A key part of the US Tax Reform passed last week includes giving US companies a tax break on profits earned and kept in banks overseas.

As per the legislation, US firms can now repatriate offshore earnings at a tax rate of 15.5%, compared with the previous rate of 35%.

In 2005, the Bush administration had a similar “tax amnesty” when over 50 US firms sent back about $350 billion in profits earned overseas.

In an interview last week, Mr Trump estimated that the total amount of US corporate profits on deposit offshore is between $3 and $5 trillion.

This is a pretty wide spread. But considering that just 5 tech firms (Apple, Microsoft, Google, Cisco and Oracle) are estimated to be holding over $650 billion offshore, it’s clear that the repatriation numbers will be much higher than in 2005.

In fact, Apple CEO, Tim Cook, announced that they intend to repatriate over $250 billion during 2018, which is over 70% of the 2005 total spread across 50 firms.

The most obvious impact of this massive transfer of funds will be the boost in demand for US Dollars. The amnesty plan in 2005 triggered a 12% rally in the USD Index from 81.00 to over 90.00 from March to July.

However, with some EU and Japanese banks already teetering from bad debts and non-performing loans, the short-term implications could be devastating to the banks that have been holding the cash that Mr Trump wants back.

We believe that with just one company like Apple draining $20 billion a month from the European banking system, there will be a negative impact on the health of many EU banks.

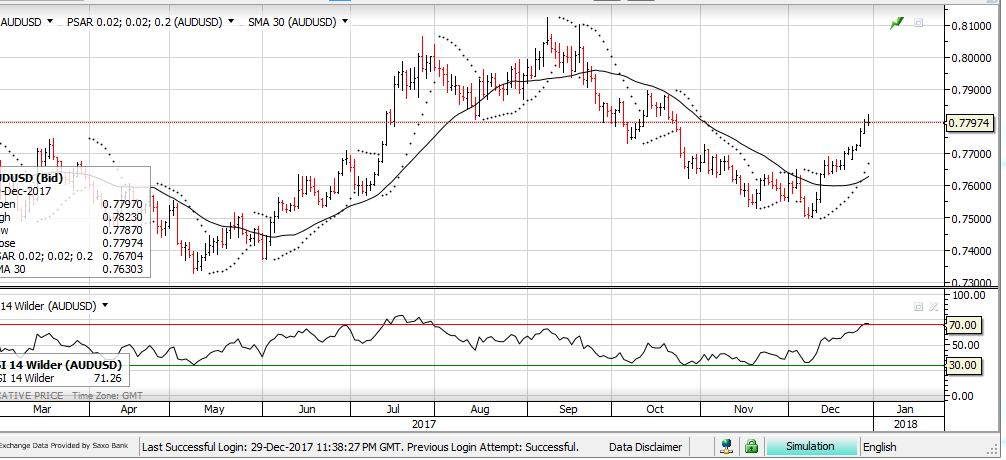

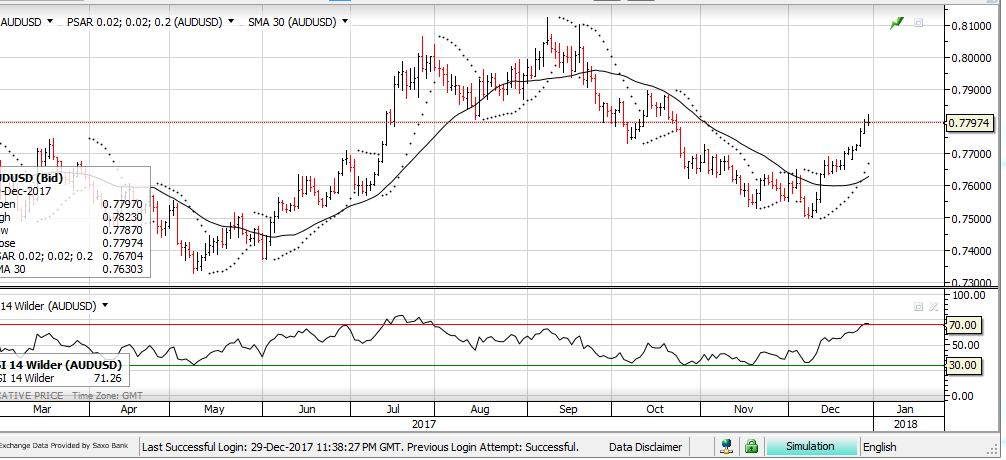

At this point we don’t have any clear numbers reflecting the amount of money being held in Australian banks, but we would expect the general strengthening of the USD, on a global basis, will see the AUD/USD retreat back into the lower .7000 handle.

