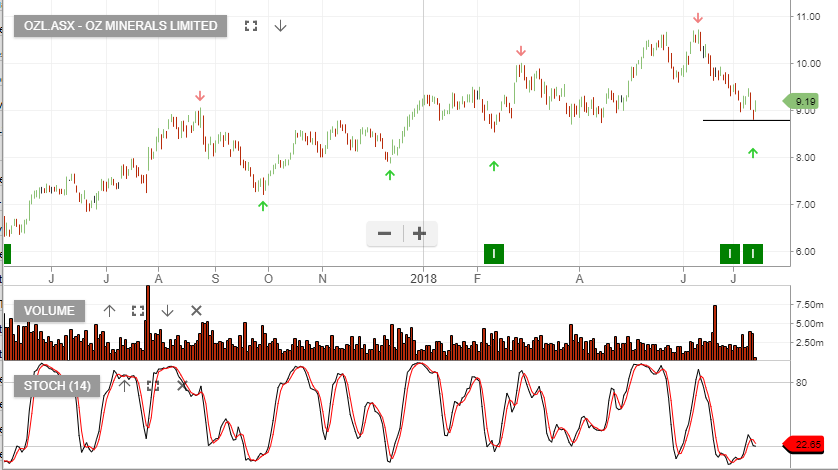

Oz Minerals Is Back In The Buy Zone

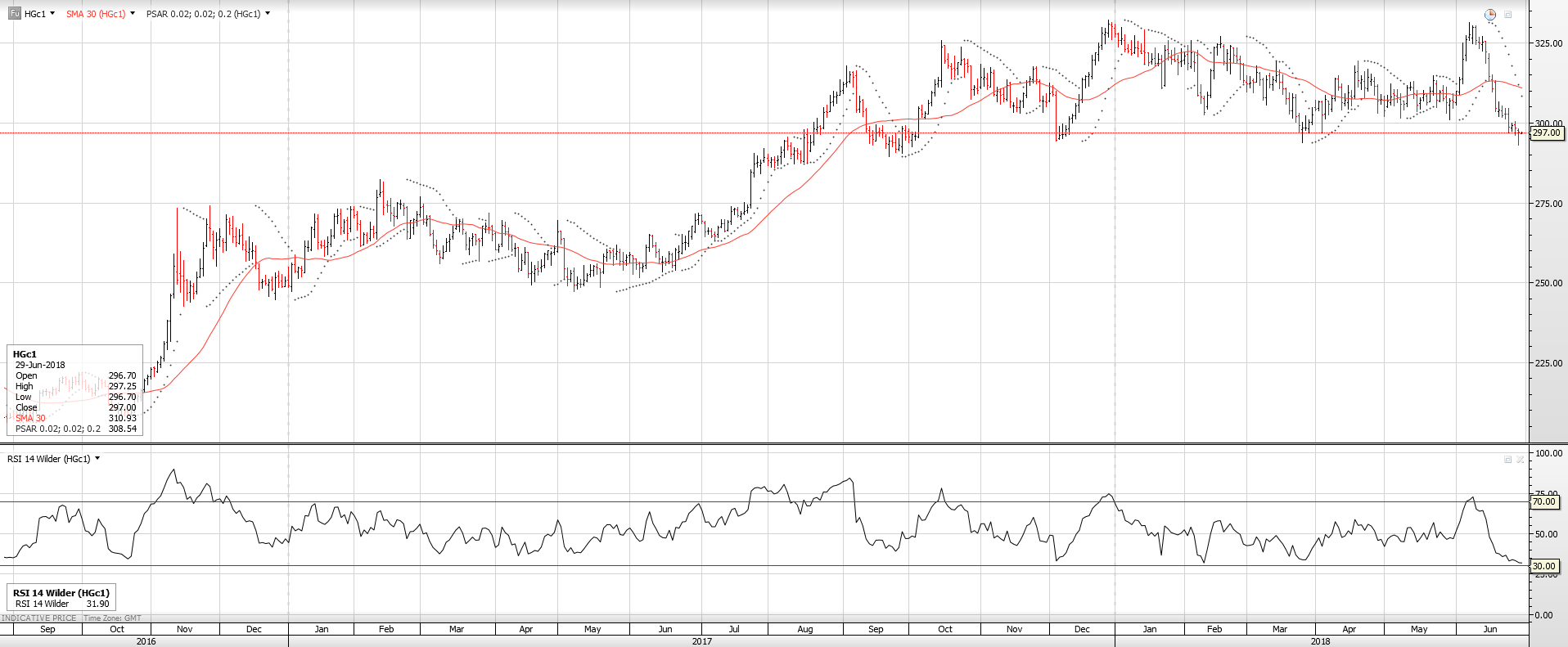

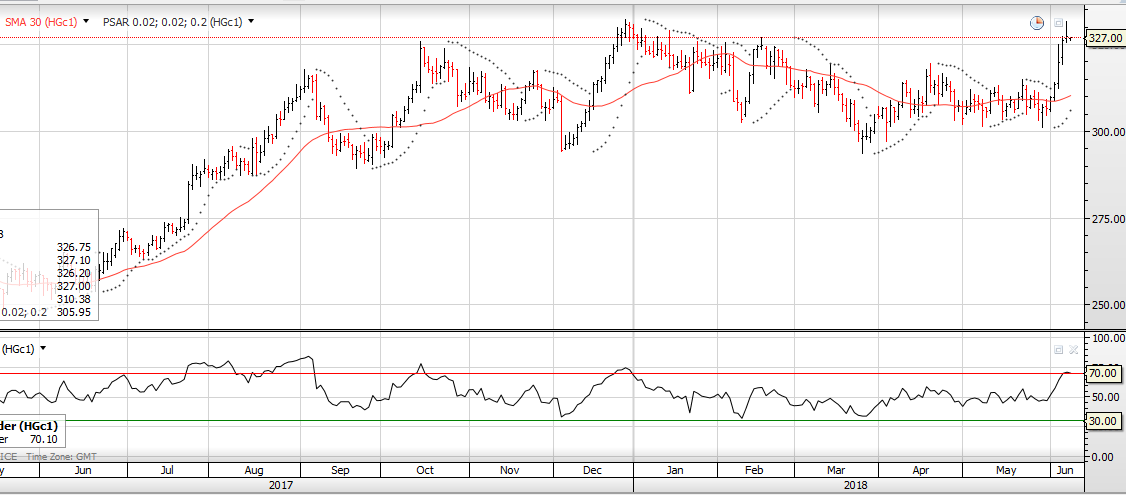

As a result of trade tensions between the US and China, prices of raw materials and precious metals have been trading sideways to lower.

The same price pattern has emerged for the shares of mining companies that export these materials.

In this environment, the shares of the lower cost producers will generally perform better as the raw material price begin to improve.

