Over the past 12 months, the correlation between the EURO and Eurozone (EZ) share market has gone through several different phases. Earlier in the year, the single currency was sold off on risk aversion when EZ equities were showing weakness. A few months later, the EURO was bid higher when EZ stocks fell as fund managers allegedly unwound currency hedges while cutting long stock positions.

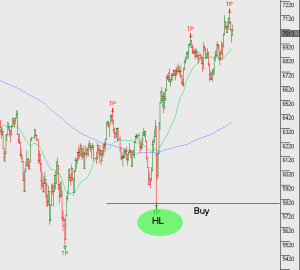

However, during last Friday’s LDN session, the EUR/USD tracked the German DAX index with pretty much a point-to-point correlation. As discussed in previous FX UPDATES, the legal and financial pressures on Deutsche Bank (DB), along with other EZ banks, has been a headwind for the EURO but so far hasn’t unravelled the current price or chart structure.

But last Friday was different. As the LDN session opened, the German DAX was pushed below the 10,200 level for the first time since early August. At the same time, the EUR/USD fell to the session low of 1.1160 and was well offered on the crosses. A well timed rumor that the US Department of Justice (DoJ) was willing to lower their penalty demand on DB down to the $5.0 billion area triggered a 1.5% rally in the DAX and reversed the EUR/USD back up to near-term resistance at 1.1250.

With a full slate of data points from both sides of the Atlantic this week, FX Investors will be watching to see if this EURO-Equity connection of stronger EZ equities driving the EUR/USD higher has any staying power, or if it was just an end of month adjustment.

It’s our base case is that the DoJ rumor was just that and the market will be sensitive to ongoing litigation between the DB and the DoJ. Further, two of the key data points this week, US ISM aggregates and the US Jobs data, are both extremely currency sensitive releases which will drive USD flows.

On balance, we expect both the ISM manufacturing and services reports to bounce back from last month’s readings, which would be USD positive and SP 500 positive. The US Payroll data has been a volatile series over the last six months, but a print near the forecasted number of 170,000 new jobs should be good enough to keep the EUR/USD on a downward trajectory.

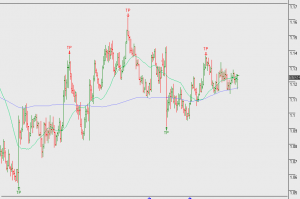

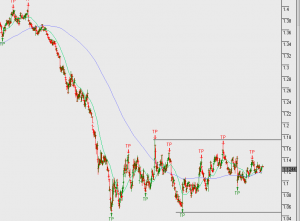

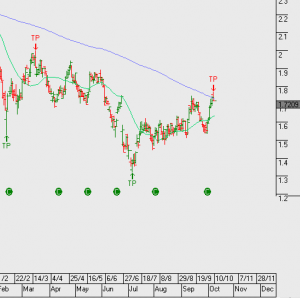

Chart – Deutsche Bank

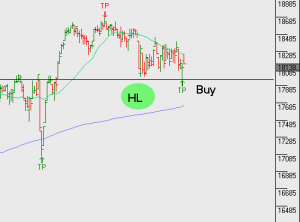

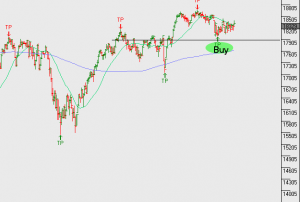

EUR/USD

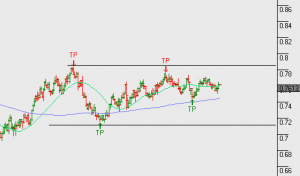

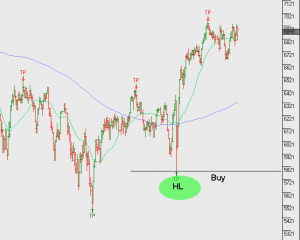

EUR/USD