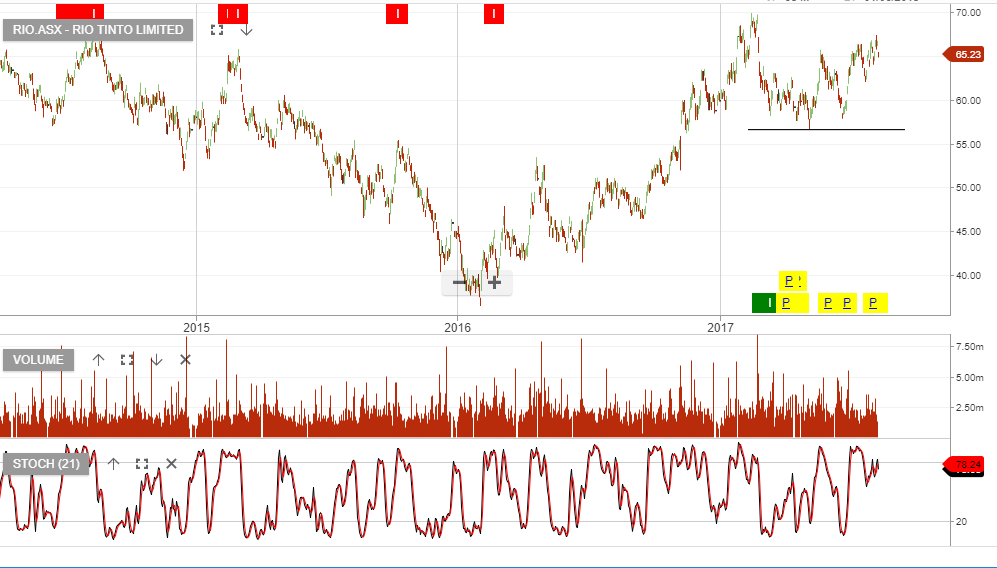

ASX listed stocks which will benefit from the lower Aussie dollar include RHC, QAN, TWE, RIO and NCM.

Aussie Dollar

Aussie Dollar

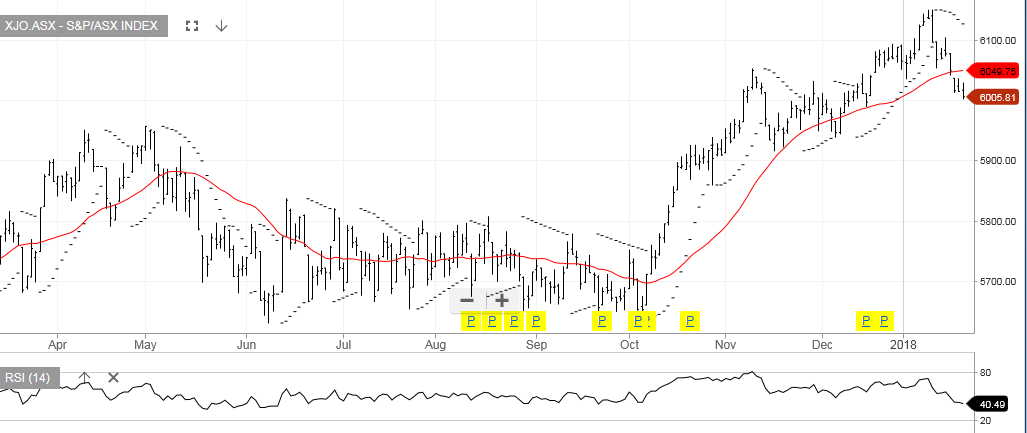

XJO Index

XJO Index Rio Tinto

Rio Tinto Aussie Dollar

Aussie Dollar

ASX XJO Index

ASX XJO Index