Crown – Jamie Packer re-joins the board

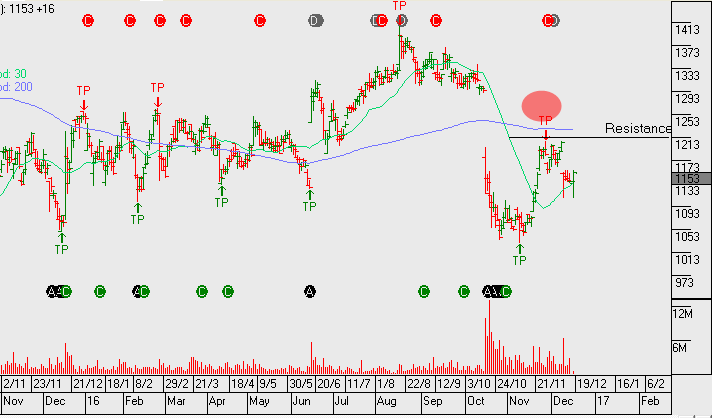

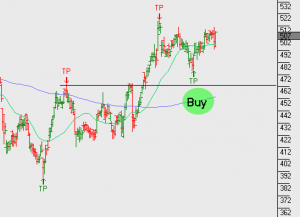

The share price in Crown Resorts (CWN) has staged a solid rebound since hitting a low of $10.30 in early November. With Jamie Packer re-joining the board and some new capital management initiatives, there could be further upside from the current price of $11.70.

An analyst report yesterday noted that Melco Crown, in which CWN owns a 11.2% stake, has declared a USD 650 million special dividend to be paid in early February.

Aside from this dividend payment, the gaming giant has lowered its VIP revenue projections, adjusted revenues for CWN’s lower equity stake in Melco, resulting in a lowering of its EPS estimates out to 2019 by close to 2%.

The company’s board reshuffle highlights that CWN has yield and near-term capital management appeal with the prospect of further de-leveraging from offshore strategic initiatives.

Taking into account the trimming of its earnings forecast, the group is trading on 9.3 times fiscal EBITDA projections.