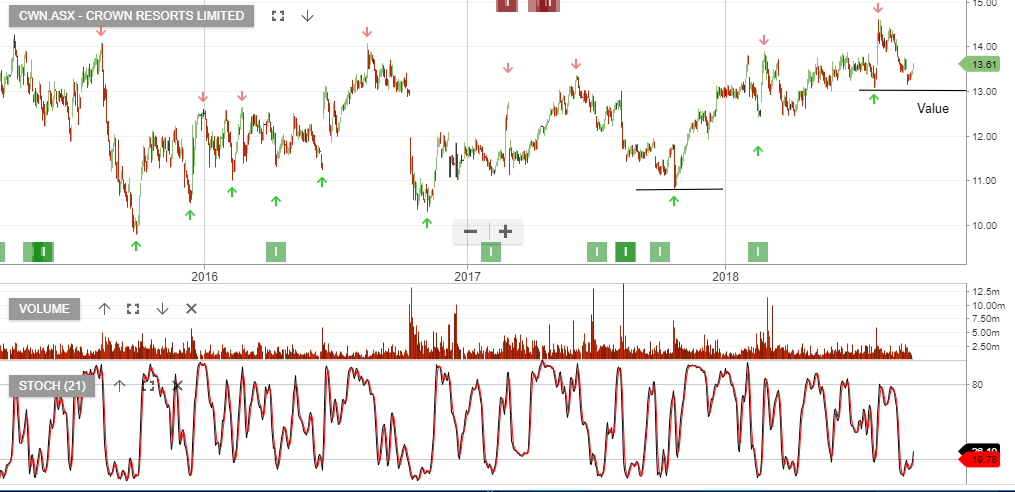

Buy Crown Resorts

We recommend accumulating shares in Crown Resorts as the price finds support near $13.50.

FY19 EPS growth will be around 8%, placing the stock on a forward yield of 4.3%.

Crown goes ex-dividend for $0.30 on the 20th March 2019.

Selling December $14.25 call options will add a further $0.21 of income per share.

Crown Resorts

Buy Crown Resorts

Buy Crown Resorts