style call options at the $26.00 strike price into November.

We still see limited upside to BHP above $26.50 and repeat that suggestion to enhance portfolio returns for investors holding BHP shares.

BHP

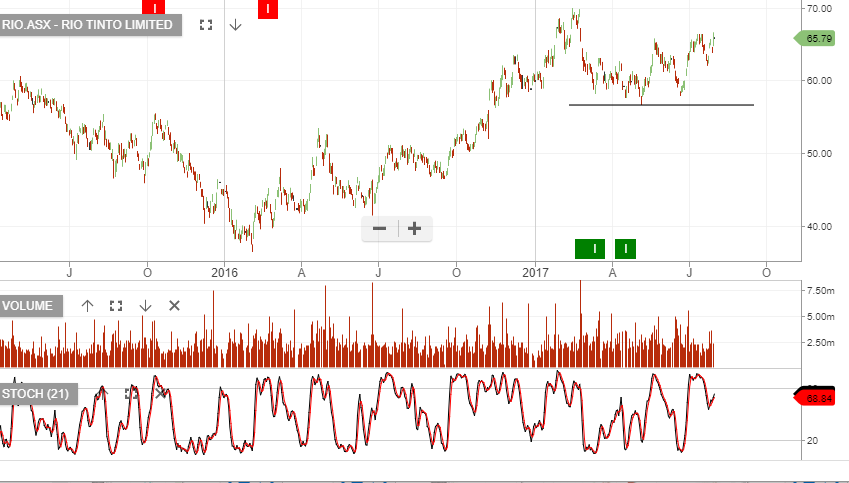

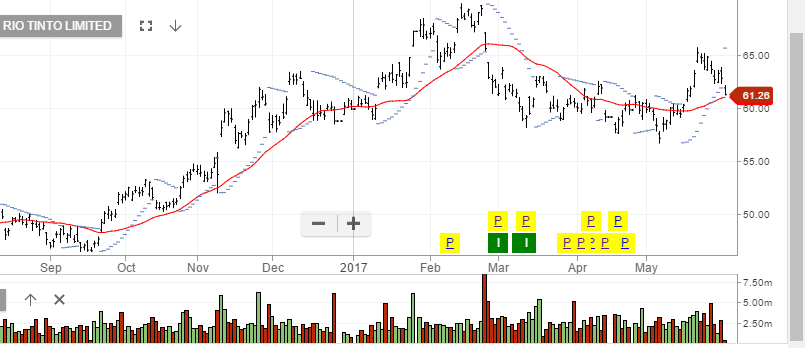

Rio Tinto

Rio Tinto BHP

BHP