During the last quarter, OZL reported that their production costs for copper had dropped from 97 cents a pound to 72 cents a pound. In addition OZL has a strong balance sheet and may expand their share buyback plans over the next 6 months.

OZL is part of our ASX model 100 portfolio. We see good support in the $8.80/90 area with an upside target near $10.20 over the medium-term.

OZ Minerals

Oz Minerals

Oz Minerals

Oz Minerals

Oz Minerals

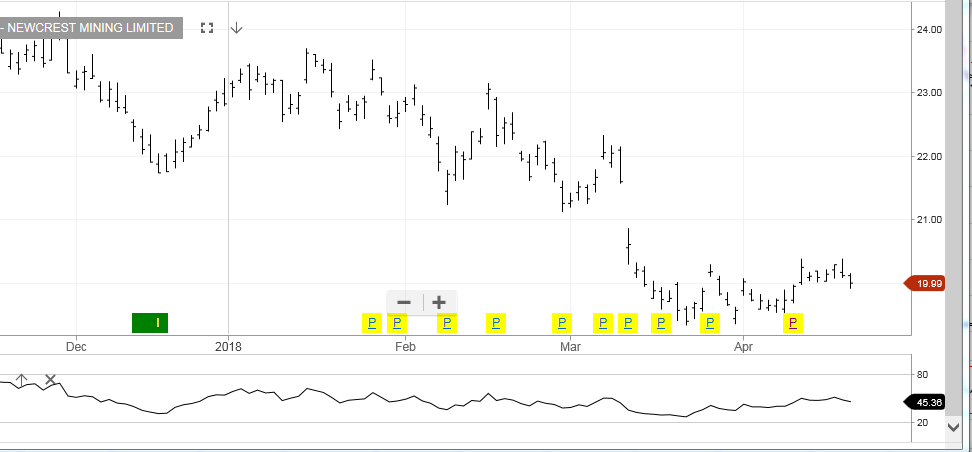

Newcrest Mining

Newcrest Mining Fortescue Metals Group

Fortescue Metals Group Oz Minerals

Oz Minerals