ASX – Keep on your watch list

Our Algo Engine generated a buy signal in ASX recently and we recommend to keep this name on your watch list.

Our target is for a sub $60.00 entry level, where we feel buying support will begin to build.

Our Algo Engine generated a buy signal in ASX recently and we recommend to keep this name on your watch list.

Our target is for a sub $60.00 entry level, where we feel buying support will begin to build.

Our ALGO engine triggered a buy signal for LLC into Friday’s ASX close at $18.70.

This “higher low” pattern is referenced to the intraday low of $17.25 posted on April 27th.

Since reaching an all-time high of $21.70 on August 7th, the share price has dropped over 14% and traded to a 5-month low on Friday.

We believe the company is well positioned in the infrastructure construction space and its international expansion will diversify the risk of a slowdown in the domestic residential market.

At current levels, we calculate LLC is trading at about 13X FY 19 earnings and expect the stock will find investor interest above the $18.00 support area.

Lend Lease

Lend Lease

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Our ALGO engine has shown a sell signal for BOQ since August 31st at $11.50.

The share price got a boost at yesterday’s AGM trading up to $11.35 just after the FY18 NPAT data was released.

However, as the trading day progressed, the lower margins on the current loan book combined with large software write offs pressured the share price back below $11.00.

We still prefer the short side of BOQ with a downside target of $9.60.

Bank Of Queensland

Over the last 24 hours, our ALGO engine has triggered sell signals for both Oz Minerals and Origin Energy.

Both OZL and ORG have been longstanding components in our ASX model portfolio.

As illustrated in the summary below, ORG returned a respectable 30.93% over the 584 day holding period and OZL returned a whopping 144.21% gain, including dividends, since July of 2015.

Both of these names have been popular with investors and we’ll update with current ALGO signals in the near-term.

Oz Minerals

Origin Energy

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

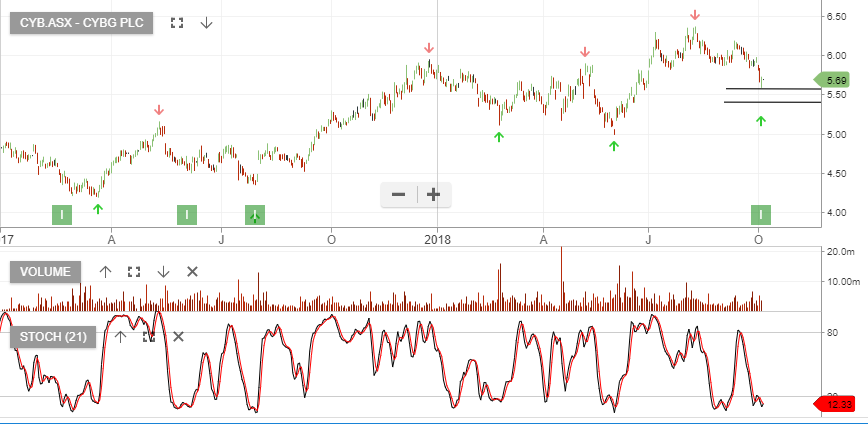

Our ALGO engine triggered a buy signal for CYB into yesterday’s ASX close at $5.69.

This “higher low” pattern is referenced to the intra-day low of $5.20 posted on June 4th.

CYB at $5.50 – $5.60 appears to be a good buying opportunity. We expect earnings upgrades next year following integration with Virgin Money.

CYB

AGL is a current holding within the ASX Top 50 and 100 model portfolios.

With the share price trading at $19.50, we consider a pessimistic view is now priced in.

We suggest buying AGL and looking to sell covered call options to enhance the cash flow.

Qantas will provide its 1Q19 trading update on 25 October 2018.

QAN was added to our ASX Top 50 model portfolio in July of 2017 at $5.25.

Due to the recent spike in oil prices, the share price has been drifting lower and nearing our original entry level.

Along those lines, we expect the trading update to include how the company’s dynamic hedging program is insulating their bottom line from higher fuel prices.

We see good value at current levels for a move back into the $7.90 area over the medium-term.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.