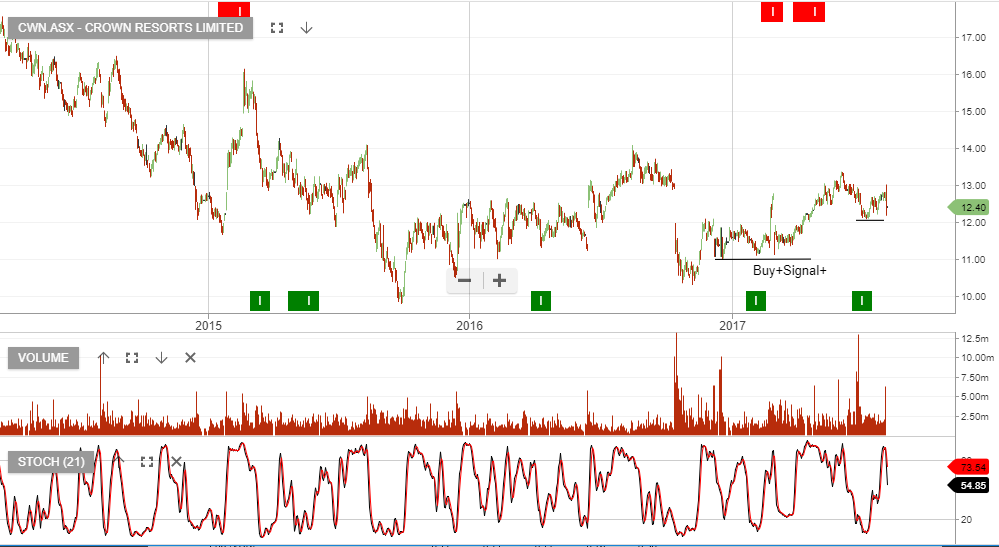

Crown – Back at support level

Our Algo Engine recently triggered a buy signal in Crown Resorts and with the stock now back on support, we recommend investors buy CWN near the $12.50 level.

Crown Resorts

Our Algo Engine recently triggered a buy signal in Crown Resorts and with the stock now back on support, we recommend investors buy CWN near the $12.50 level.

Crown Resorts

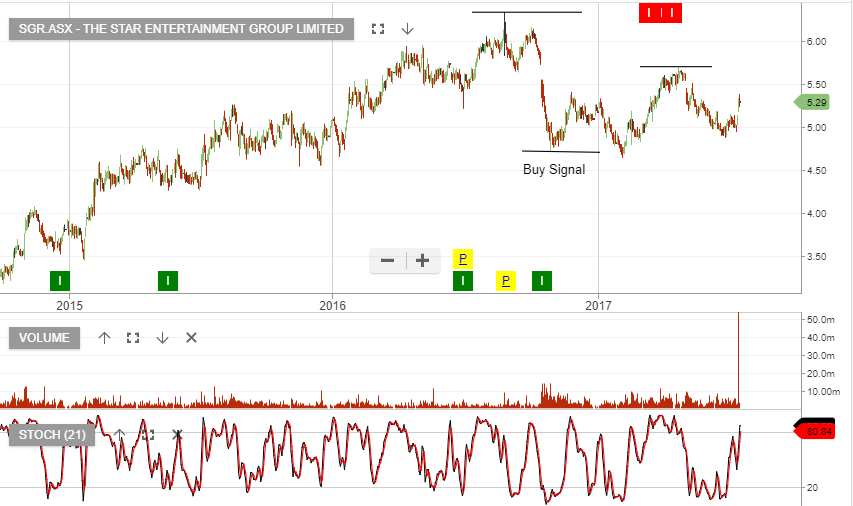

Star reported normalised NPAT of $120m, up 12% on the same time last year and revenue growth was strong, up 16%.

FY19 revenue is forecast to be $2.9b, EBIT $430m, DPS $0.16, placing the stock on a forward yield of 3%.

Investors should watch for the next Algo Engine buy signal in both Star and Crown as they approach a new higher low formation, which will provide a good entry level.

Star Casino

Crown Casino

Our ALGO engine triggered a buy signal on Crown Resorts on September 28th at $11.10.

Since then the share price has traded in a range between $11.80 and $10.90.

We are seeing an improved technical picture on the stock with buy-side support increasing in the $11.10/20 range.

Over the medium-term, we see the $11.80 level broken to the upside with a potential range extension up to $12.60.

Crown Resorts

Australian Gaming stocks look set to move higher on increased seasonal interest and improved market conditions.

The three names we prefer in the gaming sector are: TAH, SGR and CWN.

Our ALGO engine triggered a buy signal in CWN on September 28th at $11.10. The company has gotten some bad press relating to machine tampering, but has rebounded as the accusations are being dismissed as “political fanfare.”

Our medium-term target on CWN is $12.75.

