XJO Update: Miners Lead The Index Lower

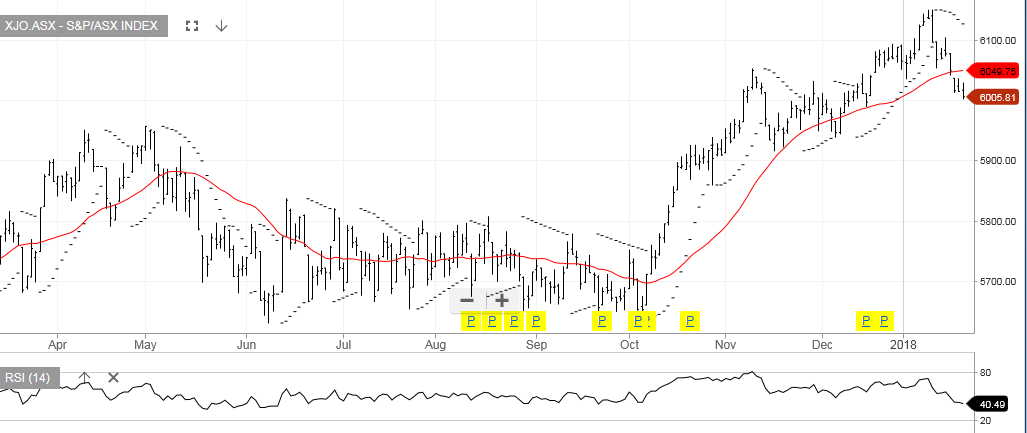

The ASX XJO Index fell 1.1% for the week and traded below the 6000 level for the first time this year.

Mining stocks and the major banks led the downside following weakness in commodity prices.

The ASX Gold index dropped four sessions in a row and lost 1.3% on Friday to close at 4874.60.

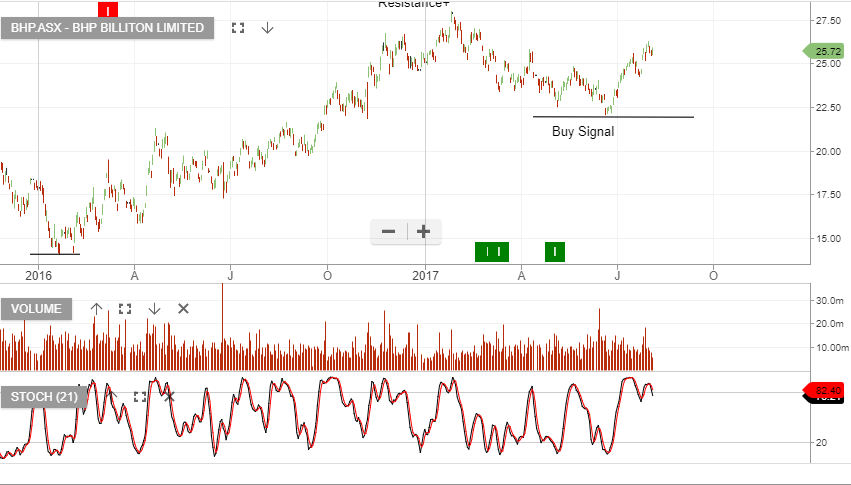

Iron Ore prices posted their first weekly loss in over a month, which pressured shares of mining giants BHP and RIO Tinto lower for the week.

Shares of RIO fell 4.6% to $78.00 while BHP slipped 3.7% to end the week at $30.70

Internal momentum indicators are looking fairly neutral on the daily charts, which suggest the index could see range trading next week between 6070 and 5985.

XJO Index

XJO Index

ASX XJO Index

ASX XJO Index