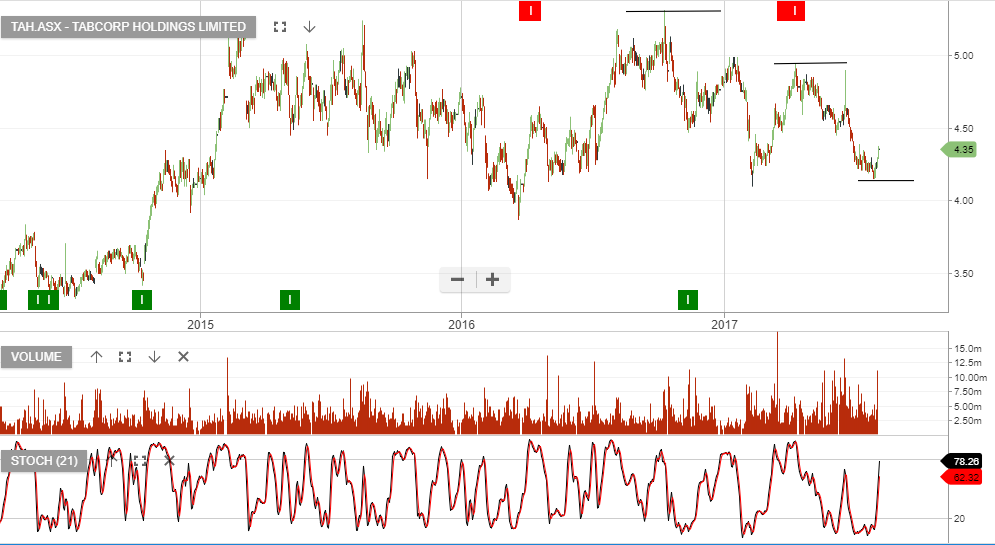

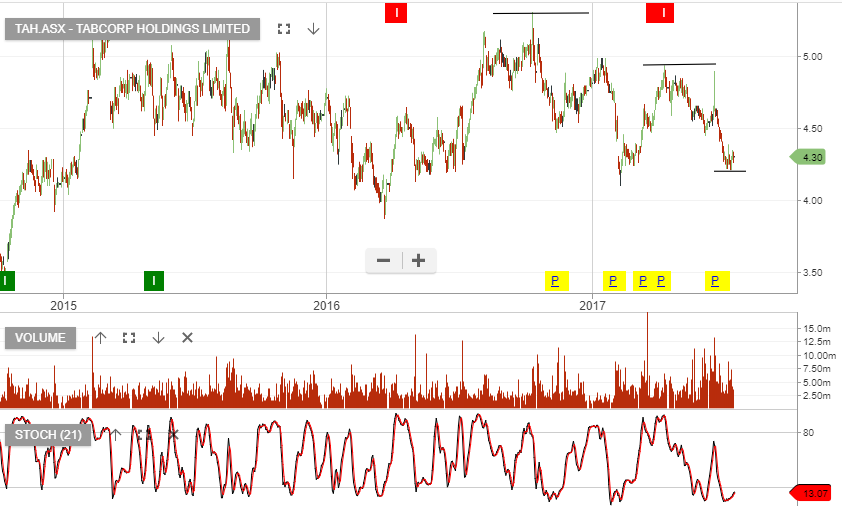

Shares of TAH have been firming off the $4.00 support area as the long-awaited merger with TTS enters the home stretch.

It’s widely believed that the government would like to consolidate corporate bookmaking and this merger would achieve that goal.

Our medium-term target for TAH is $5.25.

SGR is more of a technical play. After breaking out of a “triple top” pattern at $5.30 yesterday, the share price now has a upside measured target of $6.00.

Crown

Crown

TabCorp

TabCorp

Star Entertainment

Star Entertainment

Shares of Crown LTD have drifted back into the lower part of the $11.00 handle, which we consider a buy zone.

Our ALGO engine triggered a buy signal on August 8th at $11.43, and again at $11.15 yesterday.

We acknowledge that the recent gaming numbers from the WA casino were down, and that the general tone in the ASX 200 is soft.

However, we still see reasonable growth potential in CWN going forward and have a medium-term target of $12.80.

Crown LTD

Our ALGO engine triggered a buy signal on CWN at $11.43 on August 11th.

With the current price around $11.77, the trade has been slow to develop but we still prefer the long side.

CWN will go ex-dividend tomorrow and pay shareholders 30 cents, with 60% franking.

Looking across the gaming sector, we see improving conditions for CWN, SGR and Tabcorp. Seasonal growth in tourist numbers will benefit all three of these names.

We see scope to reach upside targets of $12.80 in CWN, $5.10 in TAH and $5.75 in SGR over the medium-term.

Crown Resorts

Tabcorp

Star Entertainment

Our Algo Engine triggered a buy signal in Crown near the recent low of $11.43.

Apply a stop-loss on a break below $11.40

Crown

Crown Resorts reported their FY17 earnings on Friday, and the result showed a 13% decline in revenue and 11% fall in EBITDA. Helping to offset this was a further $375m share buyback.

Based on $0.60 of DPS in FY18, Crown trades on a forward yield of 4.8%.

TabCorp Holdings reported FY17 earnings on Friday with underlying net profit of $179m, down 4% on the same time last year. We see encouraging trends within the core wagering business with digital turnover up 14% and fixed odds revenue growth of 15%.

We expect the Tatts merger to be completed by the end of the year and with the FY18 dividend yield at 6%, we see upside potential to $4.50 – $5.00.

Crown Resorts is likely to announce further capital management initiatives at the FY17 result on 4th of August.

Crown recently sold its remaining stake in MLCO, realizing net proceeds of A$1.3b. Our view is that these proceeds will be used to either reduce debt, or embark on the next stage of its capital management program.

Our Algo Engine triggered a recent buy signal at or near $12.00

The Australian-listed Star yesterday informed its investors that Ellerston Capital (25% owned by James Packer) now has a 5.07% stake.

Institutional investor, Perpetual, which is already Star’s biggest shareholder, also increased their holding when Malaysian casino giant Genting sold down its stake.

Star & Tabcorp have “lower high” formations, where as Crown is displaying a bullish, “higher low” formation.

Or start a free thirty day trial for our full service, which includes our ASX